In January, I introduced a new aggregate neural network model that I developed to forecast the seasonally-adjusted, annualized, real rate of change in U.S. GDP. The GDP growth rate is only reported quarterly, but the model provides a new rolling 3-month GDP growth rate forecast every month (with a one month lag). As a result, the model generates more timely information about the growth of the U.S. economy than the quarterly GDP data. The model framework and the forecast for Q1 2013 GDP (which will be released tomorrow) are explained below.

Aggregate GDP Model

The Trader Edge aggregate GDP model represents the average of two neural network model forecasts. When constructing the two neural network GDP models, I started with the same data that I used to develop the recession models. For the first model, I identified the optimal look-back period for each of the independent variables and discarded variables that had limited explanatory power. I then estimated several neural network models with different architectures and retained the one with the best overall performance. For the second neural network model, I started with the same data, but let the neural network model choose the best combination of independent variables using a greedy algorithm.

Historical Results

The Trader Edge aggregate GDP model performed well historically. The standard error of the estimate was a respectable 0.75%. For the past few months, the rolling 3-month forecast has exceeded the Q1 GDP consensus estimate. However, the consensus estimate has recently been rising, while the model forecast has been declining. The latest consensus estimate for Q1 GDP now exceeds the model forecast, although only slightly.

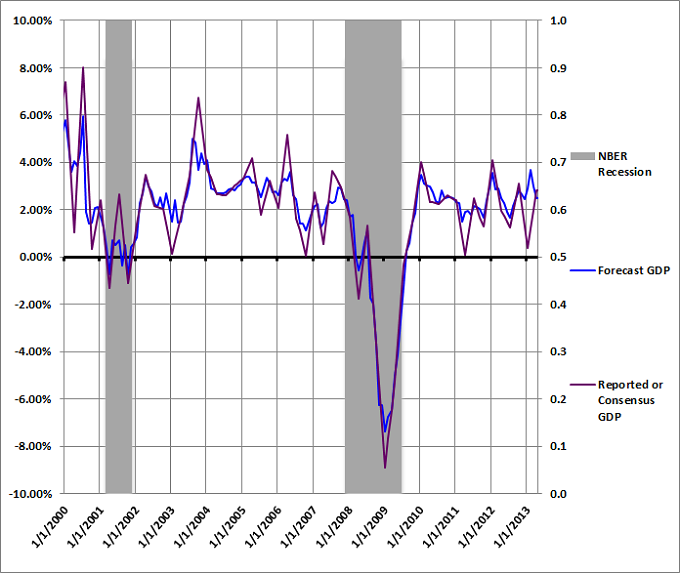

The model forecasts from 2000 to 4/1/2013 are included in Figure 1 below (blue). The purple line illustrates the actual quarterly GDP data. Both lines use the left vertical axis. The most recent "actual" GDP observation represents the current Q1 GDP consensus estimate from Briefing.com. The gray shaded regions represent past U.S. recessions as defined by the National Bureau of Economic Research (NBER).

Rolling GDP Forecast: Three Months Ending 04-01-2013

The Briefing.com consensus real GDP growth rate estimate for Q1 2013 is 2.8%. The model estimate for Q1 2013 (the 3-month period ended 04/01/2013) is now only 2.5%, which represents a decline from the revised forecast of 2.97% last month and from 3.69% the month before. According to the GDP model, the economy has weakened significantly over the past two months.

Conclusion

The GDP neural network model is still in the experimental stages and I envision future improvements in tracking changes in government expenditures and inventory. Nevertheless, the Trader Edge aggregate GDP model represents an unbiased, systematic tool for evaluating the strength of the U.S. economy. According to the model, the economy has weakened noticeably over the past two months and the consensus estimate for Q1 GDP may be too high.

Despite the recent weakening economic data, the equity indices remain near their all-time highs. This is troubling given the recent extreme divergence between earnings growth and equity price appreciation. It will be interesting to see how tomorrow's GDP release affects the equity markets.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2013 - Trading Insights, LLC - All Rights Reserved.