The following article updates the diffusion index, recession slack index, aggregate recession model, and aggregate peak-trough model through February 2014.

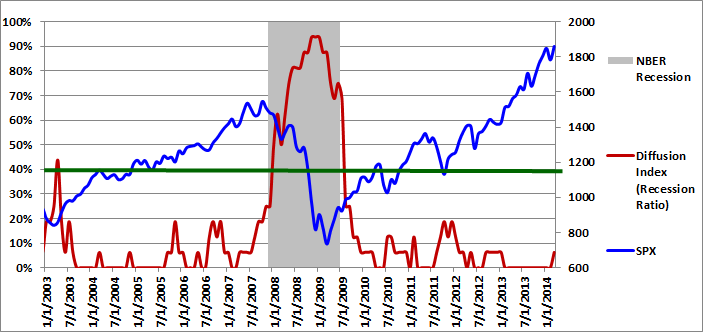

Diffusion Index

The Trader Edge diffusion index equals the percentage of independent variables indicating a recession. There are a total of 16 explanatory variables, each with a unique look-back period and recession threshold. The resulting diffusion index and changes in the diffusion index are used to estimate the probit, logit, and neural network forecasting models.

The graph of the diffusion index from 1/1/2003 to 3/1/2014 is presented in Figure 1 below (in red - left axis). If you would like to view a graph of the earlier historical data (going back to 1960), please revisit A New Recession Slack Indicator. The gray shaded regions in Figure 1 below represent U.S. recessions as defined (after the fact) by the National Bureau of Economic Research (NBER). The value of the S&P 500 index is also included (in blue - right axis).

For the first time since the end of January 2013, one of the 16 explanatory variables is currently indicating a recession. The percentage of explanatory variables indicating a recession had remained constant at 0% from the end of January 2013 through the end of January 2014. While one of 16 variables indicating a recession is not significant by itself, it is a notable change.

Please note that past estimates and index values will change whenever the historical data is revised. All current and past forecasts and index calculations are based on the latest revised data.

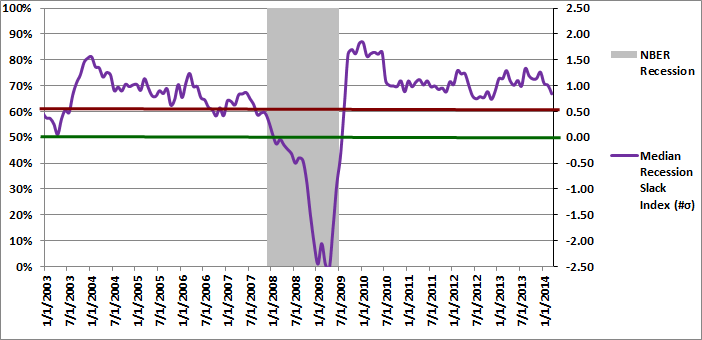

Recession Slack Index

The Trader Edge recession slack index equals the median standardized deviation of the current value of the explanatory variables from their respective recession thresholds. The resulting value signifies the amount of slack or cushion relative to the recession threshold, expressed in terms of the number of standard deviations.

The gray shaded regions in Figure 2 below again represent U.S. recessions as defined (after the fact) by the NBER. The median recession slack index is depicted in purple and is plotted against the right axis, which is expressed as the number of standard deviations above the recession threshold.

The dark-red, horizontal line at 0.50 standard deviations denotes a possible warning threshold for the recession slack index. Many of the past recessions began when the recession slack index crossed below 0.50. Similarly, many of the past recessions ended when the recession slack index crossed back above 0.0.

The latest recession slack index value was only 0.85 standard deviations above the recession threshold, which was down sharply from the revised value of 1.00 at the end of January 2014. The recession slack index varied between 0.99 and 1.33 during 2013. The most recent value of 0.85 is the lowest reading since the the end of October 2012. Since emerging from the great recession, 0.74 was the lowest recorded value of the recession slack index. In that context, the decline from 1.00 to 0.85 in a single month is troubling. Nevertheless, the recession slack index is still above the warning threshold of 0.50, but the cushion has shrunk.

The ability to track small variations and trend changes over time illustrates the advantage of monitoring the continuous recession slack index in addition to the diffusion index above, which moves in discrete steps.

While it is useful to track the actual recession slack index values directly, the values are also used to generate the more intuitive probit and logit probability forecasts.

