Earnings are the ultimate driver of stock prices and the divergence between earnings expectations and equity prices has become even more extreme. Given that the market is technically overbought, implied volatility is extremely low, the CBOE Skew Index is over 130, market sentiment is overly bullish, and retail investors are jumping back into the equity market in droves, the earnings - price divergence is particularly troubling.

Earnings and Equity Prices Diverge

FactSet is a leading vendor of market analytics, financial and market data, financial screening tools, and customized solutions. They also provide a comprehensive, detailed analysis of earnings and earnings trends, which they offer via free weekly PDF files on their site. The earnings graphs in this article are from the latest FactSet report.

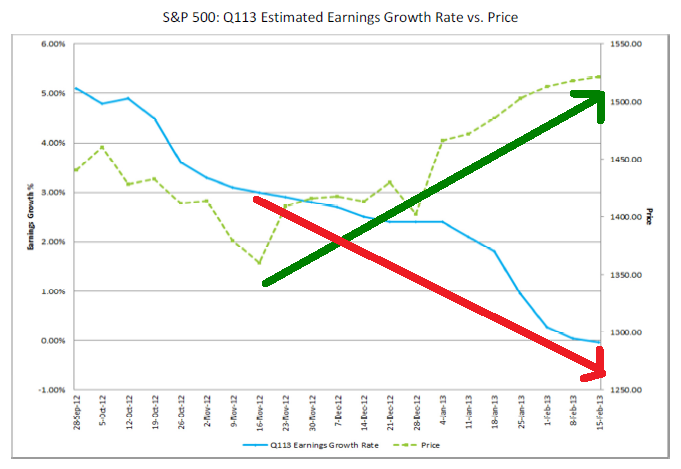

Equity prices and earnings forecasts diverged before Q3 2012 earnings were reported; prices rose dramatically while earnings forecasts declined. This preceded a significant market pull-back in the fall of 2012. Unfortunately, we are seeing the same troubling behavior again in Q1 2013. As you can see in Figure 1 below, equity prices have increased by an astounding 11.9% since mid-November. During the same period, EPS estimates for the first quarter of 2013 actually declined from +3.0% to -0.04%.

This obviously means that P/E ratios are rising. According to FactSet, forward 12-month P/E ratios are now above their 5-year average, which suggests that equities are overvalued - at least relative to metrics from the past five years.

Higher P/E ratios can only be justified by higher expected EPS growth rates or by lower interest rates. Unless we expect interest rates to become negative in the future, it would be difficult to make the argument that lower interest rates support higher P/E ratios. Higher growth rate expectations must be the answer.

Unrealistic Growth Expectations

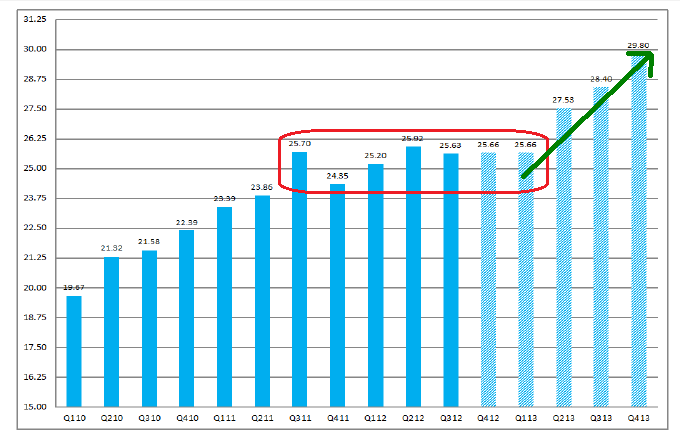

If we include the estimates for Q1 2013, S&P earnings have been flat for seven consecutive quarters. That's right, seven consecutive quarters with no earnings growth. How did the market perform over the same period? The S&P 500 was up roughly 32% since September of 2011.

Despite no EPS growth for seven straight quarters, the Q4 2013 consensus EPS forecast is 29.80, an increase of over 16% from the Q1 2013 consensus estimate (see Figure 2 below). While this growth rate is possible, a 16% increase in earnings over the next nine months certainly seems unlikely and is clearly inconsistent with the trend over the past two years.

Margins are unlikely to increase substantially going forward. As a result, future earnings growth would need to be generated primarily through top-line revenue increases, which will be difficult to achieve given the recession in Europe and Japan. In addition, higher taxes in the U.S. and the potential for decreased spending will further dampen near-term growth prospects.

Conclusion

Equity prices and earnings have continued to diverge over the past few months and over the past two years. In addition, earnings growth expectations for 2013 appear to be unrealistic, especially given the current state of the global economy and the incremental drag of austerity measures in the U.S. Finally, equity markets are currently overbought. All of these factors elevate the probability of a meaningful pullback in the equity markets. However, it is always prudent to wait for trend-change confirmation before betting against a sustained uptrend.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2013 - Trading Insights, LLC - All Rights Reserved.

sir,

i am a regular reader of this site, am from india and using amibroker for trading in indian stock market. do you track indian stock market Nifty ?

in addition will you please analysis about global commodity market?

with regards

Kumar

Kumar,

Thanks for reading Trader Edge on a regular basis. I probably should follow one of the ETFs that tracks the Indian stock market, but it is not currently one of the ETFs that I use in my strategies.

I recently started a project to automate the testing and development of several option strategies using AMIBroker. The project is complex and will require most of my time for the foreseeable future, but I will try to get back to you with some feedback about the commodity markets as soon as practicable.

Best regards,

Brian Johnson

Pingback: Earnings-Price Divergence Always Followed by Negative Returns | Trader Edge