The purpose of this series of posts is to provide a manageable list of fundamental trading rules to help you improve your trading process - regardless of your experience level. I will also explain the rationale behind each rule and highlight its significance. Here are the 9th and 10th in a series of 11 rules that will help you improve your returns and reduce your trading losses.

Rule #9: Do NOT Sell Naked (Uncovered) Options

This is another rule that is ignored by many retail traders. Many traders sell options to generate income, which can be a reasonable strategy, but only when selling covered options. However, selling naked or uncovered options requires excessive amounts of capital, offers very poor risk-return trade-offs, and is simply not prudent.

The world experiences irregular, unpredictable, catastrophic events that wreak havoc on the financial and commodity markets: terrorist attacks, sovereign defaults, nuclear accidents, wars, assassination attempts, strikes, floods, typhoons, earthquakes, hurricanes, regime changes, etc. These types of events can unfold with very little warning and often cause massive, discrete changes in asset prices. Selling naked options before one of these events could wipe out your entire portfolio.

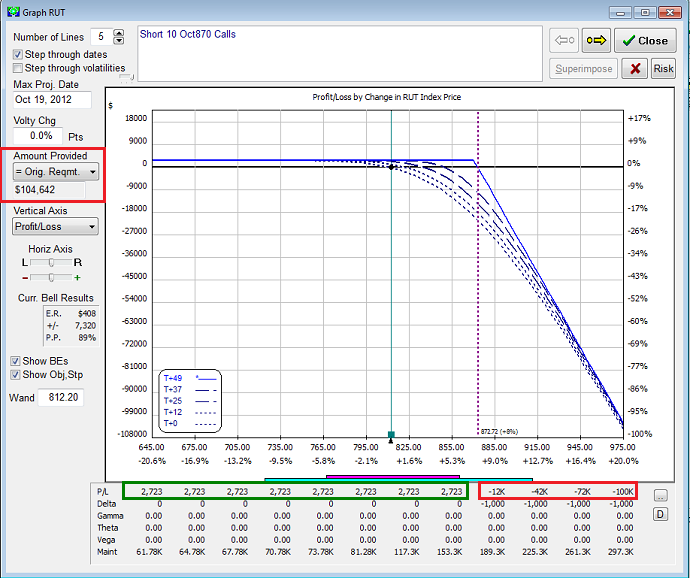

To better understand these risks, let's analyze the profit and loss diagram for a short call position. Figure 1 is an OptionVue analytical graph of 10 short October 870 calls on the Russell 2000 index (RUT) as of August 31, 2012. Short means that you have sold the call options. They are also naked or uncovered, which means that there are no offsetting long positions to limit the potential losses associated with the short calls. As a result, the potential losses of the short calls are unlimited.

The horizontal axis represents the price of the underlying index. The vertical axis denotes the return (right) and the profit or loss (left) for the strategy. The profit and loss function is shown for five different dates using five different lines. The dates range from today (T+0) to the expiration date of the October call option (T+48).

The first problem with this strategy is the very large initial margin requirement of $104,642 (red box on the left side of the diagram). The initial margin is the amount of capital that you would need to provide as a good faith deposit to cover your potential losses, which in this case are unlimited. That is why the initial margin requirement is so high. To make matters worse, the margin requirement would also increase significantly as the price of the RUT rises.

Now let's look at the risk-return profile for the short call. When selling options, the best case scenario would be for the option to expire worthless, which would allow you to keep the entire premium. In this example, the resulting profit would be $2,723 (green box below chart). Not bad for 49 days, but you would have had to put up $104,642, which means a best case return of only 2.6% on your initial capital position.

As I mentioned above, the potential losses for this strategy would be unlimited. A few of these values are provided in the red box below the chart. As you can see, you could easily lose 12K, 42K, 72K, or even more than 100K as the price of the RUT rises above the strike price of 870.

