I introduced the topic of recession forecasting in late October. I have since developed several recession forecasting tools that I created by applying probit, logit, and neural network models to a diffusion index of economic and market-related variables. This article introduces a new recession slack indicator, which was inspired by James Picerno's latest business cycle research at The Capital Spectator.

If you are new to Trader Edge and would like some additional background on the development of the Trader Edge recession models, I encourage you to read the following recession model articles in chronological order.

- Forecasting Recessions is Easier than Modeling Asset Prices

- New Probit Models: U.S. Recession Risk is Currently Low

- Recession Models and the Fiscal Cliff

- Recession Model Improvements

Diffusion Index Review

The diffusion index equals the percentage of independent variables indicating a recession. There are a total of 16 explanatory variables, each with a unique look-back period and recession threshold. The resulting diffusion index and changes in the diffusion index are used to estimate the probit, logit, and neural network forecasting models. The graph of the diffusion index from 12/7/2012 is presented in Figure 1 below.

Each of the explanatory variables has a discrete impact on the diffusion index. Either the independent variable indicates a recession or it doesn't. As each underlying variable moves between recession and non-recession indications, the diffusion index makes a discrete jump.

The diffusion index eliminates a lot of the noise in the data by focusing exclusively on the percentage of independent variables indicating a recession, rather than on the percentage changes in the variables. However, in doing so, it ignores some potentially useful information, which could be used in conjunction with the existing diffusion index, probit, logit, and recession models. For this reason, Picerno created the CS-EMI, which is simply "the monthly median percentage change for the 14 indicators that comprise the diffusion index that is the CS-ETI."

Recession Slack Index

I liked Picerno's idea of gleaning some additional insight from the underlying data, but took a slightly different approach in creating the new indicator. For each variable, I calculated the difference between the percentage change in that variable over its unique look-back period relative to its specific recession threshold, and then divided that value by its standard deviation.

The resulting value signifies the amount of slack or cushion relative to the recession threshold, expressed in terms of the number of standard deviations. A value of +1.5 would indicate a variable that was 1.5 standard deviations above its recession threshold, suggesting a very robust economic environment and a significant recessionary cushion - at least for that particular variable.

While each variable has a unique threshold and level of variability, the above slack value is standardized and can be compared or aggregated across all of the explanatory variables. After calculating the slack value for each variable, I calculated the median recession slack index. I experimented with using the average instead of the median, but the average proved to be more volatile due to the influence of outliers.

The gray shaded regions in Figure 2 below represent U.S. recessions as defined (after the fact) by the National Bureau of Economic Research (NBER). The median recession slack index is depicted in purple and is plotted against the right axis, which is expressed as the number of standard deviations above the recession threshold.

The median recession slack index captures changes in all of the variables continuously, which should help identify subtle changes in the strength of the U.S. economy, even when the diffusion index is unchanged. The slack index should also be useful in detecting trends and trend changes.

The dark-red, horizontal line at 0.50 standard deviations denotes a possible warning threshold for the recession slack index. Many of the past recessions began when the recession slack index crossed below 0.50. It might seem more intuitive to use a warning threshold at 0.0, but that is not consistent with the behavior of the diffusion index.

Recessions typically begin before 50% of the variables indicate a recession. In these environments, the median recession slack index would still be positive. As a result, a recession warning threshold value above zero is more appropriate. Conversely, when the recession slack index crosses above 0.0, that has historically coincided with the end of a recession. It is interesting to note that the recession slack index has not been below 0.50 since 7/1/2009.

The 12/7/2012 median recession slack index value was 0.76. This value has declined over the past two months, reflecting a shrinking cushion relative to the recession threshold. This is consistent with the sharp (20%+) increase last month in the UNIT and Neural Network Peak-Trough probability model forecasts.

While it is useful to track the actual recession slack index values directly, it is much more instructive to use those values to construct probit and logit probability models.

Aggregate Recession Probability Estimate

I initially used the diffusion index and recent changes in the diffusion index as explanatory variables in probit and logit models to estimate the probability of being in a recession. The original UNIT recession model represented the average of the probit and logit model forecasts.

Given the new insights into the strength of the economy offered by the median recession slack index, I decided to create a probit and logit model based on the recession slack index and recent changes in the recession slack index.

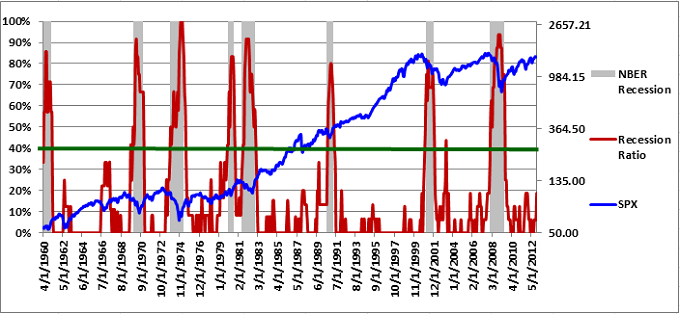

The new aggregate recession model is the average of four models: the original probit and logit models based on the diffusion index and the new probit and and logit models based on the recession slack index. The aggregate recession model estimates are depicted in Figure 3 below (red line - left vertical axis). The gray shaded regions represent NBER recessions and the blue line reflects the log value of the S&P 500 index (right vertical axis). I suggest using a warning threshold of between 30-40% for the aggregate recession model (green horizontal line).

