I introduced the concept of market breadth in a post titled "The Secret Weapon of Technical Analysis." Based on current breadth readings, the equity market is overbought and due for a pullback. However, trading against the trend has a low probability of success. The following article examines several market breadth indicators and explains how to spot a change in the price trend.

Current Market Breadth Readings

One of the most common technical indicators is the 200-day moving average. When stocks are above their 200-day moving average, that's bullish. When stocks are below their 200-day moving average, the environment is bearish.

For individual stocks, this concept may have some merit. Unfortunately, when too many stocks are trading above their respective 200-day moving averages, market sentiment is too optimistic and the probability of a pullback increases. Conversely, when too many stocks are trading below their corresponding 200-day moving averages, the stage is set for a near-term bullish reversal.

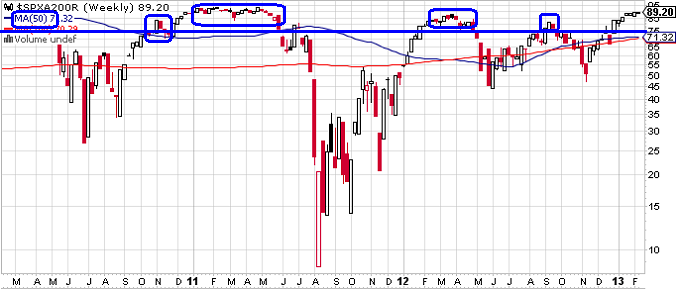

Figure 1 below is a weekly candlestick chart of the $SPXA200R, which represents the percentage of stocks in the S&P 500 index trading above their individual 200-day moving averages. Extreme bullish readings occur between 70 percent and 80 percent. The blue horizontal line represents the 75% level.

Stocks can remain overbought or oversold for extended periods and simply entering the extreme territory is not sufficient justification for a contra-trend trade. Instead, the percent of stocks trading above their 200-day moving average should be extreme AND should decline for a one or possibly two-week period. That would represent the first confirmation of a prospective trend reversal.

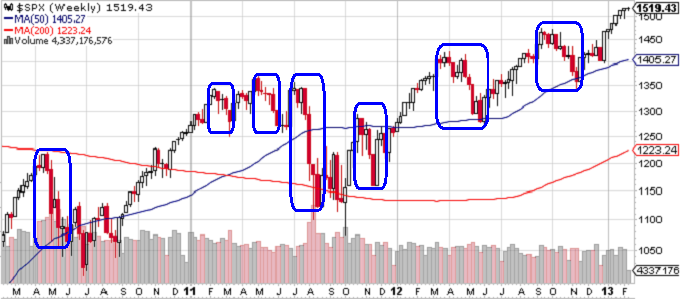

The blue circled regions highlight bearish trend reversal confirmations in Figure 1 below. These regions closely match and typically precede the actual pullbacks in the S&P 500 Index (highlighted with blue circles in Figure 2 below).

Note that the percentage of issues above their corresponding 200-day moving averages is currently extremely high. However, the breadth indicator has not suffered a single weekly decline. While the risk of a pullback is elevated, the uptrend is intact and I never trade against an established, unbroken uptrend.

All of the charts below are available on Stockcharts.com.

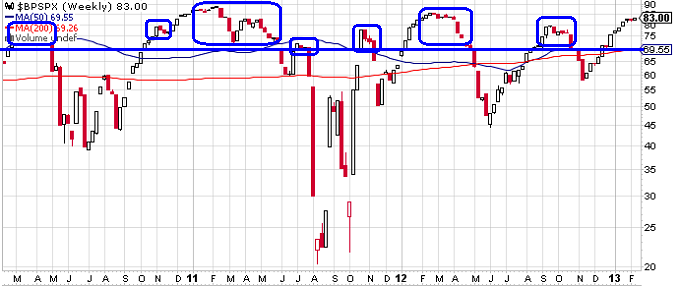

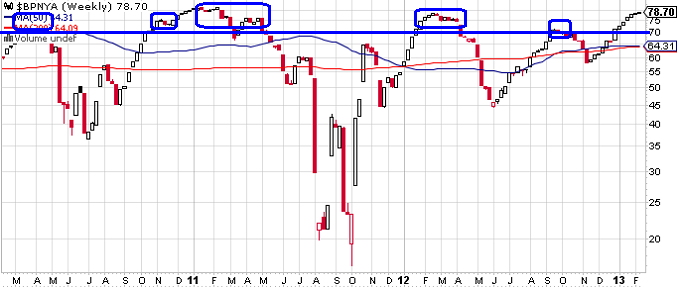

Another contrarian market breadth indicator is the percent of issues in a broad market index or on an exchange that are bullish based on the long-term point and figure method. If you would like a refresher on point and figure charting, please revisit "The Easiest Way to Identify Trends."

