The following article updates the diffusion index, recession slack index, aggregate recession model, and aggregate peak-trough model through September 2015. In January 2015, I created a new explanatory variable for a market-based indicator; I added two new explanatory variables in April and June 2015, and one more in September 2015. After adding a number of new economic and market-based variables recently with very strong explanatory power, I decided to cull three of the original independent variables with the weakest historical performance and most questionable cause and effect recessionary influence. The resulting 19-variable model has a very diverse set of explanatory variables and is very robust.

Each of the explanatory variables has predictive power individually; when combined together, the group of indicators is able to identify early recession warnings from a wide range of diverse market-based, fundamental, technical, and economic sources. After the latest additions and deletions, the total number of explanatory recession model variables is now 19. The current and historical data in this report reflect the current model configuration with all 19 variables.

Diffusion Index

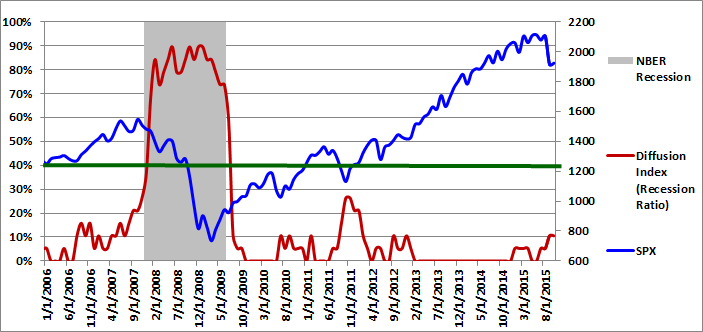

The Trader Edge diffusion index equals the percentage of independent variables indicating a recession. With the changes, there are now a total of 19 explanatory variables, each with a unique look-back period and recession threshold. The resulting diffusion index and changes in the diffusion index are used to calculate the probit, logit, and neural network model forecasts.

The graph of the diffusion index from 1/1/2006 to 10/1/2015 is presented in Figure 1 below (in red - left axis). If you would like to view a graph of the earlier historical data (going back to 1960), please revisit A New Recession Slack Indicator. The gray shaded regions in Figure 1 below represent U.S. recessions as defined (after the fact) by the National Bureau of Economic Research (NBER). The value of the S&P 500 index is also included (in blue - right axis).

In December 2014, for the first time since December 2012, one of the 19 explanatory variables indicated a recessionary environment. The number of variables indicating a recession varied between zero and one from December 2014 through July 2015, but jumped to two in August 2015 and remained at two in September 2015. Two out of 19 variables indicating a recession is not immediate cause for concern, but two more variables are currently very close to their respective recession thresholds (less than 0.05 standard deviations). The diffusion index could have easily been four in September instead of two, which would have significantly increased the recession risk.

In non-recessionary environments, weakness typically persists for a few months and then dissipates. However, if the weakness becomes more widespread or lingers for many months, that can be more problematic. The weakness has persisted throughout much of 2015, but at a relatively modest level. The recession forecasts for the next few months will be very instructive.

Please note that past estimates and index values will change whenever the historical data is revised. All current and past forecasts and index calculations are based on the latest revised data from the current data set.

Figure 1: Diffusion Index 10-01-2015

Recession Slack Index

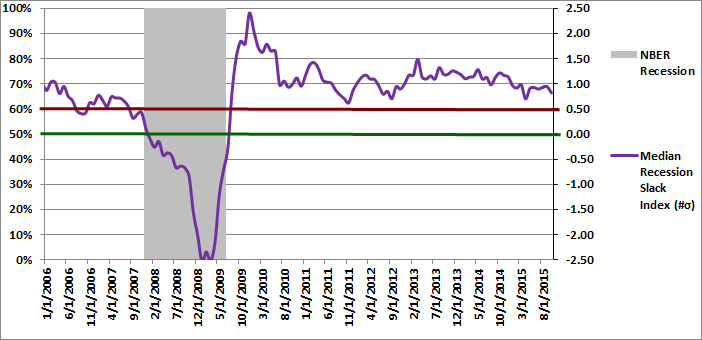

The Trader Edge recession slack index equals the median standardized deviation of the current value of the explanatory variables from their respective recession thresholds. The resulting value signifies the amount of slack or cushion relative to the recession threshold, expressed in terms of the number of standard deviations.

The gray shaded regions in Figure 2 below represent U.S. recessions as defined (after the fact) by the NBER. The median recession slack index is depicted in purple and is plotted against the right axis, which is expressed as the number of standard deviations above the recession threshold.

The dark-red, horizontal line at 0.50 standard deviations denotes a possible warning threshold for the recession slack index. Many of the past recessions began when the recession slack index crossed below 0.50. Similarly, many of the past recessions ended when the recession slack index crossed back above 0.0.