The new aggregate recession model probability estimate for 12-7-2012 was 1.7%, which was up from 0.1% at the end of October.

Aggregate Peak-Trough Probability Estimate

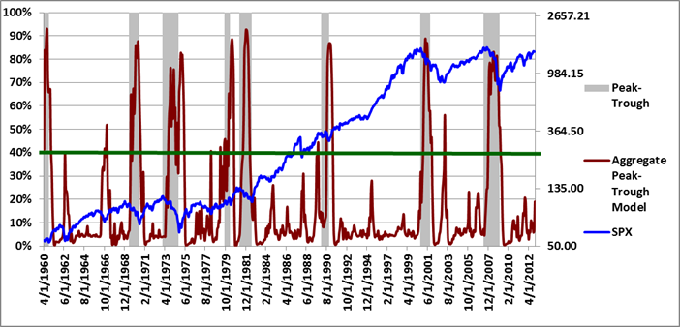

The peak-trough model forecast is different from the recession model. The peak-trough models estimate the probability of the S&P 500 being between the peak and trough associated with an NBER recession.

The initial peak-trough model represented the average of two different recession models: a probit and a logit model. I subsequently developed a neural network peak-trough model, which is the average of five different neural network models, each using a unique architecture and different independent variables (all based on the diffusion index).

As was the case with the recession model above, I created a probit and logit peak-trough probability model based on the recession slack index and recent changes in the recession slack index. The new aggregate peak-trough model equals the weighted-average of nine different models: the original probit and logit models based on the diffusion index, the new probit and logit models based on the recession slack index, and the five original neural network models.

The S&P 500 typically peaks before recessions begin and bottoms out before recessions end. As a result, it is more difficult for the peak-trough model to fit this data and the model forecasts have larger errors than the recession model. Nevertheless, the aggregate peak-trough model usually provides advance warning of impending recessions.

The aggregate peak-trough model estimates are depicted in Figure 4 below, which uses the same format as Figure 3, except that the shaded regions represent the periods between the peaks and troughs associated with NBER recessions. The new aggregate peak-trough model probability estimate for 12-7-2012 was 19.1%, which was up significantly from 7.0% at the end of October.

Conclusion

U.S. recession risk increased significantly in November, but the recession slack index was still above its 0.50 warning thresholds and the aggregate model forecasts were still well below their 30%-40% warning thresholds. As mentioned previously, the November data was affected by hurricane Sandy, which means the slowdown could be temporary. Fears of the fiscal cliff could also have influenced the data.

The new recession slack index offers unique insight into the strength of the economy and could identify recessionary risks that are not captured by the discrete diffusion index and its associated probability models. The aggregation of all of these models should provide a more robust framework for forecasting the business cycle. Going forward, I plan to only provide graphs and data for the aggregate models, rather than for each of the individual models - although I may comment on model disparities when applicable.

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future?

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2013 - Trading Insights, LLC - All Rights Reserved.

Pingback: February Recession Model Forecast a Surprise | Trader Edge

Pingback: March Recession Model Forecast Increases Slightly | Trader Edge

Pingback: Recession Models Indicate Risk Remained Low in April | Trader Edge

Pingback: Recession Risk Remained Low in May | Trader Edge

Pingback: Recession Risk Remained Low In June | Trader Edge

Pingback: Use Economic Filters to Reduce Your Strategy Losses | Trader Edge

Pingback: Recession Risk Still Low in July | Trader Edge

Pingback: Recession Model Forecast 09-01-2013 | Trader Edge

Pingback: Recession Model Forecast 10-01-2013 | Trader Edge

Pingback: Recession Model Forecast 11-01-2013 | Trader Edge

Pingback: Recession Model Forecast 12-01-2013 | Trader Edge

Pingback: Recession Model Forecast 01-01-2014 | Trader Edge

Pingback: Recession Model Forecast 02-01-2014 | Trader Edge

Pingback: Recession Model Forecast 03-01-2014 | Trader Edge

Pingback: Recession Model Forecast 04-01-2014 | Trader Edge

Pingback: Recession Model Forecast 05-01-2014 | Trader Edge

Pingback: Recession Model Forecast 06-01-2014 | Trader Edge

Pingback: Recession Model Forecast 07-01-2014 | Trader Edge

Pingback: Recession Model Forecast 08-01-2014 | Trader Edge

Pingback: Recession Model Forecast 01-01-2015 | Trader Edge

Pingback: Recession Model Forecast 04-01-2015 | Trader Edge

Pingback: Recession Model Forecast 03-01-2015 | Trader Edge

Pingback: Recession Model Forecast 12-01-2014 | Trader Edge

Pingback: Recession Model Forecast 01-01-2014 | Trader Edge

Pingback: Recession Model Forecast 11-01-2013 | Trader Edge

Pingback: Recession Model Forecast 10-01-2013 | Trader Edge

Pingback: Recession Model Forecast 09-01-2013 | Trader Edge

Pingback: Recession Model Forecast: 06-01-2015 | Trader Edge

Pingback: Recession Model Forecast: 10-01-2015 | Trader Edge

Pingback: Recession Model Forecast: 11-01-2015 | Trader Edge

Pingback: Recession Model Forecast: 12-01-2015 | Trader Edge