The latest FactSet earnings report is out and the results are not good. It is almost certain that Q3 2012 earnings will be down on a year-over-year basis. In addition, a number of high profile industry leaders have missed on earnings, top-line revenues, and/or issued negative guidance: Intel, Google, IBM, Microsoft, GE, and Caterpillar.

Weak Q3 Earnings

FactSet is a leading vendor of market analytics, financial and market data, financial screening tools, and customized solutions. They also provide a comprehensive, detailed analysis of earnings and earnings trends, which they offer via free weekly PDF files on their site.

Here are some key observations from the latest FactSet report dated October 19, 2012:

"Earnings Growth: The blended earnings growth rate for Q3 2012 is -2.3%. If -2.3% is the final growth rate for the quarter, it will mark the end of the eleven-quarter streak of earnings growth for the index.

Earnings Guidance: For Q4 2012, 21 companies have issued negative EPS guidance and 1 company has issued positive EPS guidance.

Earnings Scorecard: Of the 98 companies that have reported earnings to date for Q3 2012, 70% have reported earnings above the mean estimate, but only 42% have reported sales above the mean estimate.

As I mentioned a few weeks ago in my Q3 Earnings Preview, the S&P 500 Index was up over 29% from the prior year, but earnings were down. I also stated that "Prices and earnings will not diverge indefinitely. Either the negative earnings growth trend must reverse direction (as analysts are clearly expecting), or prices must correct (or both)."

Well, prices have recently started to correct. In my October 14, 2012 article "Multiple Indicators Point to Market Pullback," I noted that COT positions were at extreme levels and that the S&P 500 index, the Russell 2000 index, the NASDAQ 100 index and numerous other risk-on assets all had multiple confirmed trend change signals. Prices of risk-on assets have declined even further and are down sharply again today (through mid-day).

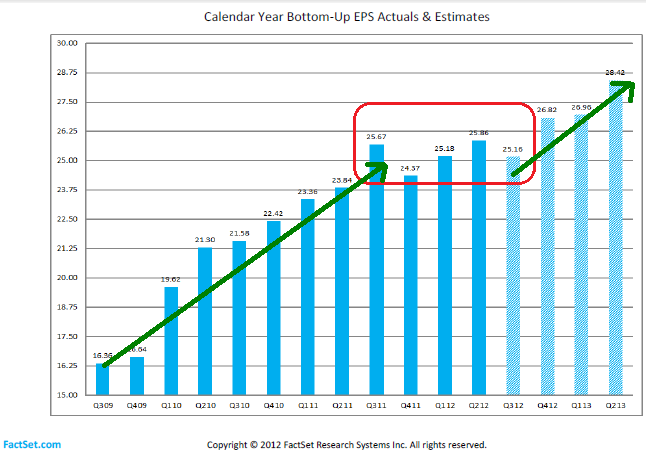

Earnings growth was very strong from Q3 2009 through Q3 2011. However, growth weakened considerably over the following five quarters. FactSet now estimates the Q3 2012 earnings growth rate will be -2.3%. For some inexplicable reason, despite the recent trend in earnings, analysts are forecasting a new earnings growth spurt over the next year (see Figure 1 below). This seems remarkably optimistic.

Figure 1: FactSet EPS Estimates 10-19-2012

While it is certainly possible for earnings growth to pause then resume, the trend toward negative earnings guidance and revenue disappointments makes this scenario even more unlikely. While there is only limited data on Q4 earnings guidance, 21 companies have issued negative guidance, while only one company has provided positive guidance.

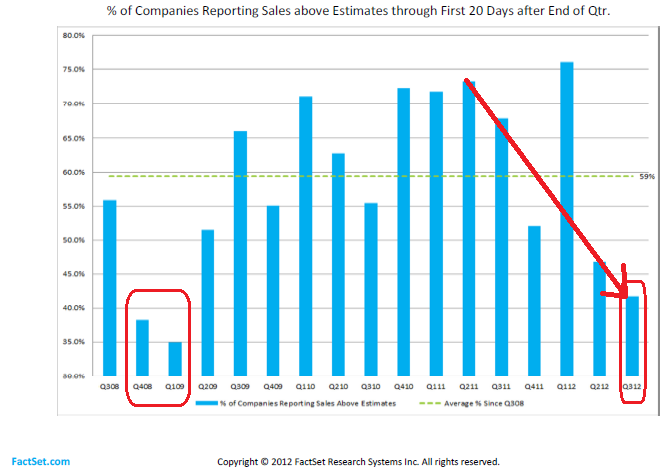

In addition, the percentage of companies reporting sales above estimates (through the first 20 days of the quarter) is at its lowest point since the first quarter of 2009 (see Figure 2 below). Except for an outlier in Q1 2012, this percentage has been declining steadily since Q2 2011.

Companies are already extremely lean and margins have little room to grow. If margins have peaked and revenues are weak, then how could earnings grow rapidly over the coming year?

