Earnings season is here again, which provides a timely reminder that earnings are the ultimate driver of stock prices. The following article explores the recent trend in equity prices and earnings estimates.

Earnings and Equity Prices Diverge

FactSet is a leading vendor of market analytics, financial and market data, financial screening tools, and customized solutions. They also provide a comprehensive, detailed analysis of earnings and earnings trends, which they offer via free weekly PDF files on their site. The earnings graphs in this article are from the latest FactSet report.

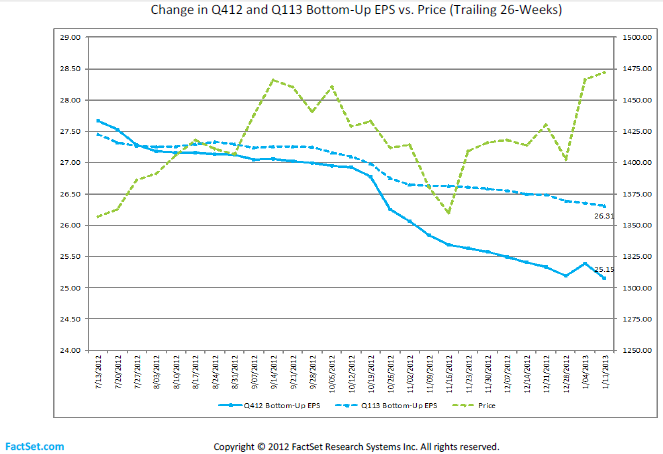

Equity prices and earnings forecasts diverged before Q3 2012 earnings were reported; prices rose dramatically while earnings forecasts declined. This preceded a significant market pull-back in the fall of 2012. Unfortunately, we are seeing the same troubling behavior again this quarter. As you can see in Figure 1 below, equity prices have increased by roughly 8% in the past two months while bottom-up EPS estimates for Q4 2012 and Q1 2013 declined by 1% to 2%.

While not as extreme as last quarter, the Price-EPS divergence for the past 12-months is still alarming. Over the past 12-months, the S&P 500 is up roughly 17% and year-over-year Q4 EPS estimates for the S&P are only up 1.5%. This obviously means that P/E ratios are rising. According to FactSet, forward 12-month P/E ratios are now above their 5-year average.

Unrealistic Growth Expectations

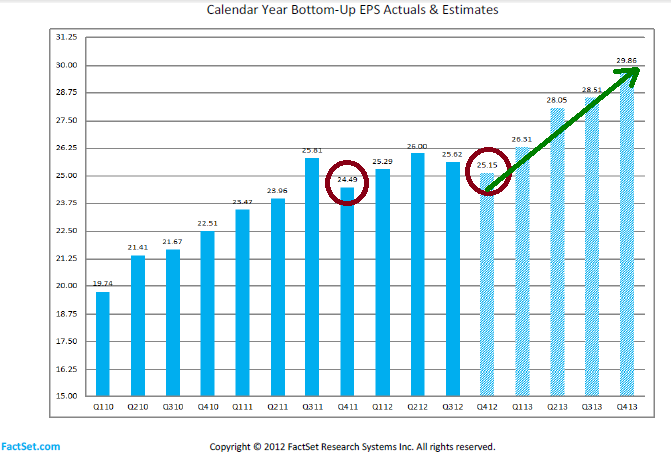

The Q4 2012 EPS estimate of 25.15 (which has since been revised lower) is slightly above the Q4 2011 estimate, but earnings have essentially been flat since Q3 2011. Now look at the earnings forecast for the upcoming 12 months (Figure 2 below). Earnings are expected to grow approximately 19%. The Trader Edge recession models are not currently indicating a U.S. recession, but 19% EPS growth for the next 12 months seems remarkably optimistic.

Companies have slashed costs over the past few years, wringing every last penny of profit out of every dollar of sales. As a result, future earnings growth will need to be generated primarily through top-line revenue increases, which will be difficult to achieve given the weakness in Europe, Japan, and the slowdown in China.

There is no question that the market responded favorably to the temporary fiscal cliff fix, but the fiscal cliff still exists, as does the debt ceiling. There will be more tax increases and probably some spending reductions as well. While accepting fiscal responsibility is prudent from a long-term perspective, it will create incremental drag on the economy and earnings in the near-term. This will make it even more difficult to achieve 19% EPS growth in the next 12 months.

Equities Overbought

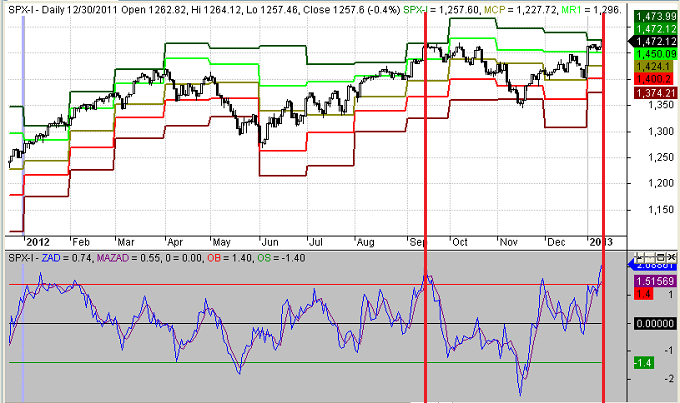

The unrealistic earnings expectations are worrisome, but the technical picture is equally problematic. All of the broad market U.S. equity indices are at or above their monthly R2 pivot resistance levels. This has historically led to pullbacks or at least periods of consolidation. The top panel below in Figure 3 below is a daily candlestick chart of the S&P 500 index with monthly pivot (support and resistance) lines. The top line (dark green) is the monthly R2 resistance line.

The bottom panel depicts a proprietary Trader Edge market breadth oscillator. The market breadth oscillator is currently above the bearish extreme threshold, implying an increased risk of a reversal. Note that a similar situation occurred in mid-September of 2012, shortly before Q3 earnings season.

Conclusion

Equity prices and earnings have diverged over the past two months and over the past year. In addition, earnings growth expectations appear to be unrealistic, especially given the current state of the global economy and the incremental drag of austerity measures in the U.S. Finally, equity markets are currently overbought, suggesting market headwinds in the near future.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2013 - Trading Insights, LLC - All Rights Reserved.

Very intriguing post. When considering other geopolitical and economic factors in conjunction with this data, I don’t have high expectations for market upside in 2013.

Ben,

I agree. The U.S. economy will be facing significant headwinds in 2013 and earnings expectations appear to be overly optimistic. In addition, we will be entering the fifth year of the recovery and GDP forecasts are declining.

Great to hear from you Ben. Thanks for continuing to follow Trader Edge.

Best regards,

Brian Johnson