Housing starts were the only bright spot in another dismal week of economic data in the U.S. The following post provides an overview of the major economic releases from this week as well as an update on market conditions, including bond yields in Italy and Spain.

Economic Data From the Week Ending 7/20/2012

Here is a partial list of the US economic reports from this week:

Housing:

- Housing Starts 760K, 17K above expectation, up 49K from prior month

- Building Permits 755K, 10K below expectation, down 29K from prior month

- Existing Home Sales 4.37M, 0.28M below expectation, down 0.25M from prior month

Consumer:

- Retail Sales -0.5%, 0.7% below expectation, 0.3% below prior month

Inflation/Deflation:

- CPI 0.0%, 0.1% lower than expectation

Business & Manufacturing:

- Industrial Production 0.4%, 0.1% above expectation

- Philadelphia Fed -12.9, 2.9 below expectation

Employment:

- Initial Unemployment Claims 386K, 21K worse than expectation, up 34K from prior week

General:

- Leading Indicators -0.3%, 0.1% below expectation, 0.6% below prior month

The source for the above economic data was www.Briefing.com.

Interpreting the Data

Housing starts were stronger than expected this week and were also up from last month. However, that strength did not translate to building permits, which were weaker than expected and down materially from the prior month. Existing home sales surprised the market on Thursday morning, coming in much weaker than expected. As discussed in earlier posts, while the housing statistics have improved modestly, the overall numbers are still down 70% from the pre-recession highs. In addition, according to estimates from Standard & Poor's Rating Services, it will take another 46 months to clear the existing shadow inventory of distressed properties.

As I discussed in my last post, this was the third consecutive monthly decline in retail sales, a streak not seen since the second half of 2008 - during the heart of the last recession. Given that retail spending is responsible for almost 70% of U.S. economic growth, this is especially troubling. CPI continues to be flat, walking the tightrope toward possible deflation.

Industrial production was consistent with expectations, but the Philadelphia Fed release of -12.9 was worse than expected. In addition, it was the third consecutive value in negative territory, signalling a contraction for the manufacturing sector. The previous ISM release also indicated a contraction. Initial unemployment claims had declined recently, but that now appears to be a temporary anomaly in the data. Unemployment claims were much worse than expected and up sharply from last week.

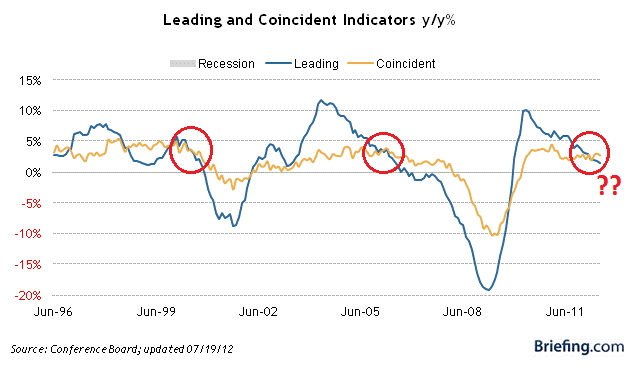

Finally, leading indicators were down 0.3%, slightly weaker than expectation. While I prefer to use the ECRI weekly leading indicator series, the government's leading indicator series can be useful, especially when compared to the year-over-year growth of the government's coincident indicator series (Figure 1 below). When the annual growth of the leading indicator series falls below the year-over-year growth of the coincident indicator series, it provides an early, reliable signal of an impending economic slowdown. The last two crossovers are circled in red below. They predated the 2000 and 2008 recessions.

Figure 1: Leading and Coincident Indicators - Source www.Briefing.com

Earnings and Europe

The second quarter earnings releases so far have been mixed. While a number of companies are beating earnings estimates, many are failing to meet revenue expectations. In other words, gains in earnings are due primarily to cost cutting measures that are not sustainable indefinitely. As explained in my last post, earnings revisions are a better market forecasting tool than historical earnings data. According to Steve Reitmeister at Zacks: 2.5 companies are seeing negative revisions for every 1 getting a positive revision. This is the worst reading since the Great Recession.

The news in Europe is not any better. Borrowing costs for Italy and Spain initially declined amidst the euphoria surrounding the recent European summit. Unfortunately, bond investors are now waking up to the fact that nothing structurally has changed in Europe. 10-year yields for Italy and Spain have now climbed back to 6.17% and 7.26%, respectively. Italy's FTSE MIB index declined by 4.38% today. Spain's IBEX 35 index was down a startling 5.82%.

Conclusion

The Economic Cycle Research Institute (ECRI) believes the U.S. is already in a recession. Even if you are not yet convinced, there is serious cause for concern. Despite the building evidence of global economic weakness, as of last night's close, the S&P 500 index was still trading near its post recession highs and implied volatility remained inexplicably low. The US equity markets appear to be far too complacent

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future?

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social network.

The "Share / Save" button below contains links to all major social networks. If you do not see your social network listed, use the down-arrow to access the entire list of social networking sites.

