Using stop loss orders on every trade is a critical component of risk management, but stops are only part of the solution. Even when using stops, most traders still take far too much risk. In many cases, they completely overlook the most important step in risk management: determining the appropriate amount of capital to risk on each trade.

Once you have determined the amount of capital to risk on a given trade, you can then use your predetermined stop level to calculate the corresponding position size to buy or sell. In other words, the amount of capital at risk, the width of the stop, and the corresponding position size are all directly related through a simple mathematical formula - one that very few traders use.

Total Capital at Risk

Before examining this formula in detail, it is important that you have a working knowledge of stop loss orders. If you would like a refresher on setting stop levels, please return to my previous post "The Key to Trading Success." Before we can calculate the position size, we must first determine the appropriate amount of capital to risk on each trade. While there are a number of complex algorithms you could use, I would like to keep this as simple as possible. Most professional traders risk no more than 1% - 2% of their total capital on an individual trade.

Note, total capital at risk of 1% - 2% does not mean that the market value of each position only represents 1% - 2% of your total capital. It means that if the trade incurs the maximum loss (as determined by the stop level), then you would lose no more 1% - 2% of your total capital.

Limiting your losses to only 1% - 2% of total capital on each trade might seem overly conservative, but every trader eventually experiences a series of consecutive losses and it is very difficult to recover from losing a large percentage of your total capital, emotionally and mathematically.

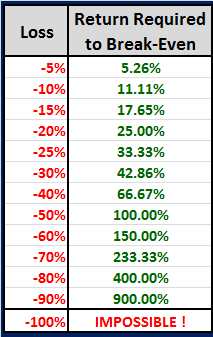

As you can see in Figure 1 to the left, it would require a 25% return to recover from a 20% loss, which would be difficult, but still possible.

After losing 50% of your total capital, you would need a 100% return to break-even. This could take years, even without the psychological baggage of a recent 50% draw-drown. Losses beyond 50% would be insurmountable for most traders.

To be a successful trader, you must maintain sufficient capital to recover from your losses.

So far, our discussion has been limited to a single trade, but if you have a number of positions and they are all highly correlated (e.g. several individual stocks), then you should also limit your aggregate risk on the entire group of correlated positions. If you would like a rule of thumb, try to risk no more than 10% of your total capital on the positively correlated positions.

We trade (or invest) because we have knowledge, experience, insight, and/or tools that give us a statistical advantage over other traders. The key to exploiting this advantage over time is to play the game repeatedly - the odds are in our favor. It is analogous to owning a casino in Las Vegas.

Casinos limit the size of each bet to ensure the probabilities work in their favor over time. They want blackjack players betting $25 on each hand and playing for hours and hours at a time. The casino's odds of winning increase dramatically as they play the game repeatedly. They do not want a player to walk in and place a $500,000 wager on a single hand of blackjack, just as we do not want to risk 50% of our total capital on a single transaction.

Calculating Position Size

Now that we have covered the amount of capital to risk, we will need to use that value and the width of the stop to calculate the corresponding position size for the trade. As I explained earlier, there is a specific formula that quantifies the relationship between the amount of capital at risk, the width of the stop, and the corresponding position size. Two versions of the formula are presented below, followed by definitions of each variable:

- TCAR = PS x SL

- PS = TCAR / SL

- TCAR = Total Capital at Risk: the percentage of your total capital that you could lose by exiting at the stop level

- PS = Position Size expressed as a percentage of total capital: the market value of the position divided by the total market value of your portfolio

- SL = Stop Loss Percentage Loss: percentage loss on the trade if you exit the trade for the maximum loss at the stop level

Let's look at a specific example of how to use the above formula to calculate the maximum position size. Assume that we have a portfolio worth $1.0 Million. We would like to buy the SPY exchange traded fund (an S&P 500 index fund), which is trading at a current price of 139.72. To be consistent with other professional traders, we decide to risk 1.5% of our total capital on the trade (TCAR = 1.5%). Finally, based on our trading strategy, we decide to exit our trade if we suffer a 10% loss; as a result, we place a stop loss order at a price 10% below our purchase price of the SPY (SL = 10%).

