The purpose of this series of posts is to provide a manageable list of fundamental trading rules to help you improve your trading process - regardless of your experience level. I will also explain the rationale behind each rule and highlight its significance. Here are the 2nd and 3rd in a series of 11 rules that will help you improve your returns and reduce your trading losses.

Rule #2: Calculate Stop-Loss Levels for Every Trade

Most traders spend the vast majority of their time determining what to buy and when to buy it; very few invest the requisite amount of time evaluating the optimal time to sell. Many traders don't even consider how they will exit a position until after they already own the security. By then, it is too late to develop an objective, unemotional and rational decision exit strategy. Unrealized profits and losses inflame emotions and cloud judgment.

Risk management isn't sexy, but it is the most important element in achieving long-term trading success. And the first rule in risk management is to always use stops. Numerous behavioral finance studies have demonstrated that the pain of losses is far greater than the satisfaction received from profits. As a result, traders avoid taking losses, hoping they will eventually turn into winners. Unfortunately, small losses often become large losses, which make those positions even more difficult to liquidate.

This is when emotions run rampant; the devil on your shoulder will say anything to prevent you from closing the position and realizing an agonizing, embarrassing loss.

- If you liked the stock at $100, then you should love it at $50.

- It already declined 50%; it can't go down much further.

- The P/E ratio doubled; it has never been this cheap.

- It is so cheap; you should buy more and reduce your average cost...

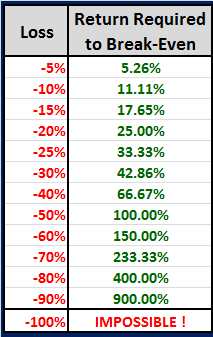

If the devil wins this argument, the losses could grow large enough to permanently threaten your capital position. Gains and losses are not symmetric. Due to the mathematics of compounding, it takes a 100% gain to recover from a 50% loss. Losses beyond 50% are often unrecoverable.

How do you prevent this from happening? Determine the stop-loss level before entering every trade. This is the specific price where you will sell a long position or cover a short position for a loss.

Ideally you should enter a stop-limit order immediately after entering the trade. In addition, you should also create an alert that will notify you if the stop-loss or trigger price were reached. This would allow you to confirm that your stop-limit order was filled.

Stop-loss levels should be based on the volatility of the underlying security and should be consistent with the specific strategy that triggered the trade. Even the best trades are not profitable immediately and need sufficient latitude for normal price fluctuations. More volatile securities require wider stops as do longer-term strategies.

Many traders use an Average True Range (ATR) or a standard deviation calculation to customize the stop level based on the historical volatility of the underlying security.

While there are valid exceptions to almost every rule, I cannot think of a single scenario that would justify not setting and respecting specific stop-loss levels for every position.

Rule #3: Limit Losses on Every Trade to Less Than 2% of Total Capital

Setting the stop-loss level is an important first step, but it alone is not sufficient to protect your capital. If you were to set the stop-loss level at 25%, but put 100% of your portfolio in the position, the amount of capital at risk would still be too high. The purposes of risk management are to deliver prudent risk-return tradeoffs and ensure that all losses are recoverable. To meet those objectives, you must set a specific stop-loss level for every trade AND use those stop-loss levels to calculate the corresponding maximum position sizes.

It is widely known that most professional traders limit losses on each trade to a maximum of 2% of their total capital. Note, this is a maximum value and many traders (including myself) use a more conservative risk level of 1% or even 0.5% of total capital.

Many traders misinterpret this simple rule. It does not mean that the maximum position size should be less than 2% of total capital. Instead, it means that if a trade were to be liquidated at the maximum stop-loss level, the resulting loss would be less than 2% of total capital. This can and does result in position sizes that are much larger than 2% of the portfolio.

Obviously, it is unrealistic to expect that you would be able to liquidate every position at the stop-loss level, which provides additional justification for setting your total capital at risk below 2%. The liquidation assumption is more realistic for large liquid futures contracts that trade almost 24 hours, which significantly reduces gap risk. However, for small, thinly-traded stocks with high levels of non-systematic risk, a much more conservative assumption should be used.

Once you have determined the specific stop-loss amount and your total capital at risk, calculating position size is straightforward.

