The following article updates the diffusion index, recession slack index, aggregate recession model, and aggregate peak-trough model through May 2016. Throughout 2015, I added a number of new economic and market-based variables with very strong explanatory power to the recession model. This allowed me to cull three of the original independent variables with the weakest historical performance and most questionable cause and effect recessionary influence. I added one new variable with surprisingly strong explanatory power at the end of February 2016. The current 21-variable model has a diverse set of explanatory variables and is quite robust.

Each of the explanatory variables has predictive power individually; when combined together, the group of indicators is able to identify early recession warnings from a wide range of diverse market-based, fundamental, technical, and economic sources. After the latest additions and deletions, the total number of explanatory recession model variables is now 21. The current and historical data in this report reflect the current model configuration with all 21 variables.

Diffusion Index

The Trader Edge diffusion index equals the percentage of independent variables indicating a recession. With the recent changes, there are now a total of 21 explanatory variables, each with a unique look-back period and recession threshold. The resulting diffusion index and changes in the diffusion index are used to calculate the probit, logit, and neural network model forecasts.

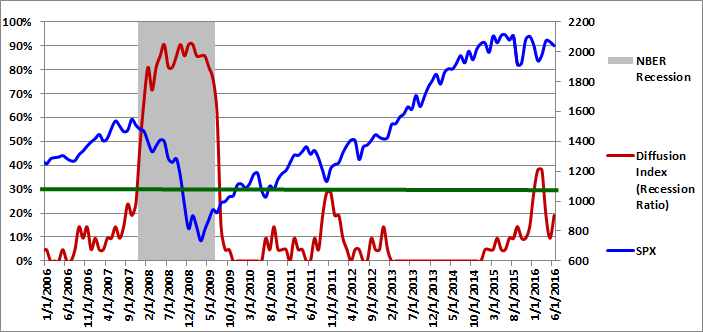

The graph of the diffusion index from 1/1/2006 to 06/1/2016 is presented in Figure 1 below (in red - left axis). The gray shaded regions in Figure 1 below represent U.S. recessions as defined (after the fact) by the National Bureau of Economic Research (NBER). The value of the S&P 500 index is also included (in blue - right axis).

In December 2014, for the first time since December 2012, one of the 21 explanatory variables indicated a recessionary environment. The number of variables indicating a recession varied between one and two from December 2014 through August 2015 and between two and three from August 2015 through November 2015. The number of variables indicating a recession jumped from three in November, to six in December, to eight in January 2016 and remained at eight in February. In response to the robust market environment that followed, the number of explanatory variables indicating a recession dropped to four (19.0%) in March and two (9.5%) in April.

Unfortunately, the brief decline in recession risk reversed again in May, when the number of explanatory variables indicating a recession jumped from two to four (19.0%). If the month of June 2016 ended today, the number of recessionary variables would increase again, from four to six. This trend reversal is troubling.

As I have explained before, several of the explanatory variables are market-based. These variables respond very quickly to changing market conditions and are never revised. This makes the Trader Edge recession model much more responsive than other recession models. The sharp rebound in the price of risk-assets in March and April improved the U.S. economic outlook, which significantly reduced the risk of an imminent U.S. recession. Those gains are now appearing to be transitory.

Please note that past estimates and index values will change whenever the historical data is revised. All current and past forecasts and index calculations are based on the latest revised data from the current data set.

Figure 1: Diffusion Index 06-01-2016

Recession Slack Index

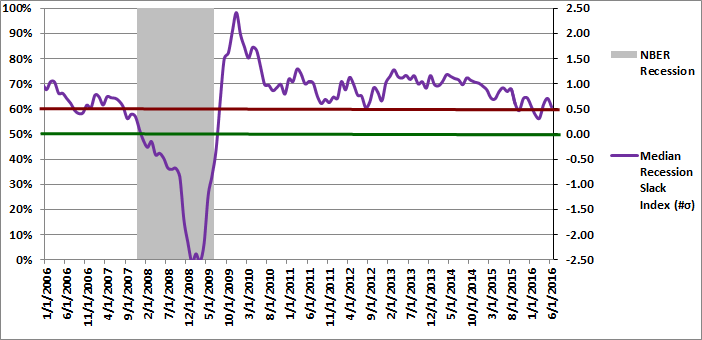

The Trader Edge recession slack index equals the median standardized deviation of the current value of the explanatory variables from their respective recession thresholds. The resulting value signifies the amount of slack or cushion relative to the recession threshold, expressed in terms of the number of standard deviations.

