The vast majority of technical indicators perform a computation on the price or volume of an individual security. While these indicators can provide valuable insights, most traders ignore the most effective type of technical indicators.

Market Breadth Indicators

Market breadth indicators do not use information based on a single security, they use information based on every security - and all securities are treated equally. This is very different from calculating an indicator value on an index or exchange traded fund (ETF), most of which are capitalization weighted.

In a capitalization weighted index, a single large cap stock (like AAPL) can have a disproportionate effect on the performance of an index, masking the true health of the overall market. As a result, market breadth indicators can provide insight into the direction of the market, long before turning points become evident in the S&P 500, the Russell 2000, the NASDAQ 100, and other broad market indices.

Breadth statistics can be calculated on any group of securities, provided it is possible to access data on each individual security. Breadth analysis is commonly performed on the NYSE, the AMEX, and the NASDAQ. It can also be applied to any index, sector, industry, or ETF. Unfortunately, breadth statistics cannot be calculated for individual stocks or for non-index futures contracts.

Components commonly used to determine breadth include: advancing and declining issues, advancing and declining volume, number of new highs and lows, percent above a moving average, and percent bullish (based on point and figure method - see previous post for more information on the point and figure method).

One of the most widely used breadth indicators is the cumulative advance decline line; in fact, I use it in several of my mechanical strategies to confirm the direction of the long-term trend in the market. To calculate the cumulative advance decline line, simply add the number of advancing issues minus the number of declining issues to the previous period's cumulative total.

How could the cumulative advance decline line help identify major cyclical turning points in the market? Consider the following scenario: we are approaching the end of a cyclical bull market and equity investors are becoming increasing concerned about the economy and the market. They begin to sell some of their smaller speculative stocks and move the proceeds to the relative safety of larger, more established companies.

This will drive down the price of a large number of small stocks, but large cap stocks will continue to advance. The price of the capitalization weighted indices may even continue to rise due to the disproportionate effect of the large cap stocks, but the market is not healthy. Fortunately, the cumulative advance decline line will begin to decrease as the number of declining issues far exceeds the number of advancing issues, offering a clear warning signal of the coming recession.

The opposite situation occurs as we approach the end of a bear market. Equity investors begin to sell their large cap companies and nibble at some of the smaller, more speculative companies, which offer much better upside potential in the upcoming growth cycle. The price of the indices may stabilize or even continue to decline slightly. The cumulative advance decline line will begin to rise as the number of advancing issues exceeds the number of declining issues.

Identifying Long-Term Trends

While the argument above makes sense in theory, what about in practice? Figure 1 below is a monthly chart of SPX (S&P 500 index) and the cumulative advance decline line during the period around the 2001 recession. The top panel of the chart is a monthly candlestick chart of the S&P 500 index.

The blue line in the second panel is the cumulative advance decline line for the combined NYSE, AMEX, and NASDAQ. The red and green lines in the second panel are custom bearish and bullish moving averages of the cumulative advance decline (AD) line, respectively. When the red line and green lines overlap, only the green line is shown. When the blue AD line is above the green line, the long-term trend is bullish. When the blue AD line is below the red line, the trend is bearish.

Finally, the bottom panel shows one of my proprietary long-term trend indicators, which is based on breadth, price action, and relative strength (more on relative strength in an upcoming article). The green lines in the histogram are positive or bullish and the red lines are negative or bearish. The blue line represents the net indicator position (bullish minus bearish).

In 1998 (point A above), the AD line fell below the green and red lines, turning bearish. As you would expect, the AD line turned down before the market. However, the signal was very early - a full two years before the S&P 500 index peaked. While the tech bubble was unusual, with prices for very large tech companies rising to absurd levels, the early AD signal does demonstrate one important rule: never trade based on a single indicator. Always look for confirmation.

The bearish AD signal was confirmed by the trend indicator in the bottom panel in 2000 (point B above), very close to the peak in the market. The AD and trend indicators both had premature buy signals in late 20001 (point C), but quickly turned bearish again (point D) for the remainder of the downtrend.

Finally, the AD indicator turned bullish again in early 2003, very close to the bottom. This bullish signal was also confirmed by my custom trend indicator above.

As you can see, breadth information proved to be very useful in forecasting the beginning and end of the 2001 bear market. However, this is only one piece of evidence. Let's see if breadth was equally useful in managing the more recent 2008 financial crisis.

The chart panels in Figure 2 below are the same as the previous chart: SPX in the first panel, AD in the second panel, and the proprietary trend indicator in the bottom panel.

