I introduced a simple non-farm payroll forecasting model a few months ago. Over the past month, I have developed a much more sophisticated model that aggregates the forecasts for three neural network models, each with a unique architecture. The aggregate neural network model is more accurate than the earlier models. This article explains the aggregate model's forecast for the January 2013 non-farm payroll data, which will be released tomorrow morning.

Non-Farm Payroll (NFP) Model Forecast - January 2013

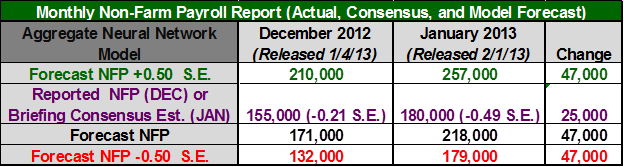

The table in Figure 1 below includes the monthly non-farm payroll data for two months: December 2012 and January 2013. The December data was released last month and the non-farm payroll data for January 2013 will be released tomorrow at 8:30 AM EST.

The model forecasts are in the third data row of the table (in black). Note that past and current forecasts reflect the latest values of the independent variables, but both forecasts will change when revisions are made to the historical economic data.

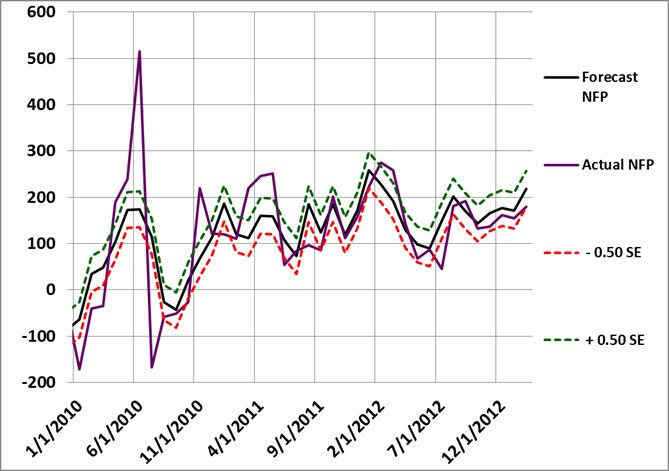

The monthly standard error of the model is approximately 77,100 jobs, which is lower than the previous models, but is still significant. Unfortunately, a lot of the variation is due to large anomalies in the reported survey data (e.g. the 2010 period in Figure 2 below). The first and last data rows of the table report the forecast + 0.5 standard errors (in green) and the forecast - 0.5 standard error (in red), respectively. All values are rounded to the nearest thousand. Assuming the model errors are normally distributed, roughly 31% of the observations would fall below -0.5 standard errors and another 31% of the observations would exceed +0.5 standard errors.

The actual non-farm payroll release for December 2012 is in the second data row of the table (in purple). The consensus estimate (reported by Briefing.com) for January 2013 is also in the second data row of the table (in purple). The reported and consensus NFP values also include the deviation from the forecast NFP (as a multiple of the standard error of the estimate). Finally, the last column of the table includes the estimated changes from December 2012 to January 2013.

Model Commentary

The model forecast for January is 218,000, which is up 47,000 from last month's revised forecast of 171,000. The Briefing.com consensus estimate for January is 180,000, which is 0.49 standard errors below the model forecast. The model forecast would appear to suggest a positive NFP surprise tomorrow.

The effects of Hurricane Sandy should have dissipated by now, but it always possible that they could have lingered into January.

As you can see from the graph in Figure 2 below, the trend in job gains over the past few months has been positive.

Summary

Using basic forecasting tools can help you identify unusual consensus economic estimates, which often lead to substantial surprises and market movements. Identifying such environments may help you protect your portfolio from these corrections and help you determine the optimal entry and exit points for your strategies. In addition, significant deviations from the new model's forecasts may foretell subsequent moves in the equity markets and the economy.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2013 - Trading Insights, LLC - All Rights Reserved.