In mid-2014, the revised median recession slack index peaked at 1.22, far above the warning level of 0.50. The revised values of the recession slack index declined alarmingly to 0.70 in March 2015, perilously close to the early warning level of 0.50. The value of 0.70 was the lowest value recorded since the end of the Great Recession. The median recession slack index remained between 0.89 and 0.94 from April through August 2015, but dropped to 0.82 in September 2015. The cushion above the warning level has shrunk considerably since mid-2014, but the slack index remains above its warning threshold.

The ability to track small variations and trend changes over time illustrates the advantage of monitoring the continuous recession slack index in addition to the diffusion index above, which moves in discrete steps.

While it is useful to track the actual recession slack index values directly, the values are also used to generate the more intuitive probit and logit probability forecasts.

Figure 2: Median Recession Slack Index 10-01-2015

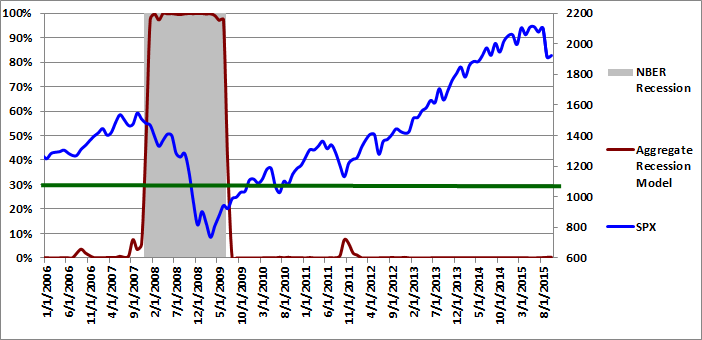

Aggregate Recession Probability Estimate

The Trader Edge aggregate recession model is the average of four models: the probit and logit models based on the diffusion index and the probit and logit models based on the recession slack index. The aggregate recession model estimates from 1/1/2006 to 10/01/2015 are depicted in Figure 3 below (red line - left vertical axis). The gray shaded regions represent NBER recessions and the blue line reflects the value of the S&P 500 index (right vertical axis). I suggest using a warning threshold of between 30-40% for the aggregate recession model (green horizontal line).

The aggregate recession model probability estimate for 10/01/2015 remained at 0.3% in September - unchanged for the month. According to the model, the probability that the U.S. is currently in a recession continues to be extremely remote.

Figure 3: Aggregate Recession Model 10-01-2015

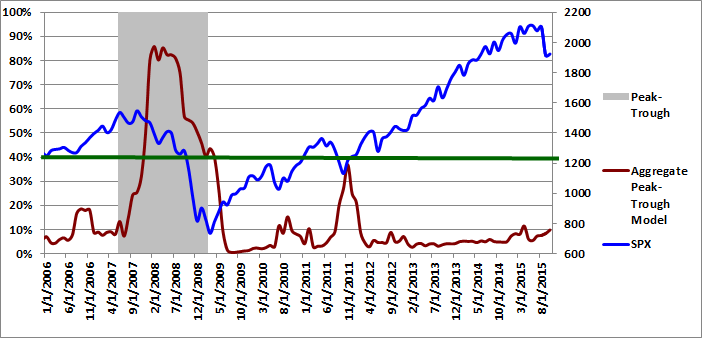

Aggregate Peak-Trough Probability Estimate

The peak-trough model forecasts are different from the recession model. The peak-trough models estimate the probability of the S&P 500 being between the peak and trough associated with an NBER recession. The S&P 500 typically peaks before recessions begin and bottoms out before recessions end. As a result, it is far more difficult for the peak-trough model to fit this data and the model forecasts have larger errors than the recession model.

The Trader Edge aggregate peak-trough model equals the weighted-average of nine different models: the probit and logit models based on the diffusion index, the probit and logit models based on the recession slack index, and five neural network models.

The aggregate peak-trough model estimates from 1/1/2006 to 10/01/2015 are depicted in Figure 4 below, which uses the same format as Figure 3, except that the shaded regions represent the periods between the peaks and troughs associated with NBER recessions.

The aggregate peak-trough model probability estimate for 10/01/2015 was 9.8%, which is up marginally from the revised value of 8.4% at the end of August. The peak-trough probability reached 11.5% in March 2015. The current peak-trough probability estimate of 9.8% is again approaching double digits, but is well below the early warning threshold of 30% to 40%. However, if the diffusion index had increased to four out of 19 variables instead of two out of 19, the aggregate peak trough model probability forecast would have been much higher.

