The market was clearly thrilled with the +163K non-farm payroll (NFP) number on Friday morning. Equity markets were up worldwide, as were most commodities. The NFP number was much better than the consensus estimate of +100K, although the estimate of +100K was probably understated given the strong ADP employment change report released on Thursday. In addition, the prior month's NFP was revised lower by 16K, which reduced the net amount of the NFP surprise. Still, to be fair to the bulls, the NFP number was significantly stronger than expected. So, what was the bad news?

The Household Survey

While the establishment survey gets the most attention, it would not be prudent to ignore the results of the household survey - which is what the market did on Friday. The household survey painted a very different picture of the job market. The civilian unemployment rate increased from 8.2% to 8.3%. You may recall that many economists predicted this would happen, but believed that it would be a good omen. Their argument was that an improving job market would draw disillusioned workers back into the labor force, which would temporarily increase the unemployment rate.

However, that is not why the unemployment rate increased last month. In fact, according to the household survey, the labor force actually decreased by 150K in July, which would normally reduce the unemployment rate. But the employment rate did not decline. Why not? Because the number of employed workers dropped by 195K and the number of unemployed workers increased by 45K, directly contradicting the results of the establishment survey.

Market Response

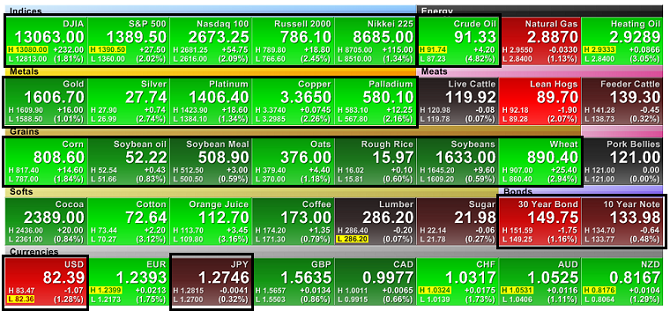

As I mentioned earlier, global equity markets were up sharply on Friday, completely reversing their Thursday decline. European equity indices increased by 2% to 6%. US equity indices rose by 2% to 2.5%. Commodities were also up significantly, especially crude oil, which jumped by 4.82% on Friday. Metals and Grains were also up across the board.

Due to the terrible growing season and the shrinking crop estimates, grain prices have now increased by 15% to 50% in the last two months. Given the increase on Friday, crude oil is now up 18% since the end of June. Completing the risk-on trade, US Treasury bond prices, the US dollar, and the Japanese Yen were all lower on Friday. The Euro was up a remarkable 1.75% against the US Dollar. See Figure 1 below for the FINVIZ futures summary for Friday, August 3, 2012.

Figure 1: FINVIZ Futures 2012-08-03

The Fed is Now Handcuffed

Here is the rest of the bad news: the dramatic rise in energy and grain prices coupled with the surprising increase in Friday's NFP number will make it very difficult for the Fed to implement the next round of Quantitative Easing (QE3), which was widely expected to be announced at the Federal Reserve's Economic Symposium on August 31, 2012 or at the next Fed meeting on September 12-13, 2012. The hope for QE3 is arguably the reason that US equity prices have risen over the past two months, despite persuasive evidence that the domestic and global economies were slowing and corporate earnings expectations were falling.

The Fed has a dual mandate: promote maximum employment and stable prices. The 15% to 50% price increases in the grain and energy sectors will translate into considerably higher retail food and gasoline prices in the coming weeks and months. While some core inflation measures exclude the more volatile food and energy components, food and energy expenditures account for almost 20% of the after-tax income of the median household in the US. For lower income households, this percentage rises radically. Food and energy costs matter and QE3 would only exacerbate the rising costs of food and especially energy.

While there are many economic indicators that are more useful than the monthly employment report, those indicators are not specifically mentioned in the Fed's dual mandate. Consistent with its mandate, the Fed focuses on employment. Before the July NFP number, the Fed possibly could have justified another round of quantitative easing. However, the recent increase in NFP from 64K in June to 163K in July (a 155% increase), will make it much more difficult for the Fed to act, especially just two short months before a fiercely divisive presidential election.