Unlike in 2001, the timing of the AD bearish signal in late 2007 was almost perfect, occurring only one month after the market peak. This signal was also confirmed by the supporting trend indicator.

The AD buy signal in early 2009 was equally effective, coming only two months after the market low. Again, the secondary trend indicator also confirmed this buy signal. Systematic market timing doesn't get any better than this.

More recently, note that neither indicator turned bearish during the market pullback in 2010, allowing the long position (established at point B) to capture additional profits as the bullish trend continued.

The AD indicator did turn bearish for one brief month at the end of September 2011 (point C above). This signal was confirmed by the accompanying trend indicator and was consistent with evidence of a slowing economy at the time. It appeared to be the beginning of a new downtrend. The short trade was closed for a loss the following month when the AD line moved back above the red custom moving average line. Eventually both indicators turned bullish again a few months later (point D).

Unfortunately, I took the short trade in September 2011 and I admit it stung a little bit at the time. The short signal was generated by several of my proven mechanical trading systems that have been in place for a number of years. While there was sufficient justification for the short position, you should always attempt to learn from your losing trades.

As a result, I did some additional research into the environment at the time and I was able to identify several factors that would have contradicted this trade. Specifically, the short-term breadth, sentiment, and commitment of traders (COT) data were all at extreme levels (more on sentiment and COT data in upcoming articles), which significantly reduced the probability of a profitable trade.

Based on this new information, I re-optimized my existing mechanical strategies in an attempt to filter out low probability trades that were initiated during short-term extreme overbought or oversold conditions. With the new extreme breadth filters, every strategy experienced higher returns, less risk, and lower draw-downs.

Many systematic traders use trend following strategies, myself included. They can be highly profitable and are not overly difficult to create. However, one significant problem with using trend following systems is the risk of establishing new positions when the market is overextended and overdue for a correction. Filters that identify short-term extreme conditions can be effective in eliminating low probability trades, while retaining the vast majority of the profitable trend-following signals.

Identifying Short-Term Extremes

When forecasting short-term trend reversals, it is important to remember that the market can remain overbought or oversold for very long periods of time. As a result, you should not expect a reversal or even a pause in the market trend just because an indicator has reached an extreme value. Instead, wait for the indicator to reach an extreme value AND for the indicator to reverse direction. This is true for all technical oscillators, not just for those based on market breadth.

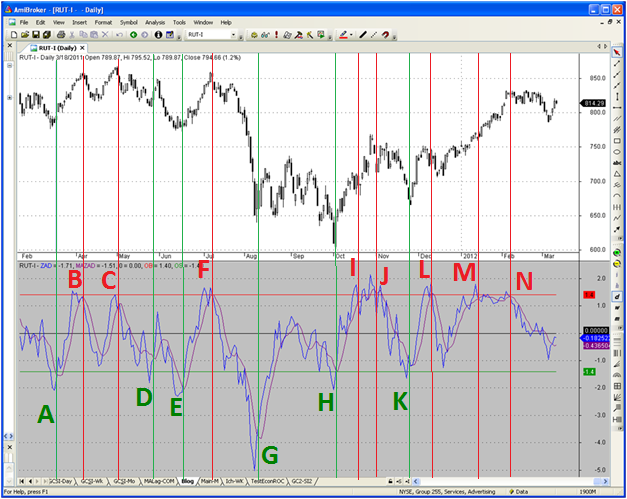

The following is a daily chart from early 2011 to early 2012 (figure 3 below). The top panel is a candlestick chart for the Russell 2000 index (RUT). The bottom panel is a proprietary indicator used to identify extreme conditions in market breadth, specifically based on the daily AD line. The blue line is the actual custom breadth indicator and the purple line is a short-term moving average of the breadth indicator.

Short-term bearish conditions are indicated when the blue breadth oscillator first crosses above the horizontal red extreme value line AND then subsequently crosses below the purple moving average line. Conversely, short-term bullish conditions are indicated when the blue breadth line initially crosses below the horizontal green extreme value line AND then subsequently crosses above the purple moving average line (see Figure 3 below).

Point G illustrates the importance of waiting for the breadth indicator to reverse before signalling a possible short-term trend reversal. In late July 2011 the market was in a free-fall, with the breadth indicator plunging far lower than the extreme oversold level. It would have been premature (and costly) to expect a market reversal when the indicator reached the extreme level. Instead, by waiting for the breadth indicator to reach an extreme level AND then reverse direction, this approach was able to accurately identify a short-term bottom.

