The following article updates the diffusion indices, recession slack index, aggregate recession model, and aggregate peak-trough model through November 2019. The current 26-variable model has a diverse set of explanatory variables and is quite robust. Each of the explanatory variables has predictive power individually; when combined, the group of indicators is able to identify early recession warnings from a wide range of diverse market-based, fundamental, technical, and economic sources.

Several of the explanatory variables are market-based. These variables are available in real-time (no lag), which means they respond very quickly to changing market conditions. In addition, they are never revised. This makes the Trader Edge recession model more responsive than many recession models. The current and historical data in this report reflect the current model configuration with all 26 variables.

Diffusion Index

The Trader Edge diffusion index equals the percentage of independent variables indicating a recession. With the latest changes, there are now a total of 26 explanatory variables, each with a unique look-back period and recession threshold. The resulting diffusion index and changes in the diffusion index are used to calculate the probit, logit, and neural network model forecasts.

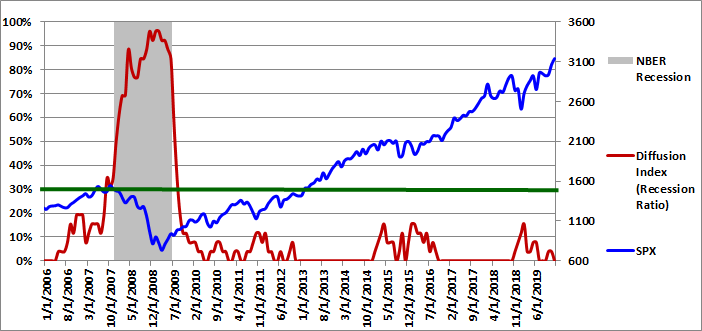

The graph of the diffusion index from 1/1/2006 to 12/1/2019 is presented in Figure 1 below (in red - left axis). The gray shaded regions in Figure 1 below represent U.S. recessions as defined (after the fact) by the National Bureau of Economic Research (NBER). The value of the S&P 500 index is also included (in blue - right axis).

The U.S. economy flirted with entering a recession in early 2016, which was reflected in the deteriorating economic, fundamental, and especially market-based data. The diffusion index, slack index, and recession probability forecasts all captured the weakening conditions. However, the weakness proved to be temporary and the conditions and recession model forecasts improved rapidly.

However, preliminary signs of weakness reemerged in late 2018 and conditions deteriorated rapidly in December and January before rebounding in February through April and stabilizing thereafter. Upon detailed examination of the individual economic data series, it is clear that the Government shutdown temporarily affected the economic data. The most recent economic data is no longer affected, but the shutdown was recently affecting the look-back data and the resulting trends, which is why I smoothed the data for every explanatory variable. Smoothing the look-back data mitigates the impact of all such data outliers now and in the future. The number of explanatory variables indicating a recession dropped from one (3.8%) to zero (0.0%) in November.

Please note that past estimates and index values will change whenever the historical data is revised. All current and past forecasts and index calculations are based on the latest revised data from the current data set.

Figure 1: Diffusion Index 12-01-2019

0.5-Sigma Diffusion Index

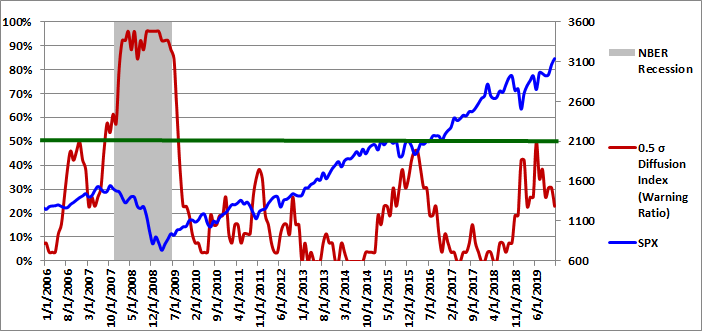

The Trader Edge 0.5-sigma diffusion Index equals the percentage of explanatory variables with Z-scores that are less than 0.5 standard deviations above their respective recession thresholds. This new diffusion index is much more sensitive than the standard (zero-sigma) diffusion index. As a result, it provides much more detail on the health of the U.S. economy. The new diffusion index is not currently being used in any of the regression models.

