Tomi Gilmore's recent MarketWatch article ("Bearish divergence is warning investors not to buy the dip in the stock market") reminded me how effective divergences can be in identifying market reversals - well before they occur. Bearish divergences occur when an indicator makes lower highs and lower lows, while price is making higher highs and higher lows. In this situation, something has to give, and it is usually price. Conversely, Bullish divergences occur when an indicator makes higher highs and higher lows, while price is making lower highs and lower lows, indicating that prices will soon rebound.

When applied to the S&P 500 index (SPX) weekly data, the Relative Strength Index (RSI) has been making lower lows and lower highs since 2014, while the SPX has been making higher highs and higher lows - until free-falling in late August.

Historical Results

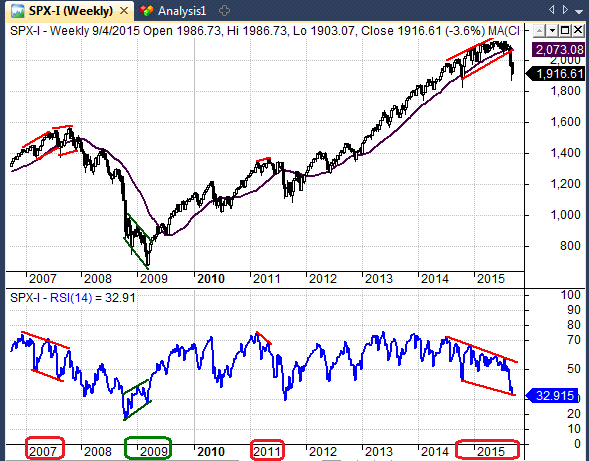

The top panel in Figure 1 below is a weekly chart of the SPX from 2007 through early September 2015. The bottom panel is the weekly, 14-period RSI. The bearish divergence are shown in red and the bullish divergences are shown in green. As you can see from the chart, bearish divergences preceded both the 2007 recession and the ongoing correction that began in August 2015. For recessions, bearish divergences tend to be extended, often beginning 12 months or more before prices break.

Short-term bearish divergences often lead to quick, sharp, pull-backs, as we saw in 2011. Most bullish divergences tend to be short-term, typically lasting less than 12 months. The bullish divergence that occurred in early 2009 almost perfectly coincided with the low price of the SPX during the Great Recession.

Figure 1: SPX-RSIDiv2015

Bearish divergences also occurred before the 2000, 1990, 1980, and 1973 recessions (not shown). A bearish RSI divergence even occurred several weeks before the 1987 crash (not shown). Bullish RSI divergences correctly signaled the end of the 1980, 2000, and 2007 recessions. RSI divergences can be early, but they are not often wrong.

Given the extended bearish RSI divergence from 2014 to August 2015, it could be a rough ride ahead.

Print and Kindle Versions of Brian Johnson's 2nd Book are Available on Amazon (75% 5-Star Reviews)

Exploiting Earnings Volatility: An Innovative New Approach to Evaluating, Optimizing, and Trading Option Strategies to Profit from Earnings Announcements.

Print and Kindle Versions of Brian Johnson's 1st Book are Available on Amazon (79% 5-Star Reviews)

Option Strategy Risk / Return Ratios: A Revolutionary New Approach to Optimizing, Adjusting, and Trading Any Option Income Strategy

Trader Edge Strategy E-Subscription Now Available: 20% ROR

The Trader Edge Asset Allocation Rotational (AAR) Strategy is a conservative, long-only, asset allocation strategy that rotates monthly among five large asset classes. The AAR strategy has generated annual returns of approximately 20% over the combined back and forward test period. Please use the above link to learn more about the AAR strategy.

Brian Johnson

Copyright 2015 - Trading Insights, LLC - All Rights Reserved.