Now we can calculate the position size for our SPY trade using formula #2 above.

PS = TCAR / SL = 1.5% / 10% = 15%

The resulting maximum position size equals 15% of our total capital or 15% x $1,000,000 = $150,000

The maximum number of shares equals the position size divided by the price per share ($150,000 / $139.72), which equals 1,073.57 shares . If you would like to execute a round-lot order (increments of 100 shares), always round down to avoid exceeding the desired total capital at risk. In this case, we would purchase 1,000 shares of SPY at $139.72.

The stop level for our trade would be $125.75, which is 10% below the purchase price ($139.72 x 0.90). The maximum loss (ignoring slippage and overnight gaps) would be $13.97 per share, which can be determined by subtracting the stop level from the purchase price ($139.72 - $125.75).

The maximum total dollar loss for the SPY trade (again, ignoring slippage and overnight gaps) would be $13,970 (1,000 shares x $13.97 per share). The resulting loss as a percentage of our total capital would be 1.397% ($13,970 / $1,000,000), which is less than our maximum specified loss of 1.5% (remember that we rounded down our calculation of the total number of shares from 1,073.57 to 1,000).

Finally, when calculating the number of shares, we always use the current market value of our portfolio. If we started with a $1,000,000 portfolio and lost $15,000 on our first trade, we would use the new market value of $985,000 to calculate the number of shares for our next trade. Since position sizes are calculated as a percentage of total capital, the dollar amount of our positions would increase if our capital grew. If we suffered a series of losses, the dollar amount of our future positions would decrease accordingly.

Calculating Position Size for Futures

Traders often get confused when thinking about futures contracts - due to margin requirements, multipliers, and other factors. Futures contracts represent the agreement to transact a specific quantity of the underlying asset at a specific time in the future.

When purchasing (or selling) a futures contract, you do not need to deposit the full value of the contract up front. Instead, the buyer and seller are both required to make a margin or good faith deposit, to guarantee that they can make good on their future obligations under the contract. Margin requirements are based on the volatility of the underlying contract, but are typically between 10% and 15% of the market value of the contract. Fortunately, the margin requirements do not affect the calculation of position size.

Let's look at a specific example of how to use our formula to calculate the maximum position size for the e-mini S&P 500 (ES) futures contract. Again, assume that our current portfolio value is $1.0 Million. However, instead of buying the SPY, we would like to buy the ES contract, which is trading at a current price of $1,391.50.

As mentioned earlier, each futures contract has a multiplier. The multiplier for the ES contract is 50, which means that the market value of each contract equals 50 times the current price. In this case, the market value of a single ES contract would be $69,575 (50 x $1,391.50).

As we did with the SPY trade, we again risk 1.5% of our total capital on the trade (TCAR = 1.5%) and we decide to exit our trade if we suffer a 10% loss; as a result, we place a stop loss order at a price 10% below the purchase price of the ES contract (SL = 10%).

Now we can calculate the position size for our ES trade using formula #2 above.

PS = TCAR / SL = 1.5% / 10% = 15% (this is obviously the same as the SPY example above)

The resulting position size equals 15% of our total capital or 15% x $1,000,000 = $150,000 (same as above)

The number of contracts equals the position size divided by the current market value of each contract ($150,000 / $69,575), which equals 2.15 ES contracts. We can only trade an integer number of contracts and we always round down to avoid exceeding the desired total capital at risk. In this case, we would purchase 2 e-mini S&P 500 (ES) contracts at a price of $1,391.50.

To find the stop level for the ES trade, we calculate the value 10% below the purchase price ($1,391.50 x 0.90) and round up to the nearest $0.25 (the minimum price increment in the ES contract is $0.25). The resulting stop level would be $1,252.50. The maximum loss per contract (ignoring slippage and overnight gaps) would be ($1,391.50 - $1, 252.50) x 50 or $6,950 per contract. Do not forget the multiplier. Each ES contract controls the equivalent of 50 times the current ES price.

