This article presents the Trader Edge aggregate neural network model forecast for the March 2014 non-farm payroll data, which is scheduled to be released tomorrow morning at 8:30 AM EDT.

Non-Farm Payroll (NFP) Model Forecast - March 2014

The Trader Edge aggregate NFP model represents the average of three neural network forecasting models, each of which employs a different neural network architecture. Unlike expert systems, neural networks use algorithms to identify and quantify complex relationships between variables based on historical data. All three models derive their forecasts from seven explanatory variables and the changes in those variables over time.

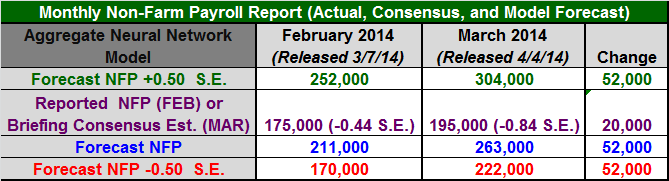

The table in Figure 1 below includes the monthly non-farm payroll data for two months: February and March 2014. The February data was released last month and the non-farm payroll data for March 2014 will be released tomorrow morning at 8:30 AM EDT.

The model forecasts are in the third data row of the table (in blue). Note that past and current forecasts reflect the latest values of the independent variables, which means that forecasts will change when revisions are made to the historical economic data.

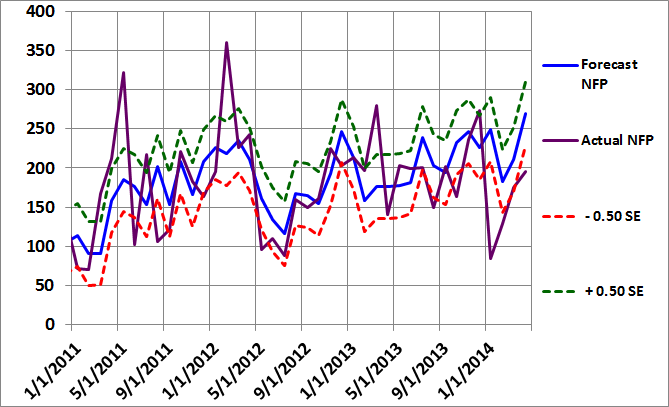

The monthly standard error of the model is approximately 81,100 jobs. The first and last data rows of the table report the forecast plus 0.5 standard errors (in green) and the forecast minus 0.5 standard errors (in red), respectively. All values are rounded to the nearest thousand. If the model errors were normally distributed, roughly 31% of the observations would fall below -0.5 standard errors and another 31% of the observations would exceed +0.5 standard errors.

The actual non-farm payroll release for February 2014 is in the second data row of the table (in purple). The consensus estimate (reported by Briefing.com) for March 2014 is also in the second data row of the table (in purple). The reported and consensus NFP values also include the deviation from the forecast NFP (as a multiple of the standard error of the estimate). Finally, the last column of the table includes the estimated changes from February to March 2014.

Model Commentary

The aggregate neural network model forecast for March is 263,000, which is up 52,000 jobs from last month's revised forecast of 211,000. The Briefing.com consensus estimate for March is only 195,000. The actual February data was below the revised February forecast (-0.44 S.E.) and the consensus estimate for March is significantly below the model forecast (-0.84S.E.).

If the past few NFP reports were adversely affected by weather, this could set the state for an upside surprise tomorrow. The consensus forecast of 195,000 is well below the forecast of 263,000 for March. In addition, the model is forecasting a significant increase in the NFP data from February to March (+52,000 jobs), which means the independent variables contain evidence of a stronger job market.

The consensus estimate also shows an increase in the NFP data from February to March, but the increase (+20,000 jobs) is not as impressive as the model forecast. Given the possible data-related winter weather anomalies over the past few months, the March report may provide the most reliable estimate of the strength in the employment environment since late last year. If the model forecast for March (+263,000) proves to be accurate, the market response could be significant.

Summary

Basic forecasting tools can help you identify unusual consensus economic estimates, which often lead to substantial surprises and market movements. Identifying such environments in advance may help you protect your portfolio from these corrections and help you determine the optimal entry and exit points for your strategies.

In the case of the NFP data, the monthly report is notoriously unreliable and prone to substantial revisions. As a result, having an independent and unbiased indicator of the health of the U.S. job market is especially important.

Trader Edge Strategy E-Subscription Now Available: 20% ROR

The Trader Edge Asset Allocation Rotational (AAR) Strategy is a conservative, long-only, asset allocation strategy that rotates monthly among five large asset classes. The AAR strategy has generated 20%+ annual returns over the 20+ year combined back and forward test period. Please use the above link to learn more about the AAR strategy.

Brian Johnson's New Book is Now Available on Amazon

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2014 - Trading Insights, LLC - All Rights Reserved.

Hi Brian

Congrats on the book!

I had a look at the free preview on Amazon. Happened to notice an error in Figure 1.3. Title shows “Implied vs Stastical Volatility”. Maybe the electronic version can be fixed quickly?

Anyway good luck with the book launch.

Regards

JD

JD,

Thanks. Good catch. No matter how many times you proof the manuscript, a few errors always seem to slip through.

Regards,

Brian Johnson