The gray shaded regions in Figure 2 below represent U.S. recessions as defined (after the fact) by the NBER. The median recession slack index is depicted in purple and is plotted against the right axis, which is expressed as the number of standard deviations above the recession threshold.

The dark-red, horizontal line at 0.50 standard deviations denotes a possible warning threshold for the recession slack index. Many of the past recessions began when the recession slack index crossed below 0.50. Similarly, many of the past recessions ended when the recession slack index crossed back above 0.0.

In mid-2014, the revised median recession slack index peaked at 1.18, far above the warning level of 0.50. The revised values of the recession slack index declined significantly to 0.70 in early 2015. The median recession slack index rebounded for several months, but resumed its decline in late 2015 and early 2016. The slack index eventually fell to a low of 0.31 in February 2016, penetrating the warning level of 0.50 for the first time since the Great Recession. The slack index bounced back to 0.59 in March and 0.71 in April, but has now fallen back to 0.54 in May, again approaching the warning level.

The latest value of 0.54 is only slightly above the warning level. Given the preliminary month-to-date values in June, the slack index is at risk of penetrating the warning level again next month. The recession risk has declined since February, but the U.S. economy is not on solid footing.

The ability to track small variations and trend changes over time illustrates the advantage of monitoring the continuous recession slack index in addition to the diffusion index above, which moves in discrete steps.

While it is useful to track the actual recession slack index values directly, the values are also used to generate the more intuitive probit and logit probability forecasts.

Figure 2: Median Recession Slack Index 06-01-2016

Aggregate Recession Probability Estimate

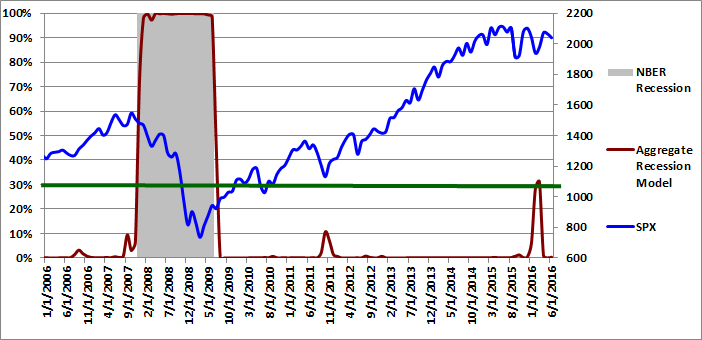

The Trader Edge aggregate recession model is the average of four models: the probit and logit models based on the diffusion index and the probit and logit models based on the recession slack index. The aggregate recession model estimates from 1/1/2006 to 06/01/2016 are depicted in Figure 3 below (red line - left vertical axis). The gray shaded regions represent NBER recessions and the blue line reflects the value of the S&P 500 index (right vertical axis). I suggest using a warning threshold of between 20-30% for the aggregate recession model (green horizontal line).

The aggregate recession model probability estimate for 06/01/2016 increased from 0.1% in April 2016 to 0.3% in May 2016. According to the model, the probability that the U.S. is currently in a recession is insignificant.

Figure 3: Aggregate Recession Model 06-01-2016

Aggregate Peak-Trough Probability Estimate

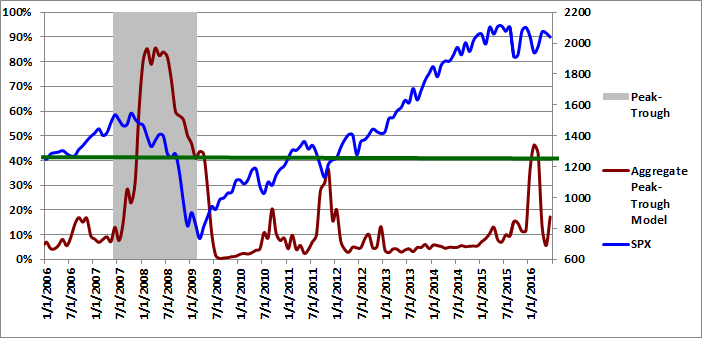

The peak-trough model forecasts are different from the recession model. The peak-trough models estimate the probability of the S&P 500 being between the peak and trough associated with an NBER recession. The S&P 500 typically peaks before recessions begin and bottoms out before recessions end. As a result, it is far more difficult for the peak-trough model to fit this data and the model forecasts have larger errors than the recession model.