The maximum total dollar loss for the ES trade (again, ignoring slippage and overnight gaps) would be $13,900 (2 contracts x $6,950 per contract). The resulting loss as a percentage of our total capital would be 1.39% ($13,900 / $1,000,000), which is less than our maximum specified loss of 1.5% (remember that we rounded down our calculation of the total number of contracts from 2.15 to 2).

As demonstrated above, the futures margin requirement does not affect our calculation of position size for futures (the number of contracts). In fact, I have not even mentioned the specific margin requirement for our ES trade. Depending on the broker, we would need to post overnight margin of approximately $4,375 per ES contract (or $8,750 in total) for our purchase of two ES contracts. As illustrated above, we could potentially lose far more than our initial overnight margin. Margin does not reflect our amount of capital at risk and it does not affect position size.

Position Size Relationships

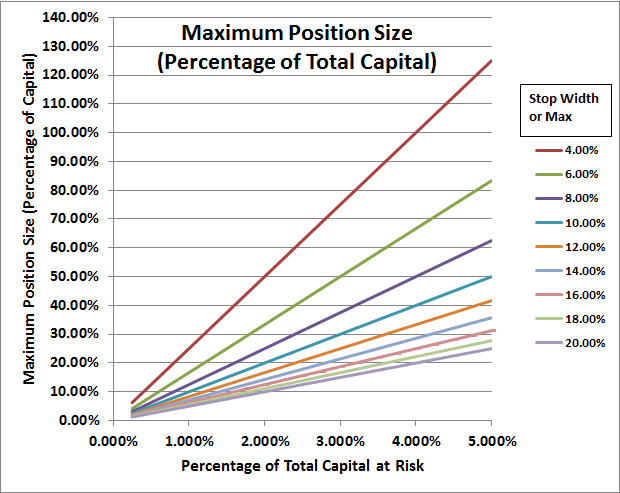

Given our formula for position size (PS = TCAR / SL), changes in the total capital at risk and the width of the stop will directly affect the maximum position size. As the total capital at risk increases, the position size increases accordingly. However, many traders do not realize that their maximum position size must shrink when using wider stops. If the risk per share (or per contract) increases, then the total number of shares (or contracts) must also decline - holding total capital at risk constant. This can be seen in the graph in Figure 2 below.

The horizontal or x-axis represents the total capital at risk per trade. The vertical or y-axis represents the maximum position size, expressed as a percentage of total capital. Each upward-sloping line depicts the position size for a given stop loss level: a 4% stop loss for the top line, increasing to a 20% stop loss for the bottom line. For a given level of risk, the maximum position size decreases as the width of the stop increases (lower lines).

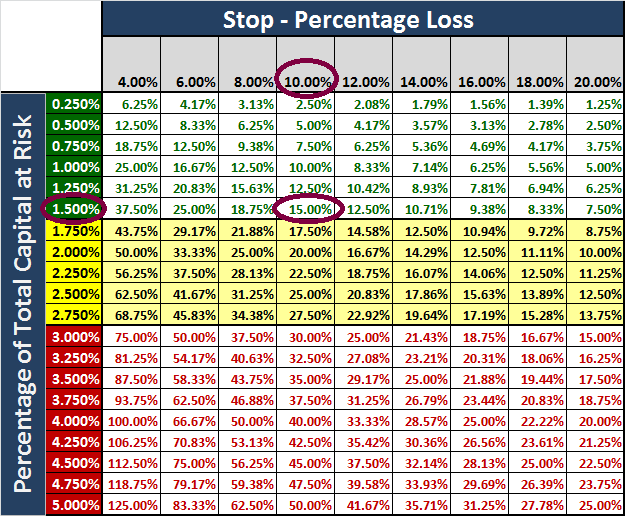

The chart above makes it easy to see the relationships between the total capital at risk, the width of the stop, and the position size. However, the table in Figure 3 below makes it easier to see the specific values for each variable in our position size formula.

The values from the SPY/ES examples above are circled below in the matrix below. The values in the matrix below represent the maximum position size for each combination of stop level (SL) and total capital at risk (TCAR).