Thank you for your support.

Brian Johnson

Copyright 2012 - Trading Insights, LLC - All Rights Reserved.

.

About Brian Johnson

I have been an investment professional for over 30 years. I worked as a fixed income portfolio manager, personally managing over $13 billion in assets for institutional clients. I was also the President of a financial consulting and software development firm, developing artificial intelligence based forecasting and risk management systems for institutional investment managers.

I am now a full-time proprietary trader in options, futures, stocks, and ETFs using both algorithmic and discretionary trading strategies.

In addition to my professional investment experience, I designed and taught courses in financial derivatives for both MBA and undergraduate business programs on a part-time basis for a number of years. I have also written four books on options and derivative strategies.

Housing Starts Only Bright Spot This Week

Housing starts were the only bright spot in another dismal week of economic data in the U.S. The following post provides an overview of the major economic releases from this week as well as an update on market conditions, including bond yields in Italy and Spain.

Economic Data From the Week Ending 7/20/2012

Here is a partial list of the US economic reports from this week:

Housing:

Consumer:

Inflation/Deflation:

Business & Manufacturing:

Employment:

General:

The source for the above economic data was www.Briefing.com.

Interpreting the Data

Housing starts were stronger than expected this week and were also up from last month. However, that strength did not translate to building permits, which were weaker than expected and down materially from the prior month. Existing home sales surprised the market on Thursday morning, coming in much weaker than expected. As discussed in earlier posts, while the housing statistics have improved modestly, the overall numbers are still down 70% from the pre-recession highs. In addition, according to estimates from Standard & Poor's Rating Services, it will take another 46 months to clear the existing shadow inventory of distressed properties.

As I discussed in my last post, this was the third consecutive monthly decline in retail sales, a streak not seen since the second half of 2008 - during the heart of the last recession. Given that retail spending is responsible for almost 70% of U.S. economic growth, this is especially troubling. CPI continues to be flat, walking the tightrope toward possible deflation.

Industrial production was consistent with expectations, but the Philadelphia Fed release of -12.9 was worse than expected. In addition, it was the third consecutive value in negative territory, signalling a contraction for the manufacturing sector. The previous ISM release also indicated a contraction. Initial unemployment claims had declined recently, but that now appears to be a temporary anomaly in the data. Unemployment claims were much worse than expected and up sharply from last week.

Finally, leading indicators were down 0.3%, slightly weaker than expectation. While I prefer to use the ECRI weekly leading indicator series, the government's leading indicator series can be useful, especially when compared to the year-over-year growth of the government's coincident indicator series (Figure 1 below). When the annual growth of the leading indicator series falls below the year-over-year growth of the coincident indicator series, it provides an early, reliable signal of an impending economic slowdown. The last two crossovers are circled in red below. They predated the 2000 and 2008 recessions.

Figure 1: Leading and Coincident Indicators - Source www.Briefing.com

Earnings and Europe

The second quarter earnings releases so far have been mixed. While a number of companies are beating earnings estimates, many are failing to meet revenue expectations. In other words, gains in earnings are due primarily to cost cutting measures that are not sustainable indefinitely. As explained in my last post, earnings revisions are a better market forecasting tool than historical earnings data. According to Steve Reitmeister at Zacks: 2.5 companies are seeing negative revisions for every 1 getting a positive revision. This is the worst reading since the Great Recession.

The news in Europe is not any better. Borrowing costs for Italy and Spain initially declined amidst the euphoria surrounding the recent European summit. Unfortunately, bond investors are now waking up to the fact that nothing structurally has changed in Europe. 10-year yields for Italy and Spain have now climbed back to 6.17% and 7.26%, respectively. Italy's FTSE MIB index declined by 4.38% today. Spain's IBEX 35 index was down a startling 5.82%.

Conclusion

The Economic Cycle Research Institute (ECRI) believes the U.S. is already in a recession. Even if you are not yet convinced, there is serious cause for concern. Despite the building evidence of global economic weakness, as of last night's close, the S&P 500 index was still trading near its post recession highs and implied volatility remained inexplicably low. The US equity markets appear to be far too complacent

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future?

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social network.

The "Share / Save" button below contains links to all major social networks. If you do not see your social network listed, use the down-arrow to access the entire list of social networking sites.

Thank you for your support.

Brian Johnson

Copyright 2012 - Trading Insights, LLC - All Rights Reserved.

.

About Brian Johnson

I have been an investment professional for over 30 years. I worked as a fixed income portfolio manager, personally managing over $13 billion in assets for institutional clients. I was also the President of a financial consulting and software development firm, developing artificial intelligence based forecasting and risk management systems for institutional investment managers. I am now a full-time proprietary trader in options, futures, stocks, and ETFs using both algorithmic and discretionary trading strategies. In addition to my professional investment experience, I designed and taught courses in financial derivatives for both MBA and undergraduate business programs on a part-time basis for a number of years. I have also written four books on options and derivative strategies.