We all have losing trades. The key to trading success is limiting the magnitude of those losses, allowing us to return to profitability quickly. Unfortunately, our very nature makes it extremely difficult for us to control our losses.

Numerous studies in behavioral finance have demonstrated that the pain of losses far exceeds the pleasure of gains. In addition, we tend not to acknowledge gains and losses until they are realized. As a result, we avoid closing losing trades, hoping and praying that they will eventually turn profitable. Conversely, we can't wait to sell our winners, fearing that they will quickly turn into losers. Regrettably, this instinctive behavior violates one of the principal rules of trading: cut your losses quickly and let your winners run. In other words, we are programmed to fail - but there is hope.

Stop Loss Orders

Before we get into practical techniques for managing trades and limiting losses, it is important that everyone has a basic understanding of stop loss orders. Unless otherwise specified, a stop order means a stop market order. When the stop condition is satisfied, a market order is triggered. A market order guarantees execution, but does not guarantee execution at a specific price. In other words, a market order will buy at the prevailing ask price and sell at the prevailing bid price.

Stop sell orders are always set below the current market price. We use stop sell orders in an attempt to limit the losses on long positions. Everything is reversed for stop buy orders. Stop buy orders are placed above the current market price and are used to limit losses on short positions (securities that we have sold, but did not own).

Let's assume that we buy 100 shares of Apple stock (AAPL) for $610 per share. If want to limit the total losses on our AAPL position to $2000, that would equate to a loss of $20 per share ($2000 / 100 shares). We would place a stop sell order at $590 per share. If the price of AAPL hits $590 per share, then a market sell order would be triggered and our 100 shares would be sold at the best available bid price at the time, which could be above or below the $590 stop price. Again, stop market orders guarantee execution, but not at a specific price.

This fact is especially important if the stock were to gap down overnight. Stop orders do not protect us when the exchange is closed. If AAPL gapped down overnight and opened at $550 per share, the market sell order would be triggered at the open and our shares would be sold for approximately $550 per share. As you can see, our stop sell order does not actually limit our loss to $20 per share (or $2000) as we had planned.

To gain more control over the position, I prefer to use stop limit orders. Two prices are specified for stop limit orders: the stop price and the limit price. When the stop condition is satisfied, a limit order is triggered. Unlike a market order, the limit order does not guarantee execution, but does guarantee a specific price (or better). You will not buy at a price higher than your limit price or sell at a price lower than your limit price.

In either a fast moving or an illiquid market, it might not be possible to buy or sell at your specified limit price when the stop condition is met. If the trade does not execute, then you would continue to be at risk until you close your position. As a result, if you use stop limit orders, you should always place alerts with your broker so you are notified immediately when the price approaches your stop price. That would allow you to log into your trading platform and monitor the order in real-time, making adjustments as necessary to exit the position.

I personally prefer to use stop limit orders rather than stop market orders, especially after witnessing the bizarre circumstances during the flash crash of 2010. I just do not trust market orders to always be executed at reasonable and predictable prices. I prefer to have full control over the execution price for all of my transactions. However, whenever I place a stop limit order, I always place a corresponding alert with my broker.

Trigger Method

So far, I have glossed over the exact stop condition that triggers the market or limit order. Here are the trigger options available on my broker's (Interactive Brokers) platform, accompanied by abridged definitions:

- Last: last execution price on the exchange

- Double Last: two consecutive last values as described above

- Bid/Ask: highest bid price for buy orders and lowest ask price for sell orders

- Double Bid/Ask: two consecutive Bid/Ask prices as described above

- Last or Bid/Ask: either the last or Bid/Ask price as described above

- Mid-Point: the midpoint between (average of) the highest bid and lowest ask price

For a stop buy order to be triggered, the above trigger price must be greater than or equal to the specified stop price. For a stop sell order to be triggered, the above trigger price must be less than or equal to the specified stop price. You have the option of choosing (only) one of the above trigger methods for every stop market or stop limit order.