As you can see in Figure 3 above, this approach was very successful in identifying short-term reversals, or at least temporary pauses in the prevailing price trend. Every one of the bullish signals (in green) identified an imminent short-term reversal. The bearish signals (in red) also did well, but there were two notable failures: points I and M. Still, not a bad success rate.

Other Short-Term Breadth Indicators

There are many other breadth indicators that can be used to identify potential short-term turning points in the market. In fact, if you have access to data on each individual security in the index or group, you can use almost any technical indicator to create a market breadth indicator.

Moving averages are very popular with market technicians. When the price of an individual security is trading above the moving average, the trend is considered bullish. The period used to calculate the moving average is directly related to the length of the trend. An 8-day moving average would reflect the short-term trend; a 50-day moving average would describe the intermediate-term trend; a 200-day moving average would capture the long-term trend.

To use a moving average to create an intermediate-term market breadth indicator, simply calculate the percentage of securities in the index that are trading above their respective 50-day moving average. Obviously, this requires you to evaluate every security in the index individually and then aggregate the results. This is how all market breadth statistics are generated.

Normally, trading above the moving average is considered bullish. However, it is possible to have too much of a good thing. When the percentage of securities (in a specific group or index) trading above their respective moving average reaches 70%-80%, the bullish momentum becomes unsustainable and a market reversal becomes increasingly likely. Conversely, when the percentage drops below 20%-30%, the bearish momentum would be expected to weaken.

One of my favorite (non-proprietary) market breadth indicators that can be used to identify potential trend reversals is the percent bullish indicator. Instead of calculating the percentage of securities trading above their moving average, the percent bullish indicator reflects the percent of stocks on a short-term point and figure buy signal (for more information on the point and figure method, see my recent post "The Easiest Way to Identify Trends").

Again, when this percentage reaches extreme levels, above 70%-80% or below 20%-30%, reversals become increasing likely. The following graph (courtesy of StockCharts.com) is a weekly candlestick chart of the percent bullish indicator for the entire NYSE index. The NYSE provides an excellent proxy for the entire market. StockCharts.com also provides similar percent bullish charts for the AMEX, NASDAQ, S&P 500, and several individual market sectors. All are based on the most recent point and figure buy signal.

As I explained earlier, overbought and oversold conditions can persist for very long periods. As a result, before forecasting potential price reversals, it is critical to wait for the percent bullish indicator to reach an extreme level (20% and 80% in Figure 4 above) AND begin to change direction. Potential reversal points are noted above by green and red circles. Please note: in the last red circle the percent bullish indicator is still trending higher and is not yet signalling a reversal.

Using Market Breadth in Your Investment Process

Which breadth statistics should you use? Well, the cumulative advance decline is widely used and is helpful for confirming long-term market cycles as well as short-term extreme conditions. However, you might consider combining the AD line data for the NYSE, AMEX, and NASDAQ, as I do in my strategies.

Breadth statistics based on new highs and new lows seem to lag those based on the cumulative advance decline line, but would be worth investigating as well. I suggest experimenting with several different breadth statistics or even combining multiple breadth series into a single, more powerful breadth indicator. I have found the percent bullish indicators to be useful for identifying extreme conditions.

There are many beneficial ways to use market breadth indicators in your investment process. The first is to use the long-term trend in market breadth as a trade filter. In other words, only take long (bullish) trades when the market breadth indicator is above its moving average and short (bearish) trades when below its moving average. This approach should improve your percentage of profitable trades as well as your average profit per trade.

However, if you use market breadth as a filter for trades in individual stocks or ETFs, always verify that the individual asset that you are trading is highly correlated with the group of securities used to calculate the breadth statistic. Otherwise, the breadth filter will not be effective.

For example, gold and gold mining companies are not normally highly correlated with the overall market. Using the cumulative advance decline on the NYSE to confirm trades in gold or individual gold mining stocks would do very little to enhance your trading and could adversely affect your profitability.

If you want to further improve your percentage of winning trades, consider adding a short-term breadth filter to eliminate the possibility of entering trades during extreme overbought or oversold conditions. The percent bullish indicator in Figure 4 used levels of 20% and 80% as possible extreme levels.

I do not normally suggest using extreme breadth conditions to trade against the prevailing trend, due to the difficulty of timing the reversal point. However, if you decide to do so, then remember to wait until the breadth indicator begins to change direction before establishing your position. The levels you decide to use will also affect your trading results. Using wider extreme values should increase your percentage of profitable trades, but would reduce the number of transactions you execute.