Figure 4: Aggregate Peak-Trough Model 10-01-2015

Conclusion

U.S. recession risk remains relatively low, but has increased since mid-2014. The diffusion index remained at two, but could have easily jumped to four. In March, the recession slack index dropped to its lowest level since the end of the Great Recession (0.70). It rebounded briefly, but fell back to 0.82 in September. The peak-trough recession probability estimate is again approaching double digits. All of the forecast values are well inside their respective warning thresholds.

Given the proximity of the diffusion index variables relative to their respective recession thresholds, the recession model forecasts over the next few months will be extremely important and instructive. The variable changes have had a minor impact on the historical data and recently reported values.

Print and Kindle Versions of Brian Johnson's 2nd Book are Available on Amazon (75% 5-Star Reviews)

Exploiting Earnings Volatility: An Innovative New Approach to Evaluating, Optimizing, and Trading Option Strategies to Profit from Earnings Announcements.

Print and Kindle Versions of Brian Johnson's 1st Book are Available on Amazon (79% 5-Star Reviews)

Option Strategy Risk / Return Ratios: A Revolutionary New Approach to Optimizing, Adjusting, and Trading Any Option Income Strategy

Trader Edge Strategy E-Subscription Now Available: 20% ROR

The Trader Edge Asset Allocation Rotational (AAR) Strategy is a conservative, long-only, asset allocation strategy that rotates monthly among five large asset classes. The AAR strategy has generated annual returns of approximately 20% over the combined back and forward test period. Please use the above link to learn more about the AAR strategy.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2015 - Trading Insights, LLC - All Rights Reserved.

Recession Model Forecast: 10-01-2015

The following article updates the diffusion index, recession slack index, aggregate recession model, and aggregate peak-trough model through September 2015. In January 2015, I created a new explanatory variable for a market-based indicator; I added two new explanatory variables in April and June 2015, and one more in September 2015. After adding a number of new economic and market-based variables recently with very strong explanatory power, I decided to cull three of the original independent variables with the weakest historical performance and most questionable cause and effect recessionary influence. The resulting 19-variable model has a very diverse set of explanatory variables and is very robust.

Each of the explanatory variables has predictive power individually; when combined together, the group of indicators is able to identify early recession warnings from a wide range of diverse market-based, fundamental, technical, and economic sources. After the latest additions and deletions, the total number of explanatory recession model variables is now 19. The current and historical data in this report reflect the current model configuration with all 19 variables.

Diffusion Index

The Trader Edge diffusion index equals the percentage of independent variables indicating a recession. With the changes, there are now a total of 19 explanatory variables, each with a unique look-back period and recession threshold. The resulting diffusion index and changes in the diffusion index are used to calculate the probit, logit, and neural network model forecasts.

The graph of the diffusion index from 1/1/2006 to 10/1/2015 is presented in Figure 1 below (in red - left axis). If you would like to view a graph of the earlier historical data (going back to 1960), please revisit A New Recession Slack Indicator. The gray shaded regions in Figure 1 below represent U.S. recessions as defined (after the fact) by the National Bureau of Economic Research (NBER). The value of the S&P 500 index is also included (in blue - right axis).

In December 2014, for the first time since December 2012, one of the 19 explanatory variables indicated a recessionary environment. The number of variables indicating a recession varied between zero and one from December 2014 through July 2015, but jumped to two in August 2015 and remained at two in September 2015. Two out of 19 variables indicating a recession is not immediate cause for concern, but two more variables are currently very close to their respective recession thresholds (less than 0.05 standard deviations). The diffusion index could have easily been four in September instead of two, which would have significantly increased the recession risk.

In non-recessionary environments, weakness typically persists for a few months and then dissipates. However, if the weakness becomes more widespread or lingers for many months, that can be more problematic. The weakness has persisted throughout much of 2015, but at a relatively modest level. The recession forecasts for the next few months will be very instructive.

Please note that past estimates and index values will change whenever the historical data is revised. All current and past forecasts and index calculations are based on the latest revised data from the current data set.

Figure 1: Diffusion Index 10-01-2015

Recession Slack Index

The Trader Edge recession slack index equals the median standardized deviation of the current value of the explanatory variables from their respective recession thresholds. The resulting value signifies the amount of slack or cushion relative to the recession threshold, expressed in terms of the number of standard deviations.

The gray shaded regions in Figure 2 below represent U.S. recessions as defined (after the fact) by the NBER. The median recession slack index is depicted in purple and is plotted against the right axis, which is expressed as the number of standard deviations above the recession threshold.

The dark-red, horizontal line at 0.50 standard deviations denotes a possible warning threshold for the recession slack index. Many of the past recessions began when the recession slack index crossed below 0.50. Similarly, many of the past recessions ended when the recession slack index crossed back above 0.0.