I trust the integrity and accuracy of actual execution prices more than I trust bid and ask prices. In addition, if one transaction price is good, then two in a row are better. As a result, I typically use the the double last method for my stop limit orders. In theory, that would prevent a single erroneous execution price on the exchange from triggering my limit order. One caveat: the last and double last trigger methods should never be used for illiquid securities that trade infrequently (including many or even most options). For these types of securities, the last price may lag far behind the current bid and ask prices, resulting in much larger losses than anticipated.

Setting Stop Prices

Now that we have covered the basics of stop loss orders, we can get into the mechanics of setting stop prices and managing our trades. Our level of profitability for a given strategy is determined by only three factors: our percentage of winning traders, the average return of our winners and the average return of our losers. The stop level that we use affects each of these three elements.

For a profitable strategy, using tighter stops will reduce the magnitude of our average loss, but it may also reduce the average return of our winning trades. In addition, if the stop level is too tight, it could also reduce our percentage of winners, as more trades get stopped out for losses. Conversely, wider stops will tend to increase the size of our average loss, but should also increase the magnitude of our average gain. In addition, wider stops normally increase our winning percentage. As you can see, when we set the width of the stop, we are making trade-offs that will affect the profitability of our strategy.

Unfortunately, setting the appropriate stop level for specific trades gets even more complicated. Many inexperienced traders make the mistake of setting the stop level at a fixed percentage (e.g. 5%) below the purchase price for every trade. While religiously using stops is a good first stop, all securities are different. As a result, we need to customize the stop level for each trade based on the specific characteristics of each individual security.

So how do we objectively set our stops, but customize the stop level for each individual security? We use the same process or tool to set our stop levels, but use the price behavior of the particular security to calculate the unique stop level for each trade. In an earlier post (The Easiest Way to Identify Trends) , I explained how to use the Point and Figure method to calculate stop levels for short-term trades. While this is an objective approach that generates custom stop levels for each trade, I would like to introduce two new tools for calculating stop values: average true range and the N-Bar stop.

Average True Range

Securities that experience higher levels of volatility (or price dispersion) require wider stops. To calculate custom stop levels, we first need an objective measure of price volatility. In the late 1970's, J. Welles Wilder Jr. wrote the famous book "New Concepts in Technical Trading Systems." In that book, he introduced several new technical indicators that are still in use today. One of the best was a volatility measure called the average true range (ATR).

Before we calculate the average true range (ATR), we must first calculate the true range (TR), which is a measure of the magnitude of the price movement for a single day. True range is equal to the greatest of:

- Today's High - Today's Low,

- Today's High - Yesterday's Close, or

- Yesterday's Close - Today's Low

To calculate the average true range, we simply calculate the average of the daily true range values over a specified period of time, typically the last 14 days. While it is important to have a basic understanding of how the ATR is calculated, you will not need to perform this calculation in practice. The ATR is widely available at various free sites on the internet.

The chart in figure 1 below is courtesy of stockcharts.com. It is a daily chart of the SPY exchange traded fund. The top panel includes a daily candlestick chart of the SPY with a 50-day and 200-day moving average; the bottom panel is a line graph of the ATR for the SPY, calculated over successive 14-day periods.

The current value of the ATR for the SPY is $1.249, which represents the average daily price movement over the past 14 trading days. To calculate the specific stop price for a trade in the SPY, we first need to specify the width of the stop, defined as the number of ATRs. Depending on the type of strategy, typical values would be between 1.0 and 2.5 ATRs.

Let's assume that we are using a value of 1.5 ATRs to calculate our stop level. If we were to purchase SPY at the current closing price of $140.81, we would place our initial stop at $138.937 ($140.81 - (1.5 x $1.249)). The maximum loss per share would be $1.8735 (1.5 x $1.249), ignoring overnight gaps and slippage. If we wanted to lose no more than $7500 on the trade, then we could purchase a maximum of 4000 shares of SPY (4000 rounded = $7500 / $1.8735).