The graph of the 0.5-sigma diffusion index from 1/1/2006 to 12/1/2019 is presented in Figure 2 below (in red - left axis). The gray shaded regions in Figure 2 below represent U.S. recessions as defined (after the fact) by the National Bureau of Economic Research (NBER). The value of the S&P 500 index is also included (in blue - right axis).

The percentage of explanatory variables with Z-scores below the 0.5-sigma early warning threshold dropped from 30.8% to 23.1% in November. The additional level of detail provided by this (more continuous and responsive) metric will be invaluable going forward, especially given the infrequent and more discrete movements of the standard (zero-sigma) diffusion index.

For example, the percentage of variables below their respective 0.5 sigma thresholds seems unusually high, especially with the standard diffusion index equal to zero. To test this hypothesis, I used the entire history to calculate the average 0.5-sigma diffusion index percentage when the zero-sigma diffusion index was zero. The resulting average was only 8.1% - compared to 23.1% at the end of November. In other words, the percentage of explanatory variables that are within 0.5 sigma of their respective recession thresholds is almost three times the historical average. As I alluded to before, this implies that the the recession probability forecasts derived from the zero-sigma diffusion index are understated; however, the downward trend is favorable. This is an area of promising future research.

When combined with the recession slack indices, the new diffusion index will provide even greater insight into rapidly changing conditions.

Figure 2: 0.5 Sigma Diffusion Index 12-01-2019

Recession Slack Index

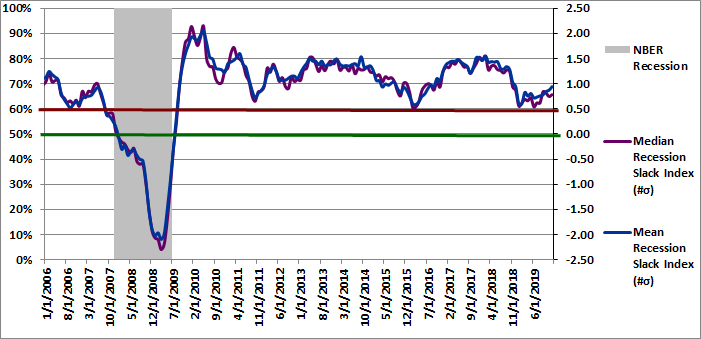

The Trader Edge recession slack index equals the median standardized deviation of the current value of the explanatory variables from their respective recession thresholds. The resulting value signifies the amount of slack or cushion relative to the recession threshold, expressed in terms of the number of standard deviations. Higher slack values signify larger cushions above recessionary threshold levels. While the median recession slack index is used in the recession models, I am now including the mean recession slack index in the graph as well.

The gray shaded regions in Figure 3 below represent U.S. recessions as defined (after the fact) by the NBER. The median recession slack index is depicted in purple and is plotted against the right axis, which is expressed as the number of standard deviations above the recession threshold. The mean recession slack index is depicted in blue and is also plotted against the right axis.

The dark-red, horizontal line at 0.50 standard deviations denotes a possible warning threshold for the recession slack index. Many of the past recessions began when the recession slack index crossed below 0.50. Similarly, many of the past recessions ended when the recession slack index crossed back above 0.0.

In early-2014, the revised median recession slack index peaked at 1.48, far above the warning level of 0.50. The recession slack index declined significantly in 2015 and reached a low of 0.53 in February 2016, before rebounding over the next few months. For most of 2017 and 2018, the median recession slack index was quite strong, but declined sharply in the fall. In early 2019, the median recession slack index dropped to a low of 0.54, but that was partially due to the temporary and artificial effects of the Government shutdown.

