This article presents the Trader Edge aggregate neural network model forecast for the June 2013 non-farm payroll data, which will be released tomorrow morning.

Non-Farm Payroll (NFP) Model Forecast - June 2013

The table in Figure 1 below includes the monthly non-farm payroll data for two months: May and June 2013. The May data was released last month and the non-farm payroll data for June 2013 will be released tomorrow morning at 8:30 AM EDT.

The model forecasts are in the third data row of the table (in blue). Note that past and current forecasts reflect the latest values of the independent variables, which means that forecasts will change when revisions are made to the historical economic data.

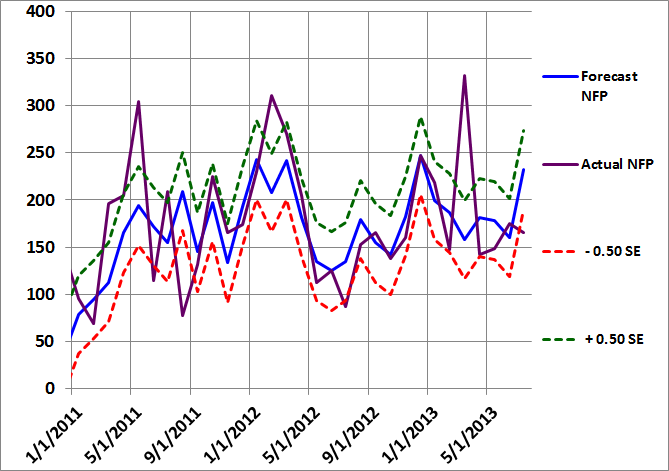

The monthly standard error of the model is approximately 83,200 jobs. The first and last data rows of the table report the forecast plus 0.5 standard errors (in green) and the forecast minus 0.5 standard errors (in red), respectively. All values are rounded to the nearest thousand. If the model errors were normally distributed, roughly 31% of the observations would fall below -0.5 standard errors and another 31% of the observations would exceed +0.5 standard errors.

The actual non-farm payroll release for May 2013 is in the second data row of the table (in purple). The consensus estimate (reported by Briefing.com) for June 2013 is also in the second data row of the table (in purple). The reported and consensus NFP values also include the deviation from the forecast NFP (as a multiple of the standard error of the estimate). Finally, the last column of the table includes the estimated changes from May to June 2013.

Model Commentary

The aggregate model forecast for June is 232,000, which is up a remarkable 72,000 jobs from last month's revised forecast of 160,000. The higher forecast for June reflects a stronger employment environment and improving U.S. economic data. The Briefing.com consensus estimate for June is only 166,000 jobs, which represents a 9,000 decrease from May. As a result, the June consensus estimate is almost a full standard error below the June forecast (-0.79 S.E.) which could lead to an upside surprise tomorrow. The actual NFP observation in May was slightly higher than the revised model forecast (+0.18 S.E.).

Summary

Normally a large upside surprise in the NFP report would cause a spike in equity prices. However, in the backward world of Q.E., anything is possible. If the June NFP employment data were to increase by 232,000 jobs, the large jump could fuel fears of a premature end to the Fed's Quantitative Easing program and could even generate additional selling.

A large upside surprise would be a negative for Treasury bonds for two reasons. First, a stronger economy usually results in higher yields due to increased inflationary pressures and rising demand for debt financing. Second, if the Fed stops buying bonds in the open market, then yields would eventually return to "normal" market levels.

Basic forecasting tools can help you identify unusual consensus economic estimates, which often lead to substantial surprises and market movements. Identifying such environments may help you protect your portfolio from these corrections and help you determine the optimal entry and exit points for your strategies.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2013 - Trading Insights, LLC - All Rights Reserved.

The actual change in the June NFP was 195K, which was below the model forecast. However, the May NFP was revised higher by 20K. The net result was an increase of 215K jobs, very close to the model forecast of +232K jobs.

The equity market initially faded, then finished strong at the end of the day. As expected, bonds got slammed.

Brian Johnson