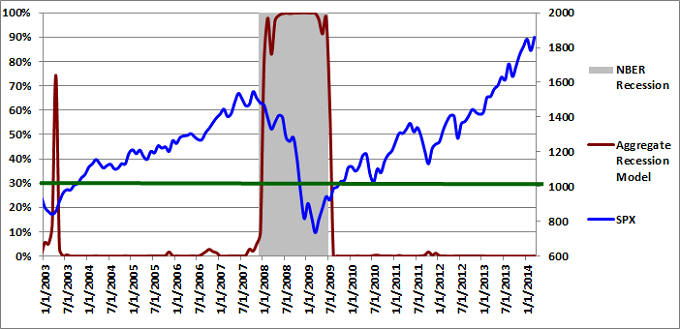

Aggregate Recession Probability Estimate

The Trader Edge aggregate recession model is the average of four models: the probit and logit models based on the diffusion index and the probit and logit models based on the recession slack index. The aggregate recession model estimates from 1/1/2003 to 3/1/2014 are depicted in Figure 3 below (red line - left vertical axis). The gray shaded regions represent NBER recessions and the blue line reflects the value of the S&P 500 index (right vertical axis). I suggest using a warning threshold of between 30-40% for the aggregate recession model (green horizontal line).

The aggregate recession model probability estimate for 3/1/2014 was 0.1%, which was a slight increase from last month's revised estimate of 0.0%. According to the model, the probability that the U.S. is currently in a recession continues to be extremely remote.

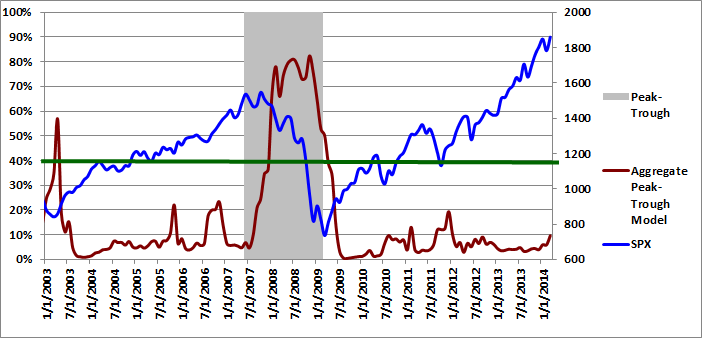

Aggregate Peak-Trough Probability Estimate

The peak-trough model forecasts are different from the recession model. The peak-trough models estimate the probability of the S&P 500 being between the peak and trough associated with an NBER recession. The S&P 500 typically peaks before recessions begin and bottoms out before recessions end. As a result, it is far more difficult for the peak-trough model to fit this data and the model forecasts have larger errors than the recession model.

The Trader Edge aggregate peak-trough model equals the weighted-average of nine different models: the probit and logit models based on the diffusion index, the probit and logit models based on the recession slack index, and five neural network models.

The aggregate peak-trough model estimates from 1/1/2003 to 3/1/2014 are depicted in Figure 4 below, which uses the same format as Figure 3, except that the shaded regions represent the periods between the peaks and troughs associated with NBER recessions. The aggregate peak-trough model probability estimate for 3/1/2014 was 9.6%, which was up from the revised value of 5.9% at the end of January. The increase is consistent with the decline in the recession slack index and the increase in the diffusion index. The current peak-trough probability estimate of 9.6% is still well below the warning threshold of 30%-40%, but still represents the highest reading since the end of December 2011.

Conclusion

U.S. recession risk remained very low in January. Nevertheless, for the first time in many months, there was a notable increase in the risk of a recession. This was evidenced by the increase in the diffusion index and the decrease in the recession slack index. The probability that we are currently in a recession did not increase significantly, but the probability that we are between the peak and trough associated with a recession increased from 5.9% to 9.6%, which was the highest value in the last two years. Despite the measurable increase in risk, all of the forecast values are well inside their respective warning thresholds.

Trader Edge Strategy E-Subscription Now Available: 20% ROR

The Trader Edge Asset Allocation Rotational (AAR) Strategy is a conservative, long-only, asset allocation strategy that rotates monthly among five large asset classes. The AAR strategy has generated annual returns of approximately 20% over the combined back and forward test period. Please use the above link to learn more about the AAR strategy.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2014 - Trading Insights, LLC - All Rights Reserved.