In November 2019, the median recession slack index increased from 0.75 to 0.78. The mean recession slack index increased from 0.87 to 0.94. As I mentioned above, the mean and median slack indices remain relatively close to the 0.5-sigma early warning threshold. This is consistent with the fact that a surprising 23.1% of the explanatory variables are below the 0.5-sigma threshold.

Similar to the situation with the 0.5-sigma diffusion index, the median slack index seems unusually low, especially with the standard diffusion index equal to zero. To test this hypothesis, I used the entire history to calculate the average median slack index when the zero-sigma diffusion index was zero. The resulting average was 1.40 standard deviations above the recession threshold - compared to a median slack index of only 0.78 standard deviations at the end of November. In other words, median slack index is only 0.28 above the early warning threshold - compared to a typical spread of 0.90 standard derivations. As a result, the cushion above the 0.5-sigma early warning threshold is a fraction of its typical value when the diffusion index equals zero. This provides additional evidence that the recession probability forecasts derived from the zero-sigma diffusion index are understated.

Note, all of these values reflect the new smoothed look-back data. It is important to recognize that median is more reliable than the mean, because it is not affected by extreme values. On a positive note, the trend in the recession slack indices is favorable.

Figure 3: Recession Slack Index 12-01-2019

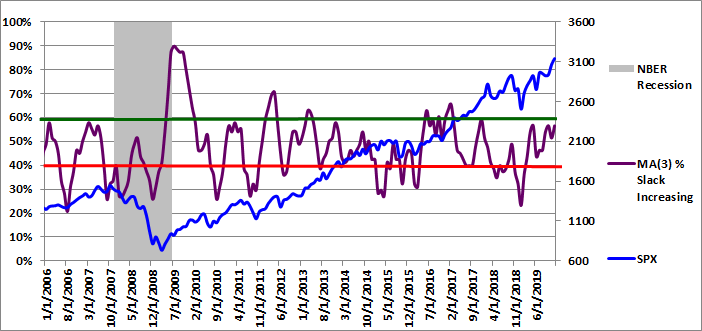

To gain further insight into the slack index, I provide the three-month moving average of the percentage of variables with increasing slack in Figure 4, but I personally monitor the monthly percentages as well.

Slack is a standardized value, so it is directly comparable across all variables. More slack indicates a larger cushion relative to a recessionary environment. As a result, we would like to see as many variables as possible with increasing slack. Given the diverse nature of the explanatory variables, it is unusual to see more than 60% of the variables with increasing slack or fewer than 40% of the variables with increasing slack. These extreme values are significant and predictive of the near-term direction of economic growth and often the equity market.

The 3-month moving average of the percentage of variables with increasing slack increased from 51.3% to 56.4% in November. New evidence of economic weakness (or strength) often shows up first in this timely metric.

Figure 4: MA(3) % Slack Increasing 12-01-2019

The ability to track small variations and trend changes over time illustrates the advantage of monitoring the continuous recession slack index. The new slack variable will provide additional insight into the near-term direction of the economy and should be used in conjunction with the median recession slack index.

While it is useful to track the actual recession slack index values and percentage of variables with increasing slack, the diffusion percentages and slack index values are also used to generate the more intuitive probit and logit probability forecasts.