If you decide to trade against the prevailing trend, you might consider using out-of-the-money (OTM) credit spreads for these types of contra-trend trades. This would allow you to earn a profit, even if the market simply pauses and does not reverse. The OTM credit spread is one of my favorite trading strategies, which I will explain in more detail in an upcoming post.

You could also use extreme breadth conditions as an exit or profit-taking trigger for trend following trades. For example, if you were in a bullish trade, you could use the NYSE percent bullish indicator as an supplemental exit rule. When the NYSE percent bullish indicator reached 80% (and then declined by a specified amount), you would exit your trade and take your profits.

Finally, you could use market breadth indicators directly to generate long-term buy and sell signals, but this should be done with caution and you should always include additional indicators for confirmation.

If you would like to learn more about market breadth, you might be interested in the book: "The Complete Guide to Market Breadth Indicators" by Gregory L. Morris. The book goes into much more detail than was possible in this article. It covers every imaginable type of breadth indicator and calculation. It explains the calculations and uses charts to illustrate the behavior of each indicator. I used this book extensively when developing my custom breadth indicators. Unfortunately, this book is more expensive than most investment books (it may be out of print), but you may be able to find used copies for sale on Amazon or similar sites

Trader Edge Strategy E-Subscription Now Available: 20% ROR

The Trader Edge Asset Allocation Rotational (AAR) Strategy is a conservative, long-only, asset allocation strategy that rotates monthly among five large asset classes. The AAR strategy has generated 20%+ annual returns over the combined back and forward test period (1/1/1990 to 7/29/2013). Please use the above link to learn more about the AAR strategy.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future?

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social network.

The "Share / Save" button below contains links to all major social networks. If you do not see your social network listed, use the down-arrow to access the entire list of social networking sites.

Thank you for your support.

Brian Johnson

Copyright 2012 - Trading Insights, LLC - All Rights Reserved.

.

Hi Brian,

At the beginning of this article, can you elaborate on advancing and declining issues. I’m assuming an “issue” is a transaction (i.e. buy/sell stock). From you explanation, “The cumulative advance decline line will begin to rise as the number of advancing issues exceeds the number of declining issues,” if traders are moving money from large-cap stock to riskier stocks as you explained shouldn’t the number of issues not change? Or does it increase because it’s expected that riskier companies have a lower stock price and therefore more shares (issues) can be bought with the same amount of money being sold out of the large caps. Or is the AD line increasing because there are new traders in the market causing the number of advancing issues to go up (I’m assuming this is less of a case as this can’t be measured).

Chris,

An “issue” is the stock of a single company. An advancing issue is the stock of a single company that increased in price over a specified period, typically one day. The number of advancing issues for the S&P 500 index (for a single day) would be the total number of stocks in the S&P 500 index that increased in price for that day. The number of declining issues for the S&P 500 index (for a single day) would be the total number of stocks in the S&P 500 index that decreased in price for that day. There would also be issues or stocks in the S&P 500 that were unchanged for the day. The cumulative advance decline line would be the cumulative total of advancing less declining issues.

If traders moved money from large-cap stocks to riskier small-cap companies, the cumulative advance decline line would increase because the money was being allocated to a larger number of companies. Think about a specific example. Currently MSFT has a market-capitalization of over $250 billion. A representative small-cap stock with a Zacks #1 ranking is ARII (American Railcar Industries, Inc.). ARII’s current market-capitalization is about $500 million.

In early 2009, if investors had decided to sell large-cap stocks like MSFT and purchase small-cap stocks like ARII, they would have needed to find a large number of smaller-cap stocks to purchase. The market-cap of MSFT is currently over 500 times the market-cap of ARII. All of the money flowing out of MSFT could not be absorbed by a single small-cap stock like ARII. Instead, it would have needed to be allocated across many small-cap companies.

In this scenario, a small number of large-cap stocks would decline in price (declining issues), but a large number of small-cap stocks would increase in price (advancing issues). By the way, if you had done the above trade in 2009, MSFT has increased by 100%, but ARII has increased by 400%. That is the rationale for increasing risk in the early growth phase of a recovery.

I hope that helps. Please let me know if I can answer any additional questions.

Brian Johnson

Wow that’s pretty good. Thanks for clarifying that helps a lot.

Pingback: How to Draw Trendlines & Avoid Severe Losses | Trader Edge

Pingback: Use Relative Strength to Identify Market Trends | Trader Edge

Pingback: Take the First Step Toward an Investment Process | Trader Edge

Hello Brian

Thanks for your time. I’ve just stumbled upon your site and I’m hoping to start a discussion with you on market breadth. I’ve developed a timing system based on the Relative Strength of the Advance Decline Line versus the SP-500. The signal to go long occurs when the Relative Strength of the A/D line c.f the SP-500 crosses north of the 20 MA of the Relative Strength of the AD Line versus the SP-500

The logic behind it is dead simple; as breadth improves relative to the SP-500, the SP-500 won’t be far behind.