Potentially making $2,723 while risking unlimited losses on a $104,642 initial investment would not prudent.

Fortunately, one simple change to the strategy would eliminate the risk of unlimited losses, reduce the capital requirement by over 90%, and increase the best case return on capital from 2.6% to 11.56%. You can turn the short calls into a credit spread by buying 10 October 880 calls on the RUT (OptionVue analytical diagram in Figure 2 below).

This would limit the worst case payout at option expiration to $10 per share (the difference between the 870 short calls and the 880 long calls). Multiply $10 per share by 10 contracts and by 100 "shares" per contract to calculate the maximum payout for the entire position ($10,000). However, when you subtract the net credit received for the spread, the maximum loss would be reduced from $10,000 to $8,964, which would also be the amount of capital required to establish the position (red box on the left side of the diagram). Adding the long call position would reduce the initial capital requirement from $104,642 for the short call to $8,964 for the bear call (credit) spread.

If both options were to expire worthless, the credit spread would earn $1,036, which is significantly less than the $2,723 for the short call. However, you would have only needed to put up $8,964 to earn the $1,036. The resulting best case return for the credit spread would be 11.56% ($1,036 / $8,964), which would be far better than the 2.6% return for the short call position.

The real advantage of the credit spread over the short call is the reduced risk. Instead of unlimited losses, the maximum loss for the credit spread would be $8,964.

The credit spread uses capital more efficiently and offers a much more attractive risk-return tradeoff. For any short option position, there is a corresponding spread or covered strategy that should substantially reduce your risk and increase your return on capital. There is no reason to incur the risk of selling uncovered or naked options.

Rule #10: Close Short OTM & ATM Option Positions Prior to Expiration

This rule is a little more subtle. The purpose of the rule is to close option positions which have unacceptable levels of risk relative to their potential return. Even if you do not sell naked options (rule #9 above), the risk-return characteristics of short out-of-the-money (OTM) and short at-the-money (ATM) covered options (spreads) can also become unattractive as they approach expiration.

The purpose of credit spreads is to earn income as the option premiums decay over time. However, as time passes, the option values and spread values decay and the unearned or remaining return also declines, but the risk actually increases. To see this, let's return to the credit spread example from Rule #9 above.

In that example, 870 calls were sold and 880 calls were purchased. The resulting credit (or inflow) was $1.036 per share (net of transaction costs) and the maximum potential payout at expiration (outflow) was $10.00 per share (870 - 880). The maximum loss was $8.964 per share ($1.036 - $10.00). At the time, the strategy risked $8.964 to earn $1.036. This might not seem like an attractive risk-return profile, but this trade has a very high probability of success (approaching 90%). In addition, stops can be used to significantly improve the risk/return ratio.

Now let's assume that the expiration date is only two days away and the original 870-880 RUT credit spread could be purchased (closed) for $0.05 per share, which would lock in a profit of $0.986 per share ($1.036 - $0.05) and would generate a return on capital of 11.00% ($0.986 / $8.964) over the holding period of 46 days.

If you did not close this spread for $0.05, you would be risking $9.95 per share to make $0.05 per share. The resulting risk/reward ratio would be 199/1. Even if the odds of losing $10.00 were very small, it would not be prudent to give 199 to 1 odds on any trade. Eventually the odds will go against you and it will be very painful.

Instead of thinking of paying $0.05 to close the original credit spread, turn the situation around and ask yourself a simple question: would you establish a new credit spread position today that forced you to risk $9.95 to make $0.05? Would you be willing to do these types of trades repeatedly? This would not be a very sound trading strategy.

Instead - spend the nickel, close the spread, take your profits, free up your capital, and move on to your next trade

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future?

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social network.

The "Share / Save" button below contains links to all major social networks. If you do not see your social network listed, use the down-arrow to access the entire list of social networking sites.

Thank you for your support.

Brian Johnson

Copyright 2012 - Trading Insights, LLC - All Rights Reserved.

.