Aggregate Recession Probability Estimate

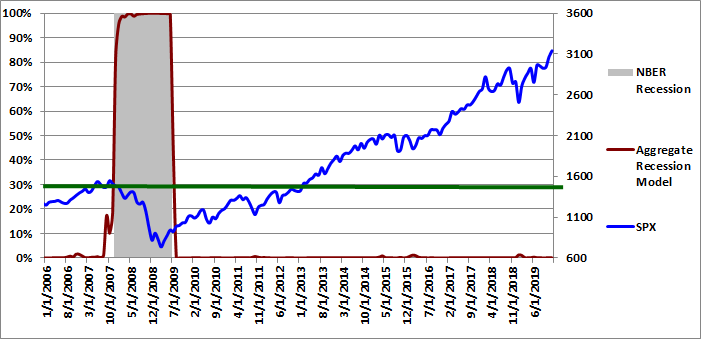

The Trader Edge aggregate recession model is the average of four models: the probit and logit models based on the diffusion index and the probit and logit models based on the recession slack index. The aggregate recession model estimates from 1/1/2006 to 12/01/2019 are depicted in Figure 5 below (red line - left vertical axis). The gray shaded regions represent NBER recessions and the blue line reflects the value of the S&P 500 index (right vertical axis). I suggest using a warning threshold of between 20-30% for the aggregate recession model (green horizontal line).

The aggregate recession model probability estimate remained decreased from 0.1% to 0.0% in November. According to the model, the probability that the U.S. is currently in a recession is extremely remote.

Figure 5: Aggregate Recession Model 12-01-2019

Aggregate Peak-Trough Probability Estimate

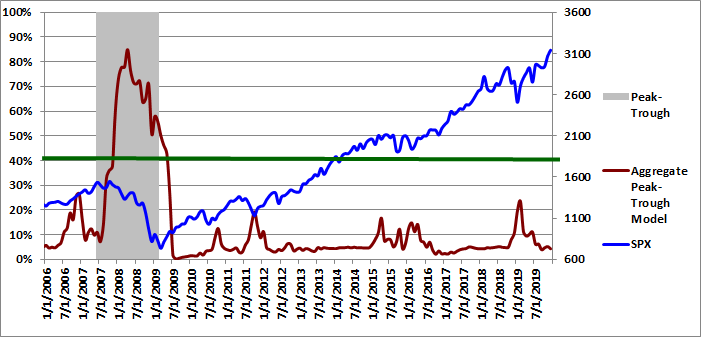

The peak-trough model forecasts are different from the recession model and are much more responsive. The peak-trough models estimate the probability of the S&P 500 being between the peak and trough associated with an NBER recession. The S&P 500 typically peaks before recessions begin and bottoms out before recessions end. As a result, it is far more difficult for the peak-trough model to fit this data and the model forecasts have larger errors than the recession model.

The Trader Edge aggregate peak-trough model equals the weighted-average of nine different models: the probit and logit models based on the diffusion index, the probit and logit models based on the recession slack index, and five neural network models.

The aggregate peak-trough model estimates from 1/1/2006 to 12/01/2019 are depicted in Figure 6 below, which uses the same format as Figure 6, except that the shaded regions represent the periods between the peaks and troughs associated with NBER recessions.

The aggregate peak-trough model probability estimate for 12/01/2019 was 4.3%, which decreased slightly from last month's revised value of 5.2%.

Figure 6: Aggregate Peak-Trough Model 12-01-2019

Conclusion

January and February 2016 marked a potential tipping point in U.S. recession risk, but those conditions proved to be temporary. Conditions improved significantly since early 2016, but deteriorated due to the Government shutdown before rebounding in the last few months. The recession risk appeared to increase in January of 2019, but this was largely due to the effects of the Government shutdown.

U.S. recession risk improved slightly in November. The diffusion index decreased from one (3.8%) to zero (0.0%) and the new 0.5-sigma diffusion index declined from 30.8% to 23.1%. The mean and median recession slack indices both increased slightly. Both slack indices remain marginally above the early warning threshold. The moving average of explanatory variables with increasing slack increased from 51.3% to 56.4% in November. The aggregate recession probability dropped from 0.1% to 0.0%. The peak-trough recession probability decreased from 5.2% to 4.3%.

Even with the relatively low recession model probabilities, the limited protection offered by the levels of the recession slack indices continues to be a concern, especially with the weak global economy and ongoing trade war.

Based on the most recent data, the equity allocation percentage regression model indicates that the expected annual price return of the S&P 500 index for the next 10 years is still negative (-0.1%), with an expected drawdown in that period of 35% (from 12/1/2019 levels). Expected price returns are still extremely low in a historical context, especially given the near-term market, economic, and geopolitical risks.

