In a recent post titled "ECRI Betrayed by Their Own Index," I noted the apparent inconsistency between the Economic Cycle Research Institute's (ECRI) current recession call and the recent strength of ECRI's proprietary weekly leading indicators series.

In response to that post, James Picerno, the editor of Capital Spectator, shared some of his thoughts on recession forecasting and provided links to articles on the Capital Spectator Economic Trend Index (CS-ETI) and the use of probit models to estimate the probability of a recession. I was intrigued by his research and by the accuracy of his models. He opened my eyes to the benefits of forecasting recessions.

A New Framework

I am no stranger to quantitative models. However, I have focused all of my attention on the development of systematic trading strategies which identified anomalies in asset prices, but completely ignored the economy. My custom indicators and models have been successful, but I am now convinced that ignoring the incremental benefits of economic cycle modeling represents a major opportunity cost. I have tracked various economic indicators anecdotally through the use of a summary market indicator score, but never constructed a formal model to identify recessionary environments.

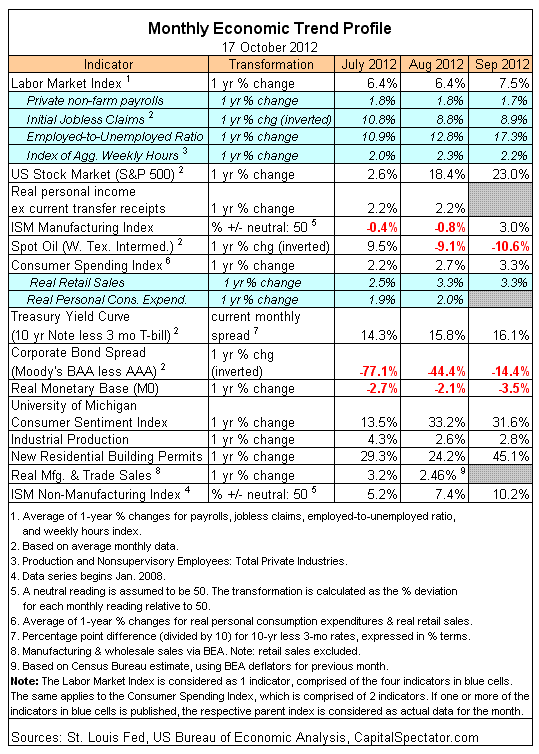

Picerno uses 18 variables (see Figure 1 below) to construct a diffusion index, which sounds complicated, but is actually relatively simple. The diffusion index represents the percentage of the 18 variables that are positive. If all of the variables were positive, the value of the diffusion index would be 1.0 or 100%. If nine of the 18 variable were positive, the value of the diffusion index would be 0.50 or 50%. 14 out of 18 variables were positive in August 2012. If I understand Picerno's methodology correctly, the resulting CS-ETI would have been 0.7777 or 77.77%.

CS-ETI and Recession Risk

This is a simple, intuitive framework, but one that does not automatically convert index values to recession risk. Picerno explains a possible rule-of-thumb for interpreting the CS-ETI index values,

"History implies that we should think of recession risk as threatening when CS-ETI falls under the 60% mark, which means that less than 60% of the underlying indicators are trending positive. A reading under 50% is an even stronger warning and effectively the point of no return."