Figure 2: FactSet Sales Estimates 10-19-2012

Conclusion

The equity market was riding an extended uptrend without a significant pull-back. Earnings disappointments, revenue weakness, and negative guidance are providing well-needed doses of reality. Worldwide quantitative easing programs by central banks fueled this rally, but eventually prices and earnings always converge.

The recent trend in economic data has been somewhat stronger, but the trend in earnings has been weaker. The uncertainty surrounding the US elections and the fiscal cliff will be resolved in the coming months and we will have access to additional economic and earnings data, which should provide some additional clarity on the long-term prospects for the market.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2012 - Trading Insights, LLC - All Rights Reserved.

About Brian Johnson

I have been an investment professional for over 30 years. I worked as a fixed income portfolio manager, personally managing over $13 billion in assets for institutional clients. I was also the President of a financial consulting and software development firm, developing artificial intelligence based forecasting and risk management systems for institutional investment managers.

I am now a full-time proprietary trader in options, futures, stocks, and ETFs using both algorithmic and discretionary trading strategies.

In addition to my professional investment experience, I designed and taught courses in financial derivatives for both MBA and undergraduate business programs on a part-time basis for a number of years. I have also written four books on options and derivative strategies.

Q3 2012 Earnings Update

The latest FactSet earnings report is out and the results are not good. It is almost certain that Q3 2012 earnings will be down on a year-over-year basis. In addition, a number of high profile industry leaders have missed on earnings, top-line revenues, and/or issued negative guidance: Intel, Google, IBM, Microsoft, GE, and Caterpillar.

Weak Q3 Earnings

FactSet is a leading vendor of market analytics, financial and market data, financial screening tools, and customized solutions. They also provide a comprehensive, detailed analysis of earnings and earnings trends, which they offer via free weekly PDF files on their site.

Here are some key observations from the latest FactSet report dated October 19, 2012:

As I mentioned a few weeks ago in my Q3 Earnings Preview, the S&P 500 Index was up over 29% from the prior year, but earnings were down. I also stated that "Prices and earnings will not diverge indefinitely. Either the negative earnings growth trend must reverse direction (as analysts are clearly expecting), or prices must correct (or both)."

Well, prices have recently started to correct. In my October 14, 2012 article "Multiple Indicators Point to Market Pullback," I noted that COT positions were at extreme levels and that the S&P 500 index, the Russell 2000 index, the NASDAQ 100 index and numerous other risk-on assets all had multiple confirmed trend change signals. Prices of risk-on assets have declined even further and are down sharply again today (through mid-day).

Earnings growth was very strong from Q3 2009 through Q3 2011. However, growth weakened considerably over the following five quarters. FactSet now estimates the Q3 2012 earnings growth rate will be -2.3%. For some inexplicable reason, despite the recent trend in earnings, analysts are forecasting a new earnings growth spurt over the next year (see Figure 1 below). This seems remarkably optimistic.

Figure 1: FactSet EPS Estimates 10-19-2012

While it is certainly possible for earnings growth to pause then resume, the trend toward negative earnings guidance and revenue disappointments makes this scenario even more unlikely. While there is only limited data on Q4 earnings guidance, 21 companies have issued negative guidance, while only one company has provided positive guidance.

In addition, the percentage of companies reporting sales above estimates (through the first 20 days of the quarter) is at its lowest point since the first quarter of 2009 (see Figure 2 below). Except for an outlier in Q1 2012, this percentage has been declining steadily since Q2 2011.

Companies are already extremely lean and margins have little room to grow. If margins have peaked and revenues are weak, then how could earnings grow rapidly over the coming year?

Figure 2: FactSet Sales Estimates 10-19-2012

Conclusion

The equity market was riding an extended uptrend without a significant pull-back. Earnings disappointments, revenue weakness, and negative guidance are providing well-needed doses of reality. Worldwide quantitative easing programs by central banks fueled this rally, but eventually prices and earnings always converge.

The recent trend in economic data has been somewhat stronger, but the trend in earnings has been weaker. The uncertainty surrounding the US elections and the fiscal cliff will be resolved in the coming months and we will have access to additional economic and earnings data, which should provide some additional clarity on the long-term prospects for the market.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2012 - Trading Insights, LLC - All Rights Reserved.

About Brian Johnson

I have been an investment professional for over 30 years. I worked as a fixed income portfolio manager, personally managing over $13 billion in assets for institutional clients. I was also the President of a financial consulting and software development firm, developing artificial intelligence based forecasting and risk management systems for institutional investment managers. I am now a full-time proprietary trader in options, futures, stocks, and ETFs using both algorithmic and discretionary trading strategies. In addition to my professional investment experience, I designed and taught courses in financial derivatives for both MBA and undergraduate business programs on a part-time basis for a number of years. I have also written four books on options and derivative strategies.