JP Morgan's Global Manufacturing PMI contracted again in September, with a reading of 48.9; PMI values below 50 signify contraction and PMI values above 50 indicate expansion. The September Global PMI was slightly higher than August's PMI of 48.1, indicating that the rate of contraction slowed in September.

JP Morgan Global Manufacturing PMI

JP Morgan and Markit developed a composite index called the JP Morgan Global Manufacturing PMI, which I have discussed in previous posts. The JP Morgan Global Manufacturing PMI index is a GDP weighted composite of each country's latest monthly PMI value. According to Markit Economics, a leading specialist in business surveys and economic indices,

"The PMIs have become the most closely-watched business surveys in the world, favored by central banks, financial markets and business decision makers for their ability to provide up-to-date, accurate and often unique monthly indicators of economic trends."

Global PMI, output, and new order indices were still below 50.0 in September, but all were higher than their respective August values, indicating a slowing in the rate of contraction. The trend is still negative, but the rate of decline eased in September. The new orders index was lower than the Global PMI again last month, which may indicate continued weakness in the manufacturing sector going forward. Input prices and employment both increased and reversed direction.

Figure 1: JPMorgan Global PMI Table September 2012

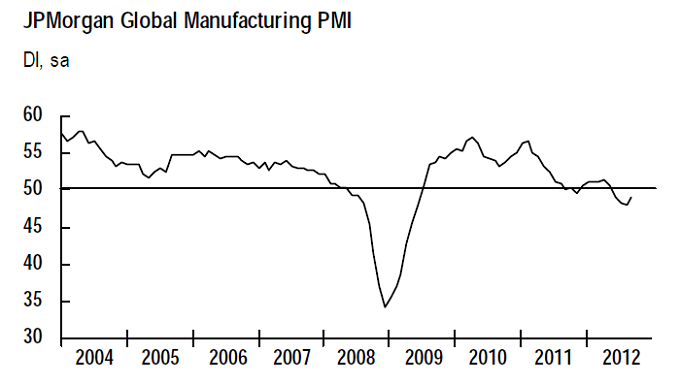

The chart in Figure 2 below represents a nine-year history of the Global Manufacturing PMI. Despite a slight increase in the September, the negative trend is still intact. The index continues to make lower highs and lower lows and has been below 50.0 for four consecutive months.

The index penetrated the 50 barrier briefly in 2011, but quickly reversed direction. Sustained penetration of the contraction line has been a very reliable indicator of recessions in the past.

Figure 2: JPMorgan Global PMI Graph September 2012

Conclusion

The PMI series is one of the best and most respected leading indicators and the Global PMI provides a comprehensive picture of the health and direction of the global economy. Even with the slight PMI increase in September, global manufacturing continues to contract, implying an impending worldwide recession - although manufacturing is currently one of the weakest economic sectors.

As I mentioned last week in my Q3 2012 Earnings Preview, year-over-year Q3 earnings growth is expected to be -2.7%, Q3 earnings guidance is the worst in FactSet's recorded history, and equity prices are still near all-time highs. In addition, several U.S. equity market indices gave reversal signals last week. Given the continued weakness in global manufacturing and the divergence between prices and earnings, downside risk continues to rise. If you are still long, it might be wise to tighten your stops.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future?

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2012 - Trading Insights, LLC - All Rights Reserved.

About Brian Johnson

I have been an investment professional for over 30 years. I worked as a fixed income portfolio manager, personally managing over $13 billion in assets for institutional clients. I was also the President of a financial consulting and software development firm, developing artificial intelligence based forecasting and risk management systems for institutional investment managers.

I am now a full-time proprietary trader in options, futures, stocks, and ETFs using both algorithmic and discretionary trading strategies.

In addition to my professional investment experience, I designed and taught courses in financial derivatives for both MBA and undergraduate business programs on a part-time basis for a number of years. I have also written four books on options and derivative strategies.

Global Manufacturing Continues to Decline in September

JP Morgan's Global Manufacturing PMI contracted again in September, with a reading of 48.9; PMI values below 50 signify contraction and PMI values above 50 indicate expansion. The September Global PMI was slightly higher than August's PMI of 48.1, indicating that the rate of contraction slowed in September.

JP Morgan Global Manufacturing PMI

JP Morgan and Markit developed a composite index called the JP Morgan Global Manufacturing PMI, which I have discussed in previous posts. The JP Morgan Global Manufacturing PMI index is a GDP weighted composite of each country's latest monthly PMI value. According to Markit Economics, a leading specialist in business surveys and economic indices,

Global PMI, output, and new order indices were still below 50.0 in September, but all were higher than their respective August values, indicating a slowing in the rate of contraction. The trend is still negative, but the rate of decline eased in September. The new orders index was lower than the Global PMI again last month, which may indicate continued weakness in the manufacturing sector going forward. Input prices and employment both increased and reversed direction.

Figure 1: JPMorgan Global PMI Table September 2012

The chart in Figure 2 below represents a nine-year history of the Global Manufacturing PMI. Despite a slight increase in the September, the negative trend is still intact. The index continues to make lower highs and lower lows and has been below 50.0 for four consecutive months.

The index penetrated the 50 barrier briefly in 2011, but quickly reversed direction. Sustained penetration of the contraction line has been a very reliable indicator of recessions in the past.

Figure 2: JPMorgan Global PMI Graph September 2012

Conclusion

The PMI series is one of the best and most respected leading indicators and the Global PMI provides a comprehensive picture of the health and direction of the global economy. Even with the slight PMI increase in September, global manufacturing continues to contract, implying an impending worldwide recession - although manufacturing is currently one of the weakest economic sectors.

As I mentioned last week in my Q3 2012 Earnings Preview, year-over-year Q3 earnings growth is expected to be -2.7%, Q3 earnings guidance is the worst in FactSet's recorded history, and equity prices are still near all-time highs. In addition, several U.S. equity market indices gave reversal signals last week. Given the continued weakness in global manufacturing and the divergence between prices and earnings, downside risk continues to rise. If you are still long, it might be wise to tighten your stops.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future?

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2012 - Trading Insights, LLC - All Rights Reserved.

About Brian Johnson

I have been an investment professional for over 30 years. I worked as a fixed income portfolio manager, personally managing over $13 billion in assets for institutional clients. I was also the President of a financial consulting and software development firm, developing artificial intelligence based forecasting and risk management systems for institutional investment managers. I am now a full-time proprietary trader in options, futures, stocks, and ETFs using both algorithmic and discretionary trading strategies. In addition to my professional investment experience, I designed and taught courses in financial derivatives for both MBA and undergraduate business programs on a part-time basis for a number of years. I have also written four books on options and derivative strategies.