The Trader Edge aggregate peak-trough model equals the weighted-average of nine different models: the probit and logit models based on the diffusion index, the probit and logit models based on the recession slack index, and five neural network models.

The aggregate peak-trough model estimates from 1/1/2006 to 6/01/2016 are depicted in Figure 4 below, which uses the same format as Figure 3, except that the shaded regions represent the periods between the peaks and troughs associated with NBER recessions.

The aggregate peak-trough model probability estimate for 06/01/2016 was 17.2%, which is up sharply from the revised value of 5.6% at the end of April 2016. The increase in recession risk reflects the rebound in the diffusion index from 9.5% to 19.0%.

Figure 4: Aggregate Peak-Trough Model 06-01-2016

Conclusion

January and February 2016 marked a potential tipping point in U.S. recession risk, but that risk declined significantly in March and April. It now appears that the brief reduction in recession risk may be transitory. Recession risk increased in May and preliminary data suggest another increase in June.

The use of several market-based indicators makes the Trader Edge recession model more responsive than many other models. Relative to traditional economic variables, market-based data have important advantages: they are highly predictive, they are never restated, and there is no lag in receiving the data. The market-based variables improved in March and again in April, but have now begun to reverse direction, as have several of the economic data series.

The latest median recession slack index value of 0.54 is significantly weaker than last month and is again approaching the early warning threshold. The large rebound in the price of risk-assets in March and April was encouraging, but prices are already weakening. Currently, four out of 21 explanatory variables are still indicating a U.S. recession, which could jump to six at the end of June.

Given that the U.S. equity market remains significantly overvalued (highest price-to-sales ratio ever) and year-over-year corporate earnings have declined for four consecutive quarters (and just suffered the worst quarterly decline since the Great Recession), the downside risk in the equity markets is severe.

The risk of exogenous shocks remains very high and are these risks are not priced into the market: Brexit, ongoing weakness in China, a waffling/clueless Federal Reserve, the potential indictment of the presumptive Democratic nominee for President, and Trump. If we add a U.S. recession to the mix, it could get very ugly.

Unlike human prognosticators, the Trader Edge recession model is completely objective and has no ego. It is not burdened by the emotional need to defend past erroneous forecasts and will always consistently apply the insights gained from new data. As a result, if economic and market conditions improve over the next few months, the recession probabilities would resume their decline. Conversely, if the deterioration in May continues and contagion spreads to the remaining explanatory variables, the recession model would objectively quantify the increased recession risk. Stay tuned; it could be a wild ride.

Print and Kindle Versions of Brian Johnson's 2nd Book are Available on Amazon (75% 5-Star Reviews)

Exploiting Earnings Volatility: An Innovative New Approach to Evaluating, Optimizing, and Trading Option Strategies to Profit from Earnings Announcements.

Print and Kindle Versions of Brian Johnson's 1st Book are Available on Amazon (79% 5-Star Reviews)

Option Strategy Risk / Return Ratios: A Revolutionary New Approach to Optimizing, Adjusting, and Trading Any Option Income Strategy

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2016 - Trading Insights, LLC - All Rights Reserved.

Recession Model Forecast: 06-01-2016

The following article updates the diffusion index, recession slack index, aggregate recession model, and aggregate peak-trough model through May 2016. Throughout 2015, I added a number of new economic and market-based variables with very strong explanatory power to the recession model. This allowed me to cull three of the original independent variables with the weakest historical performance and most questionable cause and effect recessionary influence. I added one new variable with surprisingly strong explanatory power at the end of February 2016. The current 21-variable model has a diverse set of explanatory variables and is quite robust.

Each of the explanatory variables has predictive power individually; when combined together, the group of indicators is able to identify early recession warnings from a wide range of diverse market-based, fundamental, technical, and economic sources. After the latest additions and deletions, the total number of explanatory recession model variables is now 21. The current and historical data in this report reflect the current model configuration with all 21 variables.