About Brian Johnson

I have been an investment professional for over 30 years. I worked as a fixed income portfolio manager, personally managing over $13 billion in assets for institutional clients. I was also the President of a financial consulting and software development firm, developing artificial intelligence based forecasting and risk management systems for institutional investment managers.

I am now a full-time proprietary trader in options, futures, stocks, and ETFs using both algorithmic and discretionary trading strategies.

In addition to my professional investment experience, I designed and taught courses in financial derivatives for both MBA and undergraduate business programs on a part-time basis for a number of years. I have also written four books on options and derivative strategies.

RSI Divergence Called Every Recession in the Last 25 Years

Tomi Gilmore's recent MarketWatch article ("Bearish divergence is warning investors not to buy the dip in the stock market") reminded me how effective divergences can be in identifying market reversals - well before they occur. Bearish divergences occur when an indicator makes lower highs and lower lows, while price is making higher highs and higher lows. In this situation, something has to give, and it is usually price. Conversely, Bullish divergences occur when an indicator makes higher highs and higher lows, while price is making lower highs and lower lows, indicating that prices will soon rebound.

When applied to the S&P 500 index (SPX) weekly data, the Relative Strength Index (RSI) has been making lower lows and lower highs since 2014, while the SPX has been making higher highs and higher lows - until free-falling in late August.

Historical Results

The top panel in Figure 1 below is a weekly chart of the SPX from 2007 through early September 2015. The bottom panel is the weekly, 14-period RSI. The bearish divergence are shown in red and the bullish divergences are shown in green. As you can see from the chart, bearish divergences preceded both the 2007 recession and the ongoing correction that began in August 2015. For recessions, bearish divergences tend to be extended, often beginning 12 months or more before prices break.

Short-term bearish divergences often lead to quick, sharp, pull-backs, as we saw in 2011. Most bullish divergences tend to be short-term, typically lasting less than 12 months. The bullish divergence that occurred in early 2009 almost perfectly coincided with the low price of the SPX during the Great Recession.

Figure 1: SPX-RSIDiv2015

Bearish divergences also occurred before the 2000, 1990, 1980, and 1973 recessions (not shown). A bearish RSI divergence even occurred several weeks before the 1987 crash (not shown). Bullish RSI divergences correctly signaled the end of the 1980, 2000, and 2007 recessions. RSI divergences can be early, but they are not often wrong.

Given the extended bearish RSI divergence from 2014 to August 2015, it could be a rough ride ahead.

Print and Kindle Versions of Brian Johnson's 2nd Book are Available on Amazon (75% 5-Star Reviews)

Exploiting Earnings Volatility: An Innovative New Approach to Evaluating, Optimizing, and Trading Option Strategies to Profit from Earnings Announcements.

Print and Kindle Versions of Brian Johnson's 1st Book are Available on Amazon (79% 5-Star Reviews)

Option Strategy Risk / Return Ratios: A Revolutionary New Approach to Optimizing, Adjusting, and Trading Any Option Income Strategy

Trader Edge Strategy E-Subscription Now Available: 20% ROR

The Trader Edge Asset Allocation Rotational (AAR) Strategy is a conservative, long-only, asset allocation strategy that rotates monthly among five large asset classes. The AAR strategy has generated annual returns of approximately 20% over the combined back and forward test period. Please use the above link to learn more about the AAR strategy.

Brian Johnson

Copyright 2015 - Trading Insights, LLC - All Rights Reserved.

About Brian Johnson

I have been an investment professional for over 30 years. I worked as a fixed income portfolio manager, personally managing over $13 billion in assets for institutional clients. I was also the President of a financial consulting and software development firm, developing artificial intelligence based forecasting and risk management systems for institutional investment managers. I am now a full-time proprietary trader in options, futures, stocks, and ETFs using both algorithmic and discretionary trading strategies. In addition to my professional investment experience, I designed and taught courses in financial derivatives for both MBA and undergraduate business programs on a part-time basis for a number of years. I have also written four books on options and derivative strategies.