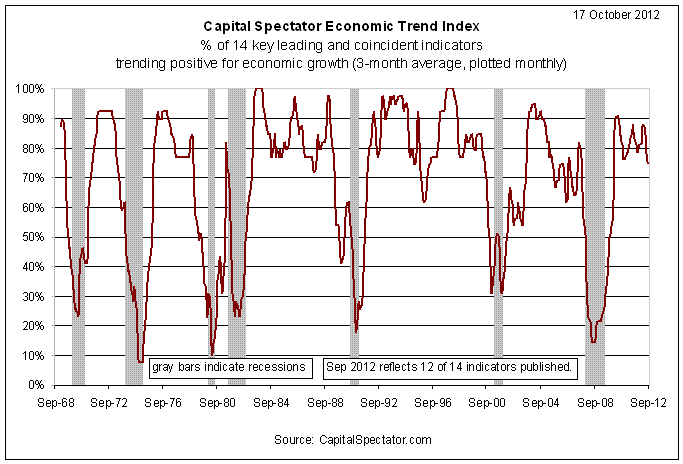

With those criteria in mind, take a look at the historical CS-ETI values in Figure 2 below. Notice how effective the 60% and 50% thresholds were in identifying recessions (the shaded regions). Even using the more conservative 60% value, there were no false signals for the period 1968 to present. In all cases, the CS-ETI provided advance warning of an imminent recession. The recessionary periods were defined by the National Bureau of Economic Research (NBER), but not until well after the fact.

Recession Probability Estimates

While the above results are impressive, it would still be helpful to convert the CS-ETI values into actual recession probability estimates, thus the need for the probit model. Picerno explains his process:

"I'm using a standard probit model that uses the monthly data for the 3-month average of CS-ETI as the independent variable and NBER's monthly recession readings (0=no recession, 1=recession). I estimate the cumulative normal distribution of the alpha and beta coefficients via a maximum likelihood technique in both Excel and R. It's all relatively conventional statistics."

The probit model converts the CS-ETI diffusion index values into more intuitive recession probability estimates (Figure 3 below) ranging from 0% to 100%. Again, the model results are impressive and are now more intuitive as well. It is interesting to note that (according to the model) the current recession risk is negligible.

Recession Forecasting versus Asset Price Modeling

How can such a simple model deliver such astounding results? Because it is easier to identify recessions than it is to forecast asset prices. The NBER defines a recession as "a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." The guidelines are straightforward and the NBER even tells us which variables are important.

In addition, unlike asset prices, there is no noise in the dependent variable when forecasting recessions; the economy was either in a recession (1) or not (0). Equity prices are highly volatile, with a never-ending sequence of rallies and pull-backs, which makes them very difficult to model.

The NBER does not define recessions until many months after the fact. This allows them to ignore temporary contractions that did not deteriorate into full-blown recessions; they benefit from perfect hindsight. As a result, the resulting probit model is designed to ignore temporary contractions as well.

Practical Considerations

Picerno was generous enough to share his variables, variable transformations, and his methodology. He also provides the historical CS-ETI and probit graphs on his website. In addition, he posts regular updates of the CS-ETI and plans to communicate significant change in the probit model probability estimates going forward. This is valuable information.

However, Picerno's work could also be used as a starting point for additional research. We all have our favorite economic indicators and many data series are available for free on the Internet, especially those provided by Government agencies.

Once you have the data, calculating a diffusion index is simple. However, when it came to the probit model, I was initially skeptical of Picerno's assertion that "It's all relatively conventional statistics." Fortunately, after a little reading on probit models, I was able to create a simple functional example in Excel.

I plan to follow the CS-ETI going forward and James graciously authorized me to provide periodic CS-ETI updates on Trader Edge. Nevertheless, I am intrigued by the power of these tools and would also like to experiment with a number of different variable combinations. The most time-consuming task would be collecting the data. Testing various combinations, transformations, and probit models would take very little time.

There is another important reason that I am considering developing my own recession model or models: I would like to have access to the historical diffusion index and probit probability estimates. I would like to test this data with my existing models, which are based primarily on technical data. The integration of proven economic and technical models could create even more profitable and robust trading strategies.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future?

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2012 - Trading Insights, LLC - All Rights Reserved.

Pingback: New Probit Models: U.S. Recession Risk is Currently Low | Trader Edge

Pingback: Recession Model Improvements | Trader Edge

Pingback: U.S. Recession Risk Jumps 20% in November | Trader Edge

Pingback: A New Recession Slack Indicator | Trader Edge

Pingback: Recession Risk Drops Sharply in December | Trader Edge