Diffusion Index

The Trader Edge diffusion index equals the percentage of independent variables indicating a recession. With the recent changes, there are now a total of 21 explanatory variables, each with a unique look-back period and recession threshold. The resulting diffusion index and changes in the diffusion index are used to calculate the probit, logit, and neural network model forecasts.

The graph of the diffusion index from 1/1/2006 to 06/1/2016 is presented in Figure 1 below (in red - left axis). The gray shaded regions in Figure 1 below represent U.S. recessions as defined (after the fact) by the National Bureau of Economic Research (NBER). The value of the S&P 500 index is also included (in blue - right axis).

In December 2014, for the first time since December 2012, one of the 21 explanatory variables indicated a recessionary environment. The number of variables indicating a recession varied between one and two from December 2014 through August 2015 and between two and three from August 2015 through November 2015. The number of variables indicating a recession jumped from three in November, to six in December, to eight in January 2016 and remained at eight in February. In response to the robust market environment that followed, the number of explanatory variables indicating a recession dropped to four (19.0%) in March and two (9.5%) in April.

Unfortunately, the brief decline in recession risk reversed again in May, when the number of explanatory variables indicating a recession jumped from two to four (19.0%). If the month of June 2016 ended today, the number of recessionary variables would increase again, from four to six. This trend reversal is troubling.

As I have explained before, several of the explanatory variables are market-based. These variables respond very quickly to changing market conditions and are never revised. This makes the Trader Edge recession model much more responsive than other recession models. The sharp rebound in the price of risk-assets in March and April improved the U.S. economic outlook, which significantly reduced the risk of an imminent U.S. recession. Those gains are now appearing to be transitory.

Please note that past estimates and index values will change whenever the historical data is revised. All current and past forecasts and index calculations are based on the latest revised data from the current data set.

Figure 1: Diffusion Index 06-01-2016

Recession Slack Index

The Trader Edge recession slack index equals the median standardized deviation of the current value of the explanatory variables from their respective recession thresholds. The resulting value signifies the amount of slack or cushion relative to the recession threshold, expressed in terms of the number of standard deviations.

The gray shaded regions in Figure 2 below represent U.S. recessions as defined (after the fact) by the NBER. The median recession slack index is depicted in purple and is plotted against the right axis, which is expressed as the number of standard deviations above the recession threshold.

The dark-red, horizontal line at 0.50 standard deviations denotes a possible warning threshold for the recession slack index. Many of the past recessions began when the recession slack index crossed below 0.50. Similarly, many of the past recessions ended when the recession slack index crossed back above 0.0.

In mid-2014, the revised median recession slack index peaked at 1.18, far above the warning level of 0.50. The revised values of the recession slack index declined significantly to 0.70 in early 2015. The median recession slack index rebounded for several months, but resumed its decline in late 2015 and early 2016. The slack index eventually fell to a low of 0.31 in February 2016, penetrating the warning level of 0.50 for the first time since the Great Recession. The slack index bounced back to 0.59 in March and 0.71 in April, but has now fallen back to 0.54 in May, again approaching the warning level.

The latest value of 0.54 is only slightly above the warning level. Given the preliminary month-to-date values in June, the slack index is at risk of penetrating the warning level again next month. The recession risk has declined since February, but the U.S. economy is not on solid footing.

The ability to track small variations and trend changes over time illustrates the advantage of monitoring the continuous recession slack index in addition to the diffusion index above, which moves in discrete steps.

While it is useful to track the actual recession slack index values directly, the values are also used to generate the more intuitive probit and logit probability forecasts.

Figure 2: Median Recession Slack Index 06-01-2016

Aggregate Recession Probability Estimate

The Trader Edge aggregate recession model is the average of four models: the probit and logit models based on the diffusion index and the probit and logit models based on the recession slack index. The aggregate recession model estimates from 1/1/2006 to 06/01/2016 are depicted in Figure 3 below (red line - left vertical axis). The gray shaded regions represent NBER recessions and the blue line reflects the value of the S&P 500 index (right vertical axis). I suggest using a warning threshold of between 20-30% for the aggregate recession model (green horizontal line).

