When forecasting recessions and market reversals, sometimes it helps to think outside the box. Everyone knows about technical indicators and economic data. Some traders follow market breadth and sentiment, but here is one that you may not follow.

Google Trends

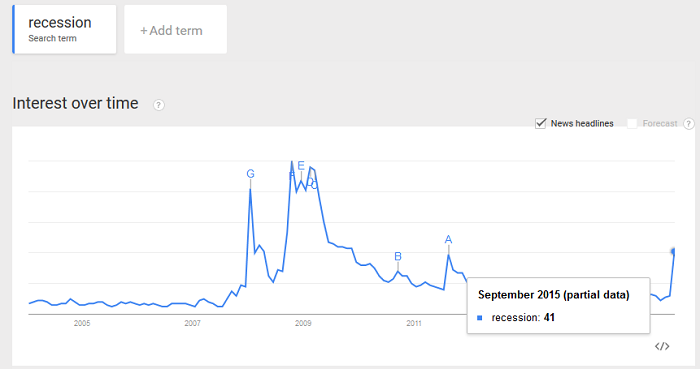

Google Trends tracks the relative search interest in terms or phrases over time, which can be very instructive when using the "wisdom of crowds" to your advantage. Below is a Google Trends chart of the search term "Recession" from 2004 to September 2015.

The search interest soared in January 2008 to 82 (G), which provided an excellent early exit signal before the Great Recession. The search interest declined for several months, before reaching its peak at 100 in October 2008 (F).

Since the end of the Great Recession, search interest in the term "Recession" jumped again in August 2011 to 39 (A), but quickly faded as the economic environment improved.

Search interest has now spiked again to 41 in September 2015, the highest value since the end of the Great Recession in 2009. In addition, the value of 41 reflects "partial data," which implies the value could increase if conditions worsen.

No indicator is perfect. As a result, it is very useful to look at a wide range of indicators that are constructed from different types of data.

Print and Kindle Versions of Brian Johnson's 2nd Book are Available on Amazon (75% 5-Star Reviews)

Print and Kindle Versions of Brian Johnson's 1st Book are Available on Amazon (79% 5-Star Reviews)

Trader Edge Strategy E-Subscription Now Available: 20% ROR

The Trader Edge Asset Allocation Rotational (AAR) Strategy is a conservative, long-only, asset allocation strategy that rotates monthly among five large asset classes. The AAR strategy has generated annual returns of approximately 20% over the combined back and forward test period. Please use the above link to learn more about the AAR strategy.

Brian Johnson

Copyright 2015 - Trading Insights, LLC - All Rights Reserved.

Pingback: 14 Recent Cautionary Articles on Trader Edge | Trader Edge