Example: Stop-Loss = 8%, Capital at Risk = 0.5%

Position Size = Total Capital At Risk / Stop-Loss Amount

Position Size = 0.50% / 8.00% = 6.25%

In the example above, the resulting maximum position size would be 6.25% of the total market value of the portfolio. Please review the tables below to improve your understanding of the position size calculation.

When developing a trading plan, it is important to understand the effects of capital at risk and stop-loss amounts on the position size calculation. Position size increases linearly with total capital at risk. This is intuitive. However, many traders fail to recognize the effect of wider stop-loss levels on position size. Increasing the stop-loss level from 5% to 10% would require a 50% reduction in position size. This effect must be considered when determining the optimal stop-loss levels for your strategies.

Conclusion

Risk management is the most important determinant of long-term trading success. In order to limit your risk to a reasonable level of total capital, you must set a specific stop-loss level for every trade AND use those stop-loss levels to calculate the corresponding maximum position sizes.

Using these risk management tools religiously will help ensure that your losses are recoverable.

Related Posts

For more in-depth information on stop losses and position sizing, please revisit these earlier posts:

Stop Loss Orders are Not Enough

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future?

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social network.

The "Share / Save" button below contains links to all major social networks. If you do not see your social network listed, use the down-arrow to access the entire list of social networking sites.

Thank you for your support.

Brian Johnson

Copyright 2012 - Trading Insights, LLC - All Rights Reserved.

Hi Brian,

As usual, very useful commentary. Regarding the following:

…I’m curious as to whether or not you would apply this maxim to targetless, rotational systems (in the vein of what you describe here http://www.relativityreport.com/?p=5393), and if so, how…

Cheers,

Bill

Bill,

Good to hear from you again.

I actively trade several different rotational strategies and use stops with all of them. The stops ensure that the maximum loss on any trade will not exceed a specific, predetermined percentage amount (except for gaps and slippage).

In the event a trade is stopped out for a loss, the proceeds would be held in cash until the next rotational ranking (daily, weekly, or monthly as determined by the individual strategy).

When the next rotational position is purchased, the new total capital amount (including the most recent loss) would be used to calculate the new position size.

AMIBroker supports this stop loss approach on their rotational strategy platform. The following AMIBroker code would allow you to optimize the stop loss percentage for any rotational strategy. In this example, stop loss percentages would be evaluated from 5.0% to 10.0% in 1.0% increments. The 7.0% value in the first line of code below is the current stop loss percentage.

BLoss = Optimize (“BLoss”, 7.0, 5.0, 10.0, 1.0);

ApplyStop (stopTypeLoss, stopModePercent, BLoss, True);

Thanks again for your continued interest in Trader Edge.

Regards,

Brian Johnson

Makes perfect sense Brian. I really appreciate the input.

For what it’s worth, I trade several such strategies as well, and have been torn on this issue for some time, particularly when it comes to the use of intraday stops (given recent events such as the 2010 “flash crash”…got burned on that one).

In backtesting my own systems, I was surprised to find that the use of such stops consistently lowered total returns. Of course, they also substantially lowered the volatility of those returns as well as my drawdowns 🙂 Typical risk v reward stuff, I suppose….

My compromise these days (when it comes to targetless systems, at least) is to strictly limit the total capital that I commit to any one strategy and to employ “disaster” market-on-close stops of 20% across all open strategy positions. Certainly not perfect, but functional to date. That said, always looking for ways to improve…

Looking forward to your next installment!

Cheers,

Bill

Bill,

I agree that stops often lower backtested compound annual returns, but usually increase CAR/max drawdown ratios, profit factors, and Sharpe ratios. I also agree that the flash crash made it more difficult to have confidence in stops. That is one reason that I always use stop-limit orders instead of stop-market orders.

There is a chance my stop-limit orders would not be filled, but that would be better than using stop-market orders and potentially selling ETFs for $0.01 (as we saw during the flash crash). I always use alerts with stop-limit orders as well, which allows me to log in and manually adjust the limit prices as needed.

Thanks again for your input regarding rotational strategies. Even with their history of excess returns, very few traders use them.

Regards,

Brian Johnson

Sorry, posted the wrong link. I meant: https://traderedge.net/2012/05/04/a-more-efficient-relative-strength-indicator/

Pingback: 11 Rules To Improve Your Trading « TraderHacks