In the AAPL example above, we used the ATR to set our initial stop value and limit our losses, but we can also use a trailing stop based on the ATR to exit our position as the price of SPY increases. A trailing stop is a stop level that we adjust daily based on the price behavior of the security. As prices rise, so does our stop. However, for a long position, the trailing stop never declines. To calculate the trailing stop price for our trade, we repeat the following steps after the market closes each day:

- Calculate Today's Closing Stop Value = Today's closing price - (1.5 x Today's ATR value)

- Calculate New Stop Price = Greater of Current Stop Price and Today's Closing Stop Value (#1 above)

- Modify outstanding stop order on broker platform using New Stop Price (#2 above)

The current stop price for our trade will initially be $138.937 as illustrated above. If the closing price of SPY continues to rise above the purchase price of $140.81, then the stop price will rise as well, reducing our potential losses and eventually locking in our gains. However, step #2 above ensures that the stop price will never decline; it can only rise or stay the same.

The market sell or limit sell order to exit the position would finally be triggered when the low of the day touches or penetrates the Stop Price. The calculations are reversed for short trades, with the stop placed above the initial sales price. Again, the stop price will never decrease for long positions and will never increase for short positions.

Finally, note that the ATR is a function of the time period used in the chart. In the SPY example above, we used a daily chart and a 14-day ATR. If we had a longer investment horizon and were trading based on a weekly chart, the ATR would represent the average weekly price movement over the past 14 weeks.

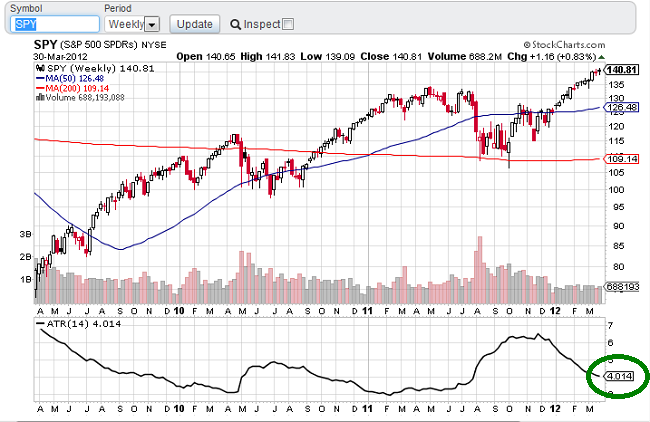

The chart in figure 2 below is also courtesy of stockcharts.com. It is a weekly chart of the SPY. The top panel includes a weekly candlestick chart of the SPY with a 50-week and 200-week moving average; the bottom panel is a line graph of the ATR for the SPY, calculated over successive 14-week periods.

Notice that the current weekly ATR of $4.014 is significantly larger than the current daily ATR of $1.249, as we would expect. If we were to use the same stop width of 1.5 ATRs to enter a longer-term trade based on a weekly chart, our resulting stops would be significantly wider. This is appropriate and desirable, since weekly trades would experience greater volatility than daily trades and would require more room for prices to fluctuate.

Even day-traders can use the same ATR method to calculate their stop levels. However, instead of daily or weekly charts, they would use 5-minute, 15-minute, or hourly charts to calculate the ATR.

Creating stops based on ATR allows us to calculate customized stop levels based on our specific investment horizons and on the volatility of the individual securities we are trading.

N-Bar Stop

N-Bar stops are even simpler than ATR stops. To calculate an N-Bar stop, we first need to specify the number of days used to calculate the stop value. Higher values result in wider stops and lower values result in narrow stops.

For long positions, the stop value is simply the lowest low over the previous N days (not including the current day). For short positions, the stop value is the highest high over the previous N days (again, not including the current day).

For example, if we purchased a security on Friday and we wanted to use a 3-Bar stop, the resulting stop price would be the lowest low on the preceding Tuesday, Wednesday, or Thursday. It's that simple. If we wanted to use the 3-Bar stop for a trailing stop as well, we would simply repeat the stop calculation every day, using the lowest low over the three preceding trading days.

For example, if we purchased a security on Friday, the stop value during the following Monday's trading session would be the lowest low on the preceding Friday, Thursday, or Wednesday. Every day we would calculate a new stop price and then adjust the stop order on our broker platform accordingly. The market sell or limit sell order to exit the position would finally be triggered when the low of the day penetrates or touches the stop price. I did not specifically state that the stop price (for a long position) is not allowed to decrease for an N-Bar stop, but a new lower low will always force us to exit the trade, so this is a moot point.