Bernanke recognizes that each successive round of Quantitative Easing offers diminishing returns. In addition, every bond or mortgage-backed security purchased during Quantitative Easing must eventually be sold. The size of the Fed's balance sheet is already massive ($2.2 Trillion in long-term Treasuries and Federal Agency Debt/MBS). When these huge positions are eventually unwound, it could cause unpredictable disruptions to the debt markets and undesirable increases in interest rates. Unless unprecedented changes are made to the US budget, record levels of new Treasury debt would need to be sold while the Fed is unwinding its accumulated bond holdings from QE1, QE2, and eventually QE3.

While the economy is clearly weak, it could definitely get a lot worse. Given the increasing food and energy prices, the unexpected rise in the July NFP number, the limited opportunities for quantitative easing in the future, and the potential perception of partisan action by the Fed, it would not be prudent for the Fed to pursue QE3 in the near future.

Conclusion

Despite widespread evidence of economic weakness and decreasing corporate earnings expectations, the S&P 500 Index closed only 2.2% below its post-recession high on Friday. The monthly employment report was not as strong as it appeared, but may be sufficiently strong to prevent the Fed from acting later this month. The recent rise in US equity markets has been fueled by hopes of QE3, which now appears increasingly doubtful - at least in the near term.

There is no viable solution in sight for the European Sovereign Debt Crisis and there has been no progress on the rapidly approaching fiscal cliff in the US. Despite all of these factors, US equity prices continue to rise and the fear index (the VIX) continues to fall. Historically, the VIX has increased dramatically from mid-August to late-October; this year should be no exception. Equity markets are currently priced for perfection

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future?

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social network.

The "Share / Save" button below contains links to all major social networks. If you do not see your social network listed, use the down-arrow to access the entire list of social networking sites.

Thank you for your support.

Brian Johnson

Copyright 2012 - Trading Insights, LLC - All Rights Reserved.

.

About Brian Johnson

I have been an investment professional for over 30 years. I worked as a fixed income portfolio manager, personally managing over $13 billion in assets for institutional clients. I was also the President of a financial consulting and software development firm, developing artificial intelligence based forecasting and risk management systems for institutional investment managers.

I am now a full-time proprietary trader in options, futures, stocks, and ETFs using both algorithmic and discretionary trading strategies.

In addition to my professional investment experience, I designed and taught courses in financial derivatives for both MBA and undergraduate business programs on a part-time basis for a number of years. I have also written four books on options and derivative strategies.

Jobs Report: Good News and Bad News

The market was clearly thrilled with the +163K non-farm payroll (NFP) number on Friday morning. Equity markets were up worldwide, as were most commodities. The NFP number was much better than the consensus estimate of +100K, although the estimate of +100K was probably understated given the strong ADP employment change report released on Thursday. In addition, the prior month's NFP was revised lower by 16K, which reduced the net amount of the NFP surprise. Still, to be fair to the bulls, the NFP number was significantly stronger than expected. So, what was the bad news?

The Household Survey

While the establishment survey gets the most attention, it would not be prudent to ignore the results of the household survey - which is what the market did on Friday. The household survey painted a very different picture of the job market. The civilian unemployment rate increased from 8.2% to 8.3%. You may recall that many economists predicted this would happen, but believed that it would be a good omen. Their argument was that an improving job market would draw disillusioned workers back into the labor force, which would temporarily increase the unemployment rate.

However, that is not why the unemployment rate increased last month. In fact, according to the household survey, the labor force actually decreased by 150K in July, which would normally reduce the unemployment rate. But the employment rate did not decline. Why not? Because the number of employed workers dropped by 195K and the number of unemployed workers increased by 45K, directly contradicting the results of the establishment survey.

Market Response

As I mentioned earlier, global equity markets were up sharply on Friday, completely reversing their Thursday decline. European equity indices increased by 2% to 6%. US equity indices rose by 2% to 2.5%. Commodities were also up significantly, especially crude oil, which jumped by 4.82% on Friday. Metals and Grains were also up across the board.

