Given the dramatic market decline in worldwide equity markets last week, Mark Hulbert's recent MarketWatch column titled "The Dow Theory just flashed a sell signal" was especially timely. Hulbert explains Dow Theory and the recent signal in his article, but the short version is that Dow Theory relies on the importance of the transportation sector in the overall economy and uses the performance of the industrial sector for confirmation.

The transportation sector delivers all consumer goods and industrial products. If transportation is not doing well, then the weakness will eventually show up in all sectors. It is the canary in the coal mine. Inspired by Dow Theory, I use seven relative strength pairs in a proprietary forecasting tool. When the leading sector in the pair under-performs, the relative strength indicator declines, which precedes market declines.

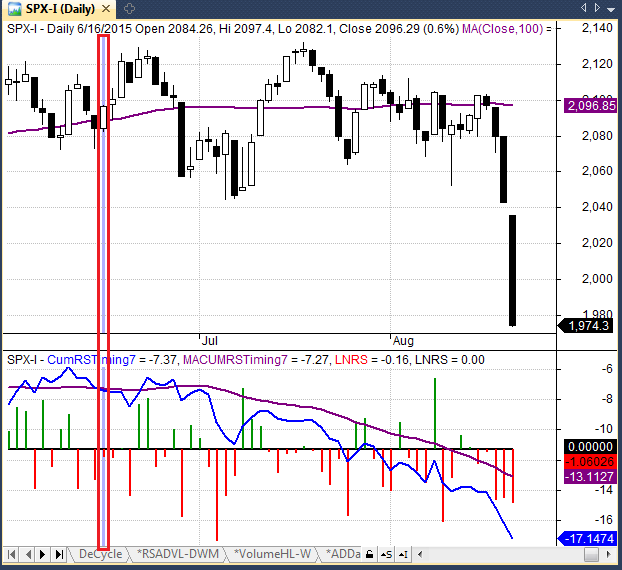

The top panel in Figure 1 below is a daily candlestick chart of the S&P 500 index as of late in the day on 08-21-2015. The bottom panel contains my relative strength indicator. The histogram represents the daily changes in the relative strength indicator. The blue line represents the cumulative relative strength and the purple line is a simple moving average of the cumulative relative strength. When the blue cumulative relative strength line is below the purple moving average line, the implications are bearish.

As you can see, the relative strength indicator turned bearish in mid-June, rebounded slightly a few days later, but has been bearish ever since, even when the market broke out to new highs in July. This represented a very bearish and prescient divergence. If price performance is not confirmed by relative strength, price gains tend to be transitory.

Figure 1: SPX 2015-08-22

The market got slammed last week and Dow Theory simultaneously generated a sell signal. Relative strength turned down last June and has become increasingly bearish. China looks like a disaster and their market is a farce. The commodities market is in a free-fall and emerging markets are suffering in kind. The only good news is that the Trader Edge recession model is not currently indicating a high probability of recession in the US, but that could change. Given recent events, I am very interested to see next month's recession model results.

Print and Kindle Versions of Brian Johnson's 2nd Book are Available on Amazon (75% 5-Star Reviews)

Exploiting Earnings Volatility: An Innovative New Approach to Evaluating, Optimizing, and Trading Option Strategies to Profit from Earnings Announcements.

Print and Kindle Versions of Brian Johnson's 1st Book are Available on Amazon (79% 5-Star Reviews)

Option Strategy Risk / Return Ratios: A Revolutionary New Approach to Optimizing, Adjusting, and Trading Any Option Income Strategy

Trader Edge Strategy E-Subscription Now Available: 20% ROR

The Trader Edge Asset Allocation Rotational (AAR) Strategy is a conservative, long-only, asset allocation strategy that rotates monthly among five large asset classes. The AAR strategy has generated annual returns of approximately 20% over the combined back and forward test period. Please use the above link to learn more about the AAR strategy.

Brian Johnson

Copyright 2015 - Trading Insights, LLC - All Rights Reserved.