The aggregate recession model probability estimate for 06/01/2016 increased from 0.1% in April 2016 to 0.3% in May 2016. According to the model, the probability that the U.S. is currently in a recession is insignificant.

Figure 3: Aggregate Recession Model 06-01-2016

Aggregate Peak-Trough Probability Estimate

The peak-trough model forecasts are different from the recession model. The peak-trough models estimate the probability of the S&P 500 being between the peak and trough associated with an NBER recession. The S&P 500 typically peaks before recessions begin and bottoms out before recessions end. As a result, it is far more difficult for the peak-trough model to fit this data and the model forecasts have larger errors than the recession model.

The Trader Edge aggregate peak-trough model equals the weighted-average of nine different models: the probit and logit models based on the diffusion index, the probit and logit models based on the recession slack index, and five neural network models.

The aggregate peak-trough model estimates from 1/1/2006 to 6/01/2016 are depicted in Figure 4 below, which uses the same format as Figure 3, except that the shaded regions represent the periods between the peaks and troughs associated with NBER recessions.

The aggregate peak-trough model probability estimate for 06/01/2016 was 17.2%, which is up sharply from the revised value of 5.6% at the end of April 2016. The increase in recession risk reflects the rebound in the diffusion index from 9.5% to 19.0%.

Figure 4: Aggregate Peak-Trough Model 06-01-2016

Conclusion

January and February 2016 marked a potential tipping point in U.S. recession risk, but that risk declined significantly in March and April. It now appears that the brief reduction in recession risk may be transitory. Recession risk increased in May and preliminary data suggest another increase in June.

The use of several market-based indicators makes the Trader Edge recession model more responsive than many other models. Relative to traditional economic variables, market-based data have important advantages: they are highly predictive, they are never restated, and there is no lag in receiving the data. The market-based variables improved in March and again in April, but have now begun to reverse direction, as have several of the economic data series.

The latest median recession slack index value of 0.54 is significantly weaker than last month and is again approaching the early warning threshold. The large rebound in the price of risk-assets in March and April was encouraging, but prices are already weakening. Currently, four out of 21 explanatory variables are still indicating a U.S. recession, which could jump to six at the end of June.

Given that the U.S. equity market remains significantly overvalued (highest price-to-sales ratio ever) and year-over-year corporate earnings have declined for four consecutive quarters (and just suffered the worst quarterly decline since the Great Recession), the downside risk in the equity markets is severe.

The risk of exogenous shocks remains very high and are these risks are not priced into the market: Brexit, ongoing weakness in China, a waffling/clueless Federal Reserve, the potential indictment of the presumptive Democratic nominee for President, and Trump. If we add a U.S. recession to the mix, it could get very ugly.

Unlike human prognosticators, the Trader Edge recession model is completely objective and has no ego. It is not burdened by the emotional need to defend past erroneous forecasts and will always consistently apply the insights gained from new data. As a result, if economic and market conditions improve over the next few months, the recession probabilities would resume their decline. Conversely, if the deterioration in May continues and contagion spreads to the remaining explanatory variables, the recession model would objectively quantify the increased recession risk. Stay tuned; it could be a wild ride.

Print and Kindle Versions of Brian Johnson's 2nd Book are Available on Amazon (75% 5-Star Reviews)

Exploiting Earnings Volatility: An Innovative New Approach to Evaluating, Optimizing, and Trading Option Strategies to Profit from Earnings Announcements.

Print and Kindle Versions of Brian Johnson's 1st Book are Available on Amazon (79% 5-Star Reviews)

Option Strategy Risk / Return Ratios: A Revolutionary New Approach to Optimizing, Adjusting, and Trading Any Option Income Strategy

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2016 - Trading Insights, LLC - All Rights Reserved.

About Brian Johnson

I have been an investment professional for over 30 years. I worked as a fixed income portfolio manager, personally managing over $13 billion in assets for institutional clients. I was also the President of a financial consulting and software development firm, developing artificial intelligence based forecasting and risk management systems for institutional investment managers. I am now a full-time proprietary trader in options, futures, stocks, and ETFs using both algorithmic and discretionary trading strategies. In addition to my professional investment experience, I designed and taught courses in financial derivatives for both MBA and undergraduate business programs on a part-time basis for a number of years. I have also written four books on options and derivative strategies.