The AAR strategy is a conservative, long-only, asset allocation strategy that rotates monthly among five large asset classes: large-cap U.S. stocks, developed country stocks in Europe and Asia, emerging market stocks, U.S. Treasury Notes, and commodities. It is one of the 20 proprietary strategies that I trade in my account and the only strategy that Trader Edge currently offers on a subscription basis.

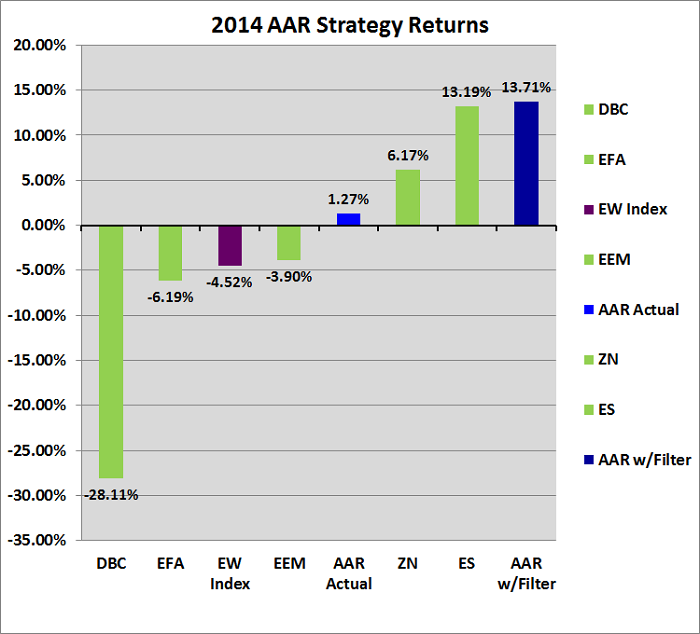

The AAR strategy earned a return of +1.27% in 2014, outperforming its equal-weighted index (-4.52%) by a notable 5.79% during the year. I added a new filter to the AAR strategy in mid-2014. In the second half of 2014, the AAR strategy earned a return of +6.93%, outperforming its equal-weighted index (-7.48%) by 14.41% during the six month period ending in December 2014.

The new filter prevented significant drawdowns that would have occurred in September and December of 2014. Had that filter been in place for the entire year, the AAR strategy would have earned a return of +13.71% in 2014.

For the two years ending in December 2014, the AAR strategy earned a compound annual return of 13.01%, outperforming its equal-weighted benchmark (+0.95%) by 12.06% compounded annually. The above AAR returns are net of round-trip transaction costs (0.10% per trade).

Remember that the AAR strategy is not an equity strategy and is not an absolute return strategy. The appropriate benchmark for the strategy is the equal-weighted monthly return of the five investment candidates, measured over a complete economic cycle.

The AAR strategy is based on the Ivy League portfolio asset allocation framework and every month it has the option of investing in any one of the five diverse investment candidates described above. If none of the five candidates pass their respective trade filters, the AAR strategy remains in cash for the month. Stop-loss orders are used on every trade to control losses and to facilitate position sizing.

New AAR Strategy Filter

I try to avoid making adjustments to strategies unless there are compelling reasons to do so. I initially developed the AAR strategy after the 2008 recession. Before releasing the AAR strategy to the public in 2013, I had not modified the strategy in some time.

A few years ago I added a new filter to my directional equity and option strategies that substantially improved returns and lowered risk. As a direct result of this filter, my long-term equity strategies performed better in early 2014 than the AAR strategy. I subsequently tested the filter with the AAR strategy and it also increased returns and lowered risk, but was particularly important in 2014.

Given these test results and based on my previous experience with the filter in my other strategies, I added the filter to the AAR strategy in mid-2014. Obviously this does not change the published AAR historical results for the first half of 2014, but it should improve the AAR strategy results when we see similar environments in the future, as we did in September and again in December of this year.

I rarely change strategy parameters, but when I do, AAR subscribers will always receive the signals from the latest version of the AAR strategy, which are the same signals I trade in my account.

AAR Strategy Returns

Of the five investment candidates, only the e-mini S&P 500 futures contract (ES: +13.19%) and U.S. Treasury Notes (ZN: +6.17%) earned positive returns in 2014. Commodities (DBC: -28.11%), the EAFE Index (EFA: -6.19%), and emerging markets (EEM: -3.90%) all earned negative returns for the year.

The 2014 returns for the five investment candidates are depicted in green (figure 1 below). The index returns (purple) were calculated using the equal-weighted monthly returns for the five investment candidates, excluding transaction costs. Finally, the AAR actual strategy return was calculated using the actual strategy signals executed at month-end closing prices, net of estimated transaction costs. For comparison purposes, the AAR strategy return (with the new filter in place for the entire year) is shown in dark blue (+13.71%).

All returns were calculated using prices back-adjusted for dividends and futures roll transactions. All prices and back-adjustments were provided by Commodity Systems, Inc. (CSI), one of the leading providers of market pricing data.

If you are not currently a subscriber and would like to learn more about the AAR strategy, there is a detailed description on the AAR Strategy page.

Print and Kindle Versions of Brian Johnson's Book are Now Both Available on Amazon (29 5-Star Reviews)

Trader Edge Strategy E-Subscription Now Available: 20% ROR

The Trader Edge Asset Allocation Rotational (AAR) Strategy is a conservative, long-only, asset allocation strategy that rotates monthly among five large asset classes. The AAR strategy has generated annual returns of approximately 20% over the combined back and forward test period. Please use the above link to learn more about the AAR strategy.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2015 - Trading Insights, LLC - All Rights Reserved.

New Filter in AAR strategy looks interesting Brian. Have to examined its effect across all years of your back test?

I continue to think that making monthly returns from the simulation would make it easier for people to sign up. I recently mentioned it to a trustee that is also considering the Dual Momentum Strategy ( Antonacci 2014). Without monthly returns the investor can’t see the correlation of AAR with their other strategies. DM, which is a fully disclosed strategy ( I understand that AAR is not), does make monthly returns available.

I do not think there is a risk of reverse engineering AAR from monthly returns because for any finite return stream the number of strategies that can replicate it is huge, if not being infinite.

best

David

David,

Good to hear from you as always. I did review the impact of the new filter over the entire backtest period and I am very familiar with the effects of the filter historically in my other strategies. Overall it improved AAR returns and reduced risk, but the filter was particularly effective in 2014. While it would have been ideal to have the filter in place for the entire year, the AAR strategy did reap the benefits of the filter in the second half of 2014.

Providing monthly returns would probably result in a few more subscriptions and I agree that the correlation data would be particularly useful for sophisticated investors. Nevertheless, I would not want to jeopardize the value of the strategy to the current subscribers (and to me personally) by increasing the risk of reverse engineering, even if slight.

I will probably need to cap the number of subscribers at some point, so maximizing revenue is not as important as preserving the value of the AAR strategy.

Best regards,

Brian Johnson