In mid-2014, the revised median recession slack index peaked at 1.22, far above the warning level of 0.50. The revised values of the recession slack index declined alarmingly to 0.70 in March 2015, perilously close to the early warning level of 0.50. The value of 0.70 was the lowest value recorded since the end of the Great Recession. The median recession slack index remained between 0.89 and 0.94 from April through August 2015, but dropped to 0.82 in September 2015. The cushion above the warning level has shrunk considerably since mid-2014, but the slack index remains above its warning threshold.

The ability to track small variations and trend changes over time illustrates the advantage of monitoring the continuous recession slack index in addition to the diffusion index above, which moves in discrete steps.

While it is useful to track the actual recession slack index values directly, the values are also used to generate the more intuitive probit and logit probability forecasts.

Figure 2: Median Recession Slack Index 10-01-2015

Aggregate Recession Probability Estimate

The Trader Edge aggregate recession model is the average of four models: the probit and logit models based on the diffusion index and the probit and logit models based on the recession slack index. The aggregate recession model estimates from 1/1/2006 to 10/01/2015 are depicted in Figure 3 below (red line - left vertical axis). The gray shaded regions represent NBER recessions and the blue line reflects the value of the S&P 500 index (right vertical axis). I suggest using a warning threshold of between 30-40% for the aggregate recession model (green horizontal line).

The aggregate recession model probability estimate for 10/01/2015 remained at 0.3% in September - unchanged for the month. According to the model, the probability that the U.S. is currently in a recession continues to be extremely remote.

Figure 3: Aggregate Recession Model 10-01-2015

Aggregate Peak-Trough Probability Estimate

The peak-trough model forecasts are different from the recession model. The peak-trough models estimate the probability of the S&P 500 being between the peak and trough associated with an NBER recession. The S&P 500 typically peaks before recessions begin and bottoms out before recessions end. As a result, it is far more difficult for the peak-trough model to fit this data and the model forecasts have larger errors than the recession model.

The Trader Edge aggregate peak-trough model equals the weighted-average of nine different models: the probit and logit models based on the diffusion index, the probit and logit models based on the recession slack index, and five neural network models.

The aggregate peak-trough model estimates from 1/1/2006 to 10/01/2015 are depicted in Figure 4 below, which uses the same format as Figure 3, except that the shaded regions represent the periods between the peaks and troughs associated with NBER recessions.

The aggregate peak-trough model probability estimate for 10/01/2015 was 9.8%, which is up marginally from the revised value of 8.4% at the end of August. The peak-trough probability reached 11.5% in March 2015. The current peak-trough probability estimate of 9.8% is again approaching double digits, but is well below the early warning threshold of 30% to 40%. However, if the diffusion index had increased to four out of 19 variables instead of two out of 19, the aggregate peak trough model probability forecast would have been much higher.

Figure 4: Aggregate Peak-Trough Model 10-01-2015

Conclusion

U.S. recession risk remains relatively low, but has increased since mid-2014. The diffusion index remained at two, but could have easily jumped to four. In March, the recession slack index dropped to its lowest level since the end of the Great Recession (0.70). It rebounded briefly, but fell back to 0.82 in September. The peak-trough recession probability estimate is again approaching double digits. All of the forecast values are well inside their respective warning thresholds.

Given the proximity of the diffusion index variables relative to their respective recession thresholds, the recession model forecasts over the next few months will be extremely important and instructive. The variable changes have had a minor impact on the historical data and recently reported values.

Print and Kindle Versions of Brian Johnson's 2nd Book are Available on Amazon (75% 5-Star Reviews)

Exploiting Earnings Volatility: An Innovative New Approach to Evaluating, Optimizing, and Trading Option Strategies to Profit from Earnings Announcements.

Print and Kindle Versions of Brian Johnson's 1st Book are Available on Amazon (79% 5-Star Reviews)

Option Strategy Risk / Return Ratios: A Revolutionary New Approach to Optimizing, Adjusting, and Trading Any Option Income Strategy

Trader Edge Strategy E-Subscription Now Available: 20% ROR

The Trader Edge Asset Allocation Rotational (AAR) Strategy is a conservative, long-only, asset allocation strategy that rotates monthly among five large asset classes. The AAR strategy has generated annual returns of approximately 20% over the combined back and forward test period. Please use the above link to learn more about the AAR strategy.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2015 - Trading Insights, LLC - All Rights Reserved.

About Brian Johnson

I have been an investment professional for over 30 years. I worked as a fixed income portfolio manager, personally managing over $13 billion in assets for institutional clients. I was also the President of a financial consulting and software development firm, developing artificial intelligence based forecasting and risk management systems for institutional investment managers. I am now a full-time proprietary trader in options, futures, stocks, and ETFs using both algorithmic and discretionary trading strategies. In addition to my professional investment experience, I designed and taught courses in financial derivatives for both MBA and undergraduate business programs on a part-time basis for a number of years. I have also written four books on options and derivative strategies.