Due to the terrible growing season and the shrinking crop estimates, grain prices have now increased by 15% to 50% in the last two months. Given the increase on Friday, crude oil is now up 18% since the end of June. Completing the risk-on trade, US Treasury bond prices, the US dollar, and the Japanese Yen were all lower on Friday. The Euro was up a remarkable 1.75% against the US Dollar. See Figure 1 below for the FINVIZ futures summary for Friday, August 3, 2012.

Figure 1: FINVIZ Futures 2012-08-03

The Fed is Now Handcuffed

Here is the rest of the bad news: the dramatic rise in energy and grain prices coupled with the surprising increase in Friday's NFP number will make it very difficult for the Fed to implement the next round of Quantitative Easing (QE3), which was widely expected to be announced at the Federal Reserve's Economic Symposium on August 31, 2012 or at the next Fed meeting on September 12-13, 2012. The hope for QE3 is arguably the reason that US equity prices have risen over the past two months, despite persuasive evidence that the domestic and global economies were slowing and corporate earnings expectations were falling.

The Fed has a dual mandate: promote maximum employment and stable prices. The 15% to 50% price increases in the grain and energy sectors will translate into considerably higher retail food and gasoline prices in the coming weeks and months. While some core inflation measures exclude the more volatile food and energy components, food and energy expenditures account for almost 20% of the after-tax income of the median household in the US. For lower income households, this percentage rises radically. Food and energy costs matter and QE3 would only exacerbate the rising costs of food and especially energy.

While there are many economic indicators that are more useful than the monthly employment report, those indicators are not specifically mentioned in the Fed's dual mandate. Consistent with its mandate, the Fed focuses on employment. Before the July NFP number, the Fed possibly could have justified another round of quantitative easing. However, the recent increase in NFP from 64K in June to 163K in July (a 155% increase), will make it much more difficult for the Fed to act, especially just two short months before a fiercely divisive presidential election.

Bernanke recognizes that each successive round of Quantitative Easing offers diminishing returns. In addition, every bond or mortgage-backed security purchased during Quantitative Easing must eventually be sold. The size of the Fed's balance sheet is already massive ($2.2 Trillion in long-term Treasuries and Federal Agency Debt/MBS). When these huge positions are eventually unwound, it could cause unpredictable disruptions to the debt markets and undesirable increases in interest rates. Unless unprecedented changes are made to the US budget, record levels of new Treasury debt would need to be sold while the Fed is unwinding its accumulated bond holdings from QE1, QE2, and eventually QE3.

While the economy is clearly weak, it could definitely get a lot worse. Given the increasing food and energy prices, the unexpected rise in the July NFP number, the limited opportunities for quantitative easing in the future, and the potential perception of partisan action by the Fed, it would not be prudent for the Fed to pursue QE3 in the near future.

Conclusion

Despite widespread evidence of economic weakness and decreasing corporate earnings expectations, the S&P 500 Index closed only 2.2% below its post-recession high on Friday. The monthly employment report was not as strong as it appeared, but may be sufficiently strong to prevent the Fed from acting later this month. The recent rise in US equity markets has been fueled by hopes of QE3, which now appears increasingly doubtful - at least in the near term.

There is no viable solution in sight for the European Sovereign Debt Crisis and there has been no progress on the rapidly approaching fiscal cliff in the US. Despite all of these factors, US equity prices continue to rise and the fear index (the VIX) continues to fall. Historically, the VIX has increased dramatically from mid-August to late-October; this year should be no exception. Equity markets are currently priced for perfection

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future?

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social network.

The "Share / Save" button below contains links to all major social networks. If you do not see your social network listed, use the down-arrow to access the entire list of social networking sites.

Thank you for your support.

Brian Johnson

Copyright 2012 - Trading Insights, LLC - All Rights Reserved.

.

About Brian Johnson

I have been an investment professional for over 30 years. I worked as a fixed income portfolio manager, personally managing over $13 billion in assets for institutional clients. I was also the President of a financial consulting and software development firm, developing artificial intelligence based forecasting and risk management systems for institutional investment managers. I am now a full-time proprietary trader in options, futures, stocks, and ETFs using both algorithmic and discretionary trading strategies. In addition to my professional investment experience, I designed and taught courses in financial derivatives for both MBA and undergraduate business programs on a part-time basis for a number of years. I have also written four books on options and derivative strategies.