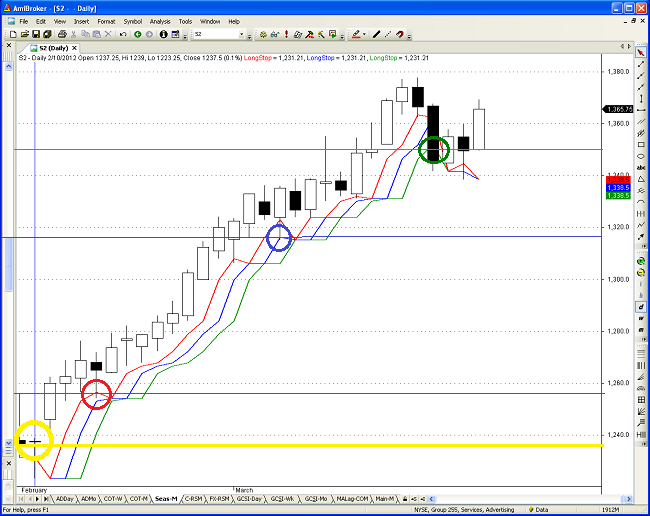

Figure 3 below is a daily chart of the continuous soybean futures contract for February and most of March 2012. Assume that we purchased soybeans futures at the closing price of $1237.50 on February 10, 2012 (see yellow circle and horizontal line below). In addition to the candlestick price chart below, the following three lines are also included on the graph:

- 1-Bar Trailing Stop (red upward-sloping line)

- 2-Bar Trailing Stop (blue upward-sloping line)

- 3-Bar Trailing Stop (green upward-sloping line)

The 1-Bar, 2-Bar, and 3-Bar trailing stop lines are drawn for the full width of the chart to allow you to see their relationship to price, but each line would obviously terminate when we exit the trade.

The stop condition would be satisfied and the market sell order triggered when the low penetrates or touches the N-Bar stop value. These exits are noted by colored circles and corresponding horizontal lines at the respective exit prices in Figure 3 below:

- 1-Bar Trailing Stop Exit Price (red) = $1256.50, resulting in a + 1.54% return

- 2-Bar Trailing Stop Exit Price (blue) = $1316.25, resulting in a + 6.36% return

- 3-Bar Trailing Stop Exit Price (green) = $1352.00, resulting in a + 9.25% return

As you can see from this example, the 3-Bar stop offers more room for prices to fluctuate than the 1-Bar or 2-Bar stops. In this example, soybeans were in a very strong uptrend, so it is not surprising that the 3-Bar stop generated the highest return. However, for losing trades, tighter stops would reduce the average size of your losses. As always, there are trade-offs and the width of the stop will affect the profitability of your trading strategy.

As was the case for ATR stops, N-Bar stops can also be used on 5-minute, 15-minute, hourly, weekly, or even monthly charts. However, always wait until the end of the chart period to update the stop. For example, if we were using an N-bar stop on a weekly chart, we would only update the stop once each week based on the lowest lows over the previous N calendar weeks.

Conclusion

To be successful traders, we must limit our losses. The magic of compounding dictates that we need a 100% profit to exactly offset a 50% loss. That means that our losses are far more important than our gains.

To stack the deck in our favor, we need to choose our stop procedure and stop parameters before entering each trade. This will help us overcome the unproductive emotions spawned by trading and our own self-destructive, innate decision-making behavior.

The type and width of stops will directly affect the profitability of your trading strategies. Ideally, you should perform a backtest on your mechanical strategies to determine the optimal stop parameters. If you do not have access to backtesting tools, I would suggest examining charts of your past trades and attempting to visualize how various stop methods would have performed

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future?

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social network.

The "Share / Save" button below contains links to all major social networks. If you do not see your social network listed, use the down-arrow to access the entire list of social networking sites.

Thank you for your support.

Brian Johnson

Copyright 2012 - Trading Insights, LLC - All Rights Reserved.

YNPED6ANF3KY

Pingback: Stop Loss Orders are Not Enough | Trader Edge

Pingback: Take the First Step Toward an Investment Process | Trader Edge

Pingback: 11 Rules to Improve Your Trading: Rules 2 & 3 | Trader Edge