In a recent article "Earnings-Price Divergence Always Followed by Negative Returns," I noted that every extreme divergence (-20% or lower) between year-over-year corporate profits and equity prices in the past 50 plus years was followed by negative year-over-year equity returns. In a subsequent article titled "S&P 500 Overvalued Based on Price-to-Sales Ratio," I observed that the S&P price-to-sales ratio had reached extreme levels, further limiting the upside potential for the equity market. Unfortunately, I recently uncovered more bad news for the bulls: investor leverage is the highest since the height of the 2000 equity market bubble.

NYSE Credit Balances

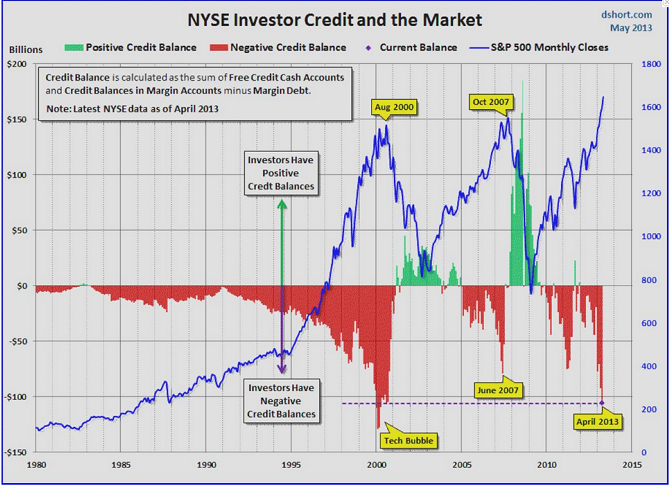

Every month, the NYSE publishes the value of credit balances, which represents free credit in investor cash accounts, plus credit balances in margin accounts, less margin debt. Net credit balances can be positive or negative. When credit balances are positive, investors have surplus cash to invest, or dry powder. Extreme negative credit balances mean investors are significantly overextended, suggesting that investors are "irrationally exuberant." The most extreme negative credit balance levels observed in 2000 and 2007 coincided almost exactly with cyclical market tops, which preceded periods of devastating losses for equity investors.

The following chart was published in an article written by Chris Kimble that appeared at Advisor Perspectives. The blue line represents the monthly close for the S&P 500 index. The green and red histogram bars reflect positive and negative monthly credit balances, respectively. In April 2013, negative credit balances were more extreme than at any point since 2000, which occurred during the height of the tech bubble.

Credit balances also reached extreme negative levels in June 2007. The market was only able to climb a few points higher before peaking in October 2007. The price of the S&P 500 index then plummeted by more than 50%. Shockingly, investor leverage is currently 33% higher than the peak level observed in 2007. Definitely not a good sign for the bulls.

Figure 1: NYSE Investor Credit

Conclusion

Investors are overextended and leverage has hit levels not seen since the 2000 tech bubble. Equity prices and earnings have recently diverged (negatively), the S&P 500 price-to-sales ratio has climbed to extreme levels, and sales growth has stalled. The market is overbought (long-term not short-term), overvalued and investors are overextended. Does this mean the market cannot continue to climb higher? Of course not. All experienced traders know the market can stay irrational longer than we can stay solvent.

However, for prices to continue to advance, the market must become more overbought, more overvalued, and investors must become even more overextended. In the current environment, the odds are clearly stacked against equities and the risk of a pullback is elevated.

According to the latest Trader Edge recession model and GDP model forecasts, there is no evidence that the U.S. economy is on the verge of another recession. However, corrections do not occur exclusively during recessions. Nevertheless, shorting bull markets has historically been a loser's game. High probability short equity trades are always accompanied by quantifiable evidence of both economic and market weakness.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2013 - Trading Insights, LLC - All Rights Reserved.

About Brian Johnson

I have been an investment professional for over 30 years. I worked as a fixed income portfolio manager, personally managing over $13 billion in assets for institutional clients. I was also the President of a financial consulting and software development firm, developing artificial intelligence based forecasting and risk management systems for institutional investment managers.

I am now a full-time proprietary trader in options, futures, stocks, and ETFs using both algorithmic and discretionary trading strategies.

In addition to my professional investment experience, I designed and taught courses in financial derivatives for both MBA and undergraduate business programs on a part-time basis for a number of years. I have also written four books on options and derivative strategies.

April 2013: Most Extreme Investor Leverage Since 2001 Bubble

In a recent article "Earnings-Price Divergence Always Followed by Negative Returns," I noted that every extreme divergence (-20% or lower) between year-over-year corporate profits and equity prices in the past 50 plus years was followed by negative year-over-year equity returns. In a subsequent article titled "S&P 500 Overvalued Based on Price-to-Sales Ratio," I observed that the S&P price-to-sales ratio had reached extreme levels, further limiting the upside potential for the equity market. Unfortunately, I recently uncovered more bad news for the bulls: investor leverage is the highest since the height of the 2000 equity market bubble.

NYSE Credit Balances

Every month, the NYSE publishes the value of credit balances, which represents free credit in investor cash accounts, plus credit balances in margin accounts, less margin debt. Net credit balances can be positive or negative. When credit balances are positive, investors have surplus cash to invest, or dry powder. Extreme negative credit balances mean investors are significantly overextended, suggesting that investors are "irrationally exuberant." The most extreme negative credit balance levels observed in 2000 and 2007 coincided almost exactly with cyclical market tops, which preceded periods of devastating losses for equity investors.

The following chart was published in an article written by Chris Kimble that appeared at Advisor Perspectives. The blue line represents the monthly close for the S&P 500 index. The green and red histogram bars reflect positive and negative monthly credit balances, respectively. In April 2013, negative credit balances were more extreme than at any point since 2000, which occurred during the height of the tech bubble.

Credit balances also reached extreme negative levels in June 2007. The market was only able to climb a few points higher before peaking in October 2007. The price of the S&P 500 index then plummeted by more than 50%. Shockingly, investor leverage is currently 33% higher than the peak level observed in 2007. Definitely not a good sign for the bulls.

Figure 1: NYSE Investor Credit

Conclusion

Investors are overextended and leverage has hit levels not seen since the 2000 tech bubble. Equity prices and earnings have recently diverged (negatively), the S&P 500 price-to-sales ratio has climbed to extreme levels, and sales growth has stalled. The market is overbought (long-term not short-term), overvalued and investors are overextended. Does this mean the market cannot continue to climb higher? Of course not. All experienced traders know the market can stay irrational longer than we can stay solvent.

However, for prices to continue to advance, the market must become more overbought, more overvalued, and investors must become even more overextended. In the current environment, the odds are clearly stacked against equities and the risk of a pullback is elevated.

According to the latest Trader Edge recession model and GDP model forecasts, there is no evidence that the U.S. economy is on the verge of another recession. However, corrections do not occur exclusively during recessions. Nevertheless, shorting bull markets has historically been a loser's game. High probability short equity trades are always accompanied by quantifiable evidence of both economic and market weakness.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2013 - Trading Insights, LLC - All Rights Reserved.

About Brian Johnson

I have been an investment professional for over 30 years. I worked as a fixed income portfolio manager, personally managing over $13 billion in assets for institutional clients. I was also the President of a financial consulting and software development firm, developing artificial intelligence based forecasting and risk management systems for institutional investment managers. I am now a full-time proprietary trader in options, futures, stocks, and ETFs using both algorithmic and discretionary trading strategies. In addition to my professional investment experience, I designed and taught courses in financial derivatives for both MBA and undergraduate business programs on a part-time basis for a number of years. I have also written four books on options and derivative strategies.