The following article reports and evaluates the 2015 results of the AAR strategy. The AAR strategy is a conservative, long-only, asset allocation strategy that rotates monthly among five large asset classes: large-cap U.S. stocks, developed country stocks in Europe and Asia, emerging market stocks, U.S. Treasury Notes, and commodities. It is one of the 25+ proprietary strategies that I trade in my personal account and the only strategy that Trader Edge currently offers on a subscription basis.

Market Environment

The AAR strategy is designed to perform well in (almost) all environments, but 2015 was a very unusual year. The AAR strategy is based on momentum, one of the most reliable and proven techniques in long-term investing. However, momentum requires one or more of the candidates to be in an established uptrend.

Normally, US Treasuries outperform when stocks perform poorly, but the change in the Fed's accommodate stance created headwinds for bonds in 2015. In addition, commodities are not typically in a severe downtrend when stock and bond returns are weak. As a result, none of the investment candidates performed well in 2015 and the AAR strategy is limited to long positions in the investment candidates or cash.

To further complicate the situation last year, every investment candidate had a negative serial (month-to-month) correlation in 2015, which is also unusual. As a result, positive returns in one month tended to be followed by poor returns the following month. These discrete reversals are also problematic for momentum strategies.

The AAR strategy performed well in 2008 and in previous recessions, but the 2015 environment was particularly difficult and unusual. All of these factors contributed to the underperformance of the AAR strategy in 2015. The AAR strategy earned a return of -15.25% in 2015 (including transaction costs), under-performing its equal-weighted index (-8.78%) by 6.47% during the year.

It is important to remember that the AAR strategy is not an equity strategy and is not an absolute return strategy. The appropriate benchmark for the strategy is the equal-weighted monthly return of the five investment candidates, measured over a complete economic cycle.

The AAR strategy is based on the Ivy League portfolio asset allocation framework and every month it has the option of investing in any one of the five diverse investment candidates described above. If none of the five candidates pass their respective trade filters, the AAR strategy remains in cash for the month. Stop-loss orders are used on every trade to control losses and to facilitate position sizing.

AAR Strategy Returns

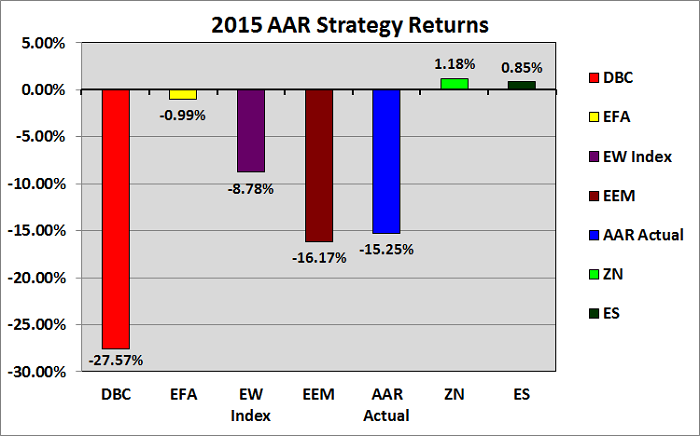

Of the five investment candidates, only the e-mini S&P 500 futures contract (ES: +0.85%) and U.S. Treasury Notes (ZN: +1.18%) earned positive returns in 2015. Commodities (DBC: -27.57%), the EAFE Index (EFA: -0.99%), and emerging markets (EEM: -16.17%) all earned negative returns for the year. Slight differences in total return may be due to rounding errors. The poor returns of each of the investment candidates illustrates the unusually difficult environment for momentum strategies in 2015.

The 2015 returns for the five investment candidates are depicted below, each shown in different colors (figure 1 below). The index return of -8.78% (purple) was calculated using the equal-weighted monthly returns for the five investment candidates, excluding transaction costs. Finally, the AAR actual strategy return was calculated using the actual strategy signals executed at month-end closing prices, net of estimated transaction costs. The 2015 AAR strategy return is shown in blue (-15.25%).

Here are the links to the 2013 and 2014 AAR Strategy results. All returns were calculated using prices back-adjusted for dividends and futures roll transactions. All prices and back-adjustments were provided by Commodity Systems, Inc. (CSI), one of the leading providers of market pricing data.

If you are not currently a subscriber and would like to learn more about the AAR strategy, there is a detailed description on the AAR Strategy page.

Print and Kindle Versions of Brian Johnson's 2nd Book are Available on Amazon (75% 5-Star Reviews)

Print and Kindle Versions of Brian Johnson's 1st Book are Available on Amazon (79% 5-Star Reviews)

Trader Edge Strategy E-Subscription Now Available: 20% ROR

The Trader Edge Asset Allocation Rotational (AAR) Strategy is a conservative, long-only, asset allocation strategy that rotates monthly among five large asset classes. The AAR strategy has generated annual returns of approximately 20% over the combined back and forward test period. Please use the above link to learn more about the AAR strategy.

Brian Johnson

Copyright 2016 - Trading Insights, LLC - All Rights Reserved.