About Brian Johnson

I have been an investment professional for over 30 years. I worked as a fixed income portfolio manager, personally managing over $13 billion in assets for institutional clients. I was also the President of a financial consulting and software development firm, developing artificial intelligence based forecasting and risk management systems for institutional investment managers.

I am now a full-time proprietary trader in options, futures, stocks, and ETFs using both algorithmic and discretionary trading strategies.

In addition to my professional investment experience, I designed and taught courses in financial derivatives for both MBA and undergraduate business programs on a part-time basis for a number of years. I have also written four books on options and derivative strategies.

Dow Theory Sell Signal

Given the dramatic market decline in worldwide equity markets last week, Mark Hulbert's recent MarketWatch column titled "The Dow Theory just flashed a sell signal" was especially timely. Hulbert explains Dow Theory and the recent signal in his article, but the short version is that Dow Theory relies on the importance of the transportation sector in the overall economy and uses the performance of the industrial sector for confirmation.

The transportation sector delivers all consumer goods and industrial products. If transportation is not doing well, then the weakness will eventually show up in all sectors. It is the canary in the coal mine. Inspired by Dow Theory, I use seven relative strength pairs in a proprietary forecasting tool. When the leading sector in the pair under-performs, the relative strength indicator declines, which precedes market declines.

The top panel in Figure 1 below is a daily candlestick chart of the S&P 500 index as of late in the day on 08-21-2015. The bottom panel contains my relative strength indicator. The histogram represents the daily changes in the relative strength indicator. The blue line represents the cumulative relative strength and the purple line is a simple moving average of the cumulative relative strength. When the blue cumulative relative strength line is below the purple moving average line, the implications are bearish.

As you can see, the relative strength indicator turned bearish in mid-June, rebounded slightly a few days later, but has been bearish ever since, even when the market broke out to new highs in July. This represented a very bearish and prescient divergence. If price performance is not confirmed by relative strength, price gains tend to be transitory.

Figure 1: SPX 2015-08-22

The market got slammed last week and Dow Theory simultaneously generated a sell signal. Relative strength turned down last June and has become increasingly bearish. China looks like a disaster and their market is a farce. The commodities market is in a free-fall and emerging markets are suffering in kind. The only good news is that the Trader Edge recession model is not currently indicating a high probability of recession in the US, but that could change. Given recent events, I am very interested to see next month's recession model results.

Print and Kindle Versions of Brian Johnson's 2nd Book are Available on Amazon (75% 5-Star Reviews)

Exploiting Earnings Volatility: An Innovative New Approach to Evaluating, Optimizing, and Trading Option Strategies to Profit from Earnings Announcements.

Print and Kindle Versions of Brian Johnson's 1st Book are Available on Amazon (79% 5-Star Reviews)

Option Strategy Risk / Return Ratios: A Revolutionary New Approach to Optimizing, Adjusting, and Trading Any Option Income Strategy

Trader Edge Strategy E-Subscription Now Available: 20% ROR

The Trader Edge Asset Allocation Rotational (AAR) Strategy is a conservative, long-only, asset allocation strategy that rotates monthly among five large asset classes. The AAR strategy has generated annual returns of approximately 20% over the combined back and forward test period. Please use the above link to learn more about the AAR strategy.

Brian Johnson

Copyright 2015 - Trading Insights, LLC - All Rights Reserved.

About Brian Johnson

I have been an investment professional for over 30 years. I worked as a fixed income portfolio manager, personally managing over $13 billion in assets for institutional clients. I was also the President of a financial consulting and software development firm, developing artificial intelligence based forecasting and risk management systems for institutional investment managers. I am now a full-time proprietary trader in options, futures, stocks, and ETFs using both algorithmic and discretionary trading strategies. In addition to my professional investment experience, I designed and taught courses in financial derivatives for both MBA and undergraduate business programs on a part-time basis for a number of years. I have also written four books on options and derivative strategies.