The "Buffett Indicator" regression model currently indicates that the expected annual price return of the S&P 500 index for the next 10 years is materially negative (-5.3%), with an expected drawdown in that 10-year period of 56% (from 12/1/2019 levels).

Overvalued markets can always become more overvalued - especially in the near-term. That said, history offers compelling evidence that bullish equity positions today will face significant headwinds over the coming years.

Unlike human prognosticators, the Trader Edge recession model is completely objective and has no ego. It is not burdened by the emotional need to defend past erroneous forecasts and will always consistently apply the insights gained from new data.

Brian Johnson

Copyright 2019 Trading Insights, LLC. All rights reserved.

Option Strategy Risk Management: An In-Depth Article Introducing an Interactive Analytical Framework for Hedging Option Strategy Risk

Option Income Strategy Trade Filters: An In-Depth Article Demonstrating the Use of Trade Filters to Enhance Returns and Reduce Risk

Exploiting Earnings Volatility: An Innovative New Approach to Evaluating, Optimizing, and Trading Option Strategies to Profit from Earnings Announcements.

Option Strategy Risk / Return Ratios: A Revolutionary New Approach to Optimizing, Adjusting, and Trading Any Option Income Strategy

Recession Model Forecast: 12-01-2019

The following article updates the diffusion indices, recession slack index, aggregate recession model, and aggregate peak-trough model through November 2019. The current 26-variable model has a diverse set of explanatory variables and is quite robust. Each of the explanatory variables has predictive power individually; when combined, the group of indicators is able to identify early recession warnings from a wide range of diverse market-based, fundamental, technical, and economic sources.

Several of the explanatory variables are market-based. These variables are available in real-time (no lag), which means they respond very quickly to changing market conditions. In addition, they are never revised. This makes the Trader Edge recession model more responsive than many recession models. The current and historical data in this report reflect the current model configuration with all 26 variables.

Diffusion Index

The Trader Edge diffusion index equals the percentage of independent variables indicating a recession. With the latest changes, there are now a total of 26 explanatory variables, each with a unique look-back period and recession threshold. The resulting diffusion index and changes in the diffusion index are used to calculate the probit, logit, and neural network model forecasts.

The graph of the diffusion index from 1/1/2006 to 12/1/2019 is presented in Figure 1 below (in red - left axis). The gray shaded regions in Figure 1 below represent U.S. recessions as defined (after the fact) by the National Bureau of Economic Research (NBER). The value of the S&P 500 index is also included (in blue - right axis).

The U.S. economy flirted with entering a recession in early 2016, which was reflected in the deteriorating economic, fundamental, and especially market-based data. The diffusion index, slack index, and recession probability forecasts all captured the weakening conditions. However, the weakness proved to be temporary and the conditions and recession model forecasts improved rapidly.

However, preliminary signs of weakness reemerged in late 2018 and conditions deteriorated rapidly in December and January before rebounding in February through April and stabilizing thereafter. Upon detailed examination of the individual economic data series, it is clear that the Government shutdown temporarily affected the economic data. The most recent economic data is no longer affected, but the shutdown was recently affecting the look-back data and the resulting trends, which is why I smoothed the data for every explanatory variable. Smoothing the look-back data mitigates the impact of all such data outliers now and in the future. The number of explanatory variables indicating a recession dropped from one (3.8%) to zero (0.0%) in November.

Please note that past estimates and index values will change whenever the historical data is revised. All current and past forecasts and index calculations are based on the latest revised data from the current data set.

Figure 1: Diffusion Index 12-01-2019

0.5-Sigma Diffusion Index

The Trader Edge 0.5-sigma diffusion Index equals the percentage of explanatory variables with Z-scores that are less than 0.5 standard deviations above their respective recession thresholds. This new diffusion index is much more sensitive than the standard (zero-sigma) diffusion index. As a result, it provides much more detail on the health of the U.S. economy. The new diffusion index is not currently being used in any of the regression models.

