This article presents the Trader Edge aggregate neural network model forecast for the September 2015 non-farm payroll data, which is scheduled to be released tomorrow morning at 8:30 AM EDT.

Non-Farm Payroll (NFP) Model Forecast - September 2015

The Trader Edge aggregate NFP model represents the average of three neural network forecasting models, each of which employs a different neural network architecture. Unlike expert systems, neural networks use algorithms to identify and quantify complex relationships between variables based on historical data. All three models derive their forecasts from seven explanatory variables and the changes in those variables over time.

The table in Figure 1 below includes the monthly non-farm payroll data for two months: August and September 2015. The August data was released last month and the non-farm payroll data for September 2015 will be released tomorrow morning at 8:30 AM EDT.

The model forecasts are in the third data row of the table (in blue). Note that past and current forecasts reflect the latest values of the independent variables, which means that forecasts will change when revisions are made to the historical economic data.

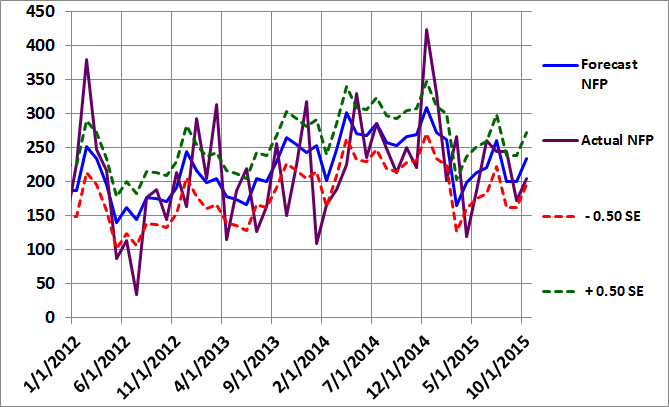

The monthly standard error of the model is approximately 76,000 jobs. The first and last data rows of the table report the forecast plus 0.5 standard errors (in green) and the forecast minus 0.5 standard errors (in red), respectively. All values are rounded to the nearest thousand. If the model errors were normally distributed, roughly 31% of the observations would fall below -0.5 standard errors and another 31% of the observations would exceed +0.5 standard errors.

The actual non-farm payroll release for August 2015 is in the second data row of the table (in purple). The consensus estimate (reported by Briefing.com) for September 2015 is also in the second data row of the table (in purple). The reported and consensus NFP values also include the deviation from the forecast NFP (as a multiple of the standard error of the estimate). Finally, the last column of the table includes the estimated changes from August 2015 to September 2015.

Model Commentary

The aggregate neural network model forecast for September is 233,000, which is up noticeably from last month's revised forecast of 200,000, reflecting a modest increase in the strength of the employment environment during the month of September. The Briefing.com consensus estimate for September is 205,000, which is 32,000 higher than the August NFP data (173,000), also indicating a modest strengthening in the employment environment. The actual August data was slightly below the revised August forecast (-0.35 S.E.) and the consensus estimate for September is also slightly below the model forecast (-0.37 S.E.).

If we ignore the large NFP outliers, there had been a gradual and sustained positive trend in the employment data from mid-2012 through January of 2015. The trend is easier to see in the forecast data due to fewer outliers. The positive trend in the model forecasts definitely leveled off in early 2015 and reversed for several months and continues to be weaker than in 2014.

The difference between the September NFP consensus and September NFP forecast is modest, but a positive surprise tomorrow could help convince the Federal Reserve to finally pull the trigger on raising interest rates.

Summary

Basic forecasting tools can help you identify unusual consensus economic estimates, which often lead to substantial surprises and market movements. Identifying such environments in advance may help you protect your portfolio from these corrections and help you determine the optimal entry and exit points for your strategies.

In the case of the NFP data, the monthly report data is highly variable and prone to substantial revisions. As a result, having an independent and unbiased indicator of the health of the U.S. job market is especially important.

Print and Kindle Versions of Brian Johnson's 2nd Book are Available on Amazon (75% 5-Star Reviews)

Print and Kindle Versions of Brian Johnson's 1st Book are Available on Amazon (79% 5-Star Reviews)

Trader Edge Strategy E-Subscription Now Available: 20% ROR

The Trader Edge Asset Allocation Rotational (AAR) Strategy is a conservative, long-only, asset allocation strategy that rotates monthly among five large asset classes. The AAR strategy has generated annual returns of approximately 20% over the combined back and forward test period. Please use the above link to learn more about the AAR strategy.

Brian Johnson

Copyright 2015 - Trading Insights, LLC - All Rights Reserved.

My forecast sept 2015 is 219 and 238, and August revision is going to be between 200 – 220

Kind Regards

Anthony,

It looks like our forecasts are very close this month. What type of model or models do you use?

Best regards,

Brian Johnson