As was the case above, when the percent bullish indicator becomes extreme (70 percent to 80 percent), the probability of a reversal increases. Figure 3 below depicts the weekly percent bullish indicator for the S&P 500 index. The blue horizontal line represents the 75% warning level.

Figure 4 below depicts the weekly percent bullish indicator for all of the issues on the NYSE. The blue horizontal line represents the 70% warning level.

The blue circled regions in Figures 3 and 4 highlight bearish trend reversal confirmations based on the percent bullish indicator. Again, these regions closely match and typically precede the actual pullbacks in the S&P 500 Index in Figure 2 above.

Confirmation of Trend Change

One or more weekly declines in one or more of the market breadth indicators is the first step in identifying a prospective trend reversal. However, before establishing a contra-trend trade, it would also be prudent to see evidence of a change in the actual price trend. There are many ways to do this:

- A break in the daily or weekly trendline (see "How to Draw Trendlines & Avoid Severe Losses.")

- One or more closes below a daily or weekly moving average

- A DMI crossover

- One of the many other trend confirmation indicators of your choice

Possible Investment Vehicles or Strategies

After confirming a trend change using both breadth and price, there are several ways to implement a bearish strategy. You could obviously short ETFs or futures. Futures are liquid and they trade overnight, which would allow you to eliminate gap risk by using stop loss orders that could be triggered after hours. Futures also have low commissions and tight bid-ask spreads. Finally, futures have a symmetric payoff function, which makes them easier to understand.

If you are an experienced option trader, you have many more investment alternatives. First, you could sell out-of-the money bear call spreads above the current market price (see Active Trader Article titled "The Science of Selling Options").

You could also execute a bearish diagonal spread, which I explained in detail in a January 2013 Active Trader article titled "Option Strategies for Bull-Market Reversals." Unfortunately, this article is not yet available for download.

Both of these strategies would allow you to profit - even if prices were to move slightly higher or remain unchanged. The positive yield (Theta) component of these strategies improves the percentage of profitable trades.

Regardless which strategy you choose, understand your exit strategy in advance and identify stop loss levels to control your risk if the trade moves against you.

Conclusion

When market breadth indicators are overbought and breadth and price both turn down and confirm a trend reversal, the probability of a market pullback increases significantly. Breadth is currently above the extreme thresholds for most if not all market breadth indicators. However, breadth has not yet begun to turn down and the price trend remains intact. Confirmed trend changes in breadth and price should signal a high probability reversal.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2013 - Trading Insights, LLC - All Rights Reserved.

Professor Johnson,

First off, always enjoy reading the blog. The material is incredibly informative, and I continue to learn new concepts from you.

I understand what you say that when market breadth indicators are overbought and breadth and price both turn down and confirm a trend reversal, the probability of a market pullback increases significantly. In your experience how quick has that turn down and trend reversal come into effect? Is there any correlation between the VIX level and market events that drive that reversal?

Always appreciate your comments.

Best,

AJ

AJ,

Great to hear from you again. I am glad that you are enjoying the blog.

Unfortunately, it is very difficult to forecast the timing of a bull-market reversal in advance. The market can remain overbought for extended periods. Many traders (myself included) have fallen into the trap of executing reversal trades too early, in anticipation of a market pullback.

The only way that I know of to prevent this mistake is to always wait for a confirmed trend change in the breadth indicators and in price. Breadth changes often precede price changes, but it would still be wise to wait for price confirmation as well.

Ideally, the reversal strategy should be backtested (and forward tested) using historical data to fine-tune the entry and exit rules and to verify that an trading advantage exists.

The VIX could also be used for confirmation. After an lengthy bullish advance, the VIX level would be low. The VIX will often jump sharply when the reversal begins. In addition, historical or realized volatility may begin to increase even before the VIX (which measures implied volatility). As a result, increases in historical volatility could also be used to confirm the trend change.

I am in the early stages of writing code in AMIBroker that should allow me to develop, optimize, and test systematic credit spread strategies based on theoretical option prices. If I can get the option component to work correctly in AMIBroker, this would open up whole new area of systematic strategy development.

Keep in touch,

Brian Johnson

Pingback: Extreme Divergence: Earnings and Equity Prices | Trader Edge

Pingback: Extreme Divergence: Earnings and Equity Prices | Trader Edge