The graph of the 0.5-sigma diffusion index from 1/1/2006 to 12/1/2019 is presented in Figure 2 below (in red - left axis). The gray shaded regions in Figure 2 below represent U.S. recessions as defined (after the fact) by the National Bureau of Economic Research (NBER). The value of the S&P 500 index is also included (in blue - right axis).

The percentage of explanatory variables with Z-scores below the 0.5-sigma early warning threshold dropped from 30.8% to 23.1% in November. The additional level of detail provided by this (more continuous and responsive) metric will be invaluable going forward, especially given the infrequent and more discrete movements of the standard (zero-sigma) diffusion index.

For example, the percentage of variables below their respective 0.5 sigma thresholds seems unusually high, especially with the standard diffusion index equal to zero. To test this hypothesis, I used the entire history to calculate the average 0.5-sigma diffusion index percentage when the zero-sigma diffusion index was zero. The resulting average was only 8.1% - compared to 23.1% at the end of November. In other words, the percentage of explanatory variables that are within 0.5 sigma of their respective recession thresholds is almost three times the historical average. As I alluded to before, this implies that the the recession probability forecasts derived from the zero-sigma diffusion index are understated; however, the downward trend is favorable. This is an area of promising future research.

When combined with the recession slack indices, the new diffusion index will provide even greater insight into rapidly changing conditions.

Figure 2: 0.5 Sigma Diffusion Index 12-01-2019

Recession Slack Index

The Trader Edge recession slack index equals the median standardized deviation of the current value of the explanatory variables from their respective recession thresholds. The resulting value signifies the amount of slack or cushion relative to the recession threshold, expressed in terms of the number of standard deviations. Higher slack values signify larger cushions above recessionary threshold levels. While the median recession slack index is used in the recession models, I am now including the mean recession slack index in the graph as well.

The gray shaded regions in Figure 3 below represent U.S. recessions as defined (after the fact) by the NBER. The median recession slack index is depicted in purple and is plotted against the right axis, which is expressed as the number of standard deviations above the recession threshold. The mean recession slack index is depicted in blue and is also plotted against the right axis.

The dark-red, horizontal line at 0.50 standard deviations denotes a possible warning threshold for the recession slack index. Many of the past recessions began when the recession slack index crossed below 0.50. Similarly, many of the past recessions ended when the recession slack index crossed back above 0.0.

In early-2014, the revised median recession slack index peaked at 1.48, far above the warning level of 0.50. The recession slack index declined significantly in 2015 and reached a low of 0.53 in February 2016, before rebounding over the next few months. For most of 2017 and 2018, the median recession slack index was quite strong, but declined sharply in the fall. In early 2019, the median recession slack index dropped to a low of 0.54, but that was partially due to the temporary and artificial effects of the Government shutdown.

In November 2019, the median recession slack index increased from 0.75 to 0.78. The mean recession slack index increased from 0.87 to 0.94. As I mentioned above, the mean and median slack indices remain relatively close to the 0.5-sigma early warning threshold. This is consistent with the fact that a surprising 23.1% of the explanatory variables are below the 0.5-sigma threshold.

Similar to the situation with the 0.5-sigma diffusion index, the median slack index seems unusually low, especially with the standard diffusion index equal to zero. To test this hypothesis, I used the entire history to calculate the average median slack index when the zero-sigma diffusion index was zero. The resulting average was 1.40 standard deviations above the recession threshold - compared to a median slack index of only 0.78 standard deviations at the end of November. In other words, median slack index is only 0.28 above the early warning threshold - compared to a typical spread of 0.90 standard derivations. As a result, the cushion above the 0.5-sigma early warning threshold is a fraction of its typical value when the diffusion index equals zero. This provides additional evidence that the recession probability forecasts derived from the zero-sigma diffusion index are understated.

Note, all of these values reflect the new smoothed look-back data. It is important to recognize that median is more