Calculating Position Sizes in Practice

I cannot give you a specific recommendation for the percentage of total capital to risk on each trade. The optimal percentage will depend on your specific strategy. For strategies with a very high percentage of winning trades, you could probably justify using a higher total capital at risk per trade - simply due to the reduced likelihood of a string of consecutive losses. However, I would caution you against going beyond the 1% - 2% professional guideline that I mentioned earlier.

For a detailed discussion of how to use stop loss orders and how wide to set your stop level, please revisit my previous post "The Key to Trading Success." While we used the stop loss percentage to calculate the maximum position size, stop loss orders cannot guarantee you will exit the trade at (or even near) the stop level. As a result, the maximum loss can exceed the specified percentage of total capital at risk. This is another very good reason to use a conservative value for total capital at risk.

Overnight gaps and fast or illiquid markets could also render your stop loss orders completely ineffective. In addition, you will notice some very high position size values in the above table, some exceeding 100% of total capital.

The width of stops is a function of the volatility of the underlying security and the investment horizon. Day-traders have very short investment horizons and very tight stops. As a result, they often have very large positions relative to their total amount of capital. This is consistent with the results in Figure 2 and Figure 3 above.

However, keep in mind that when day-traders have such large positions in place, they are tethered to their trading screens and have their fingers poised above their keyboards to exit their trades. Most traders do not have the flexibility to monitor their trades this closely. Even if they did, it is impossible to exit a trade when the market is closed. In addition, discrete releases of information result in discrete price changes, which can circumvent our carefully positioned stop levels.

Finally, the calculated position size is the maximum value, not a recommendation. You need to evaluate the specific risk of the security, the need for diversification, and the probability of being able to exit the trade at or near the calculated stop level.

Even with the above caveats, if you limit your risk to a reasonable percentage of your total capital, use a custom stop level for every trade, and calculate the resulting position size for every position and group of correlated positions, then you will greatly enhance your ability to survive your losses and return to profitability

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future?

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social network.

The "Share / Save" button below contains links to all major social networks. If you do not see your social network listed, use the down-arrow to access the entire list of social networking sites.

Thank you for your support.

Brian Johnson

Copyright 2012 - Trading Insights, LLC - All Rights Reserved.

.

Pingback: 11 Rules to Improve Your Trading: Rules 2 & 3 | Trader Edge

Pingback: Doubling Down: Enhancing Returns without Increasing Risk | Trader Edge

Pingback: Choosing the Optimal Strategy | Trader Edge

I have read many articles, both on the web and in books, on position sizing and setting stops. None have matched yours in its precise logic and ease of understanding.

Bravo!

I can not help but wonder, though, what technique you yourself employ for setting stops. I like the ATR stop method, or perhaps Chandelier Stops, with accompanying trailing stops in order to let profits run. What are your thoughts on the new Smartstops proprietary software that takes into account macro economic conditions, and thereby helps guard against catastrophic market crashes? Also, can your strategies be employed within an algo or some such thing, in order to completely automate them?

Thank you for your comments. I currently trade over 20 systematic strategies in options, futures, and ETFs. Each strategy has unique stop rules, but every strategy has a fixed loss stop to facilitate position sizing and to limit risk.

Many of the strategies employ volatility based stops, where the width of each stop is a function of the volatility of the underlying instrument. ATR based stops would fall into this category. Some of the strategies use some form of trailing stop, but others rely on exit signals to close the position. The exit strategy is always designed to be consistent with the type of strategy being deployed.

I am not familiar with Smartstops proprietary software, but I believe stops should always be used regardless of the macro economic environment. Catastrophic events can happen, even in seemingly benign environments.

While my strategies are systematic, I personally enter every buy and sell order manually. It would certainly be possible to automate the trade entry process as well, but I would not be comfortable completely automating the process.

Thanks again for your comments and for your interest in Trader Edge.

Best regards,

Brian Johnson

Pingback: Pyrimid Trading: Enhancing Returns without Increasing Risk | Trader Edge