I’m reasonably new to trading and would love your thoughts. Have I stumbled upon a breadth system you’re familiar with? It’s backtested really well since April 2010. (I use telechart and so am hunting for charts that go back even further – 2008 will be interesting).

What’s interesting about your site is you mention using an extra indicator to prevent short term whipsaw trades – something that’s happening this past month – although this system remains stubbornly profitable.

Finally if you know of a chart provider that provides the above going back ten years, I’d appreciate it.

Anyway, thanks for your time and knowledge. Please hook into the logic behind my system – better you than the market telling me it’s flawed.

Cheers

Tony

Tony,

Thanks for your in-depth question. In my experience, market breadth tends to lead the S&P 500, so when the advance decline line is stronger than the S&P 500, it would be logical to assume that the S&P would follow. However, as I mentioned in the article, extremes in recent advance decline changes tend to lead to short-term reversals. With that caveat, your premise seems promising and would definitely be worth additional testing with more data.

I agree that you should try to test the strategy over 10+ years if possible. A start date of April 2010 would not give you enough data and none of that data would be from a bear market environment. If you were able to get data back to the late 1990s, you would be able to run your backtest over two full market cycles. I also agree that 2008 would be very interesting. As you mentioned above, using a second indicator as a filter is always a good idea and could improve your strategy results significantly.

I use CSI for most of my daily data (listed as an affiliate in the right sidebar), but I need to confirm that they are also supplying my market breadth data. I also use a second source for some market breadth data. Let me check and I will post a second reply this afternoon.

Good luck with the strategy. I would be interested to hear how it works with a longer data set.

Thanks for your interest in Trader Edge.

Regards,

Brian Johnson

Tony,

I checked my source for breadth data (to create the advance decline line) and it is CSI. I believe the CSI breadth data goes back to 1980. CSI is not inexpensive, but they have the best quality data that I have found for stocks, ETFs, and futures. Again, you will find a link to CSI in the side bar to the right.

CSI is only the data source. I use AMIBroker to develop and test strategies.

Let me know how it turns out.

Regards,

Brian Johnson

Thanks Brian

Appreciate it. I’ll let you know once I can get my hands on this data. I tried Stockcharts but I can’t get chart ‘right’. I forgot to let you know that my entry is the previous day’s high – that helps prevent some bad trades. Of the small sample, since 2010, it’s been returning 98% and 43% before costs, and running about 20 trades p.a. This year (and I start my year in April for ridiculous reasons) it’s around 6%.

Speak soon and thanks for the CSI suggestion.

Tony

Tony,

Your initial results certainly look promising. It will be interesting to see the returns with more data.

Regards,

Brian Johnson

Pingback: 11 Rules to Improve Your Trading: Rule #1 | Trader Edge

Pingback: A More Efficient Relative Strength Indicator | Trader Edge

Pingback: Q4 1012 Earnings Preview | Trader Edge

Pingback: Market Overbought - But Wait for the Trend Change | Trader Edge

hai brian,

it will be helpful if you give me the amibroker code of proprietary trend indicator in the Figure 1: SPX & AD 2001 Recession bottom panel ?

regards

kumar

Kummar,

I try to provide Amibroker code when possible, but I can’t release the code for proprietary indicators that are the foundation for my trading strategies – or else I would not be able to make a living. The proprietary trend indicator that you mentioned is one of the primary tools that I use in my long-term equity timing models.

I am sorry that I could not help you in this case.

Best regards,

Brian Johnson

thanks for the reply and also know breadth oscillator is also in this category ie.foundation for your trading strategies?

regards

Kumar

Kumar,

Yes, I also use the breadth oscillator directly in my trading strategies and cannot supply the AMIBroker code.

Breadth indicators can substantially improve the performance of both short-term and long-term equity strategies. Breadth, relative strength, COT data, and volume are the principal tools I use to enhance price-based strategies.

Best regards,

Brian Johnson

thanks for the reply

regards

kumar

Pingback: The Deadly Double Divergence | Trader Edge

Pingback: Five Headwinds for Equities | Trader Edge

Pingback: Market Breadth Divergence Update | Trader Edge

Pingback: Top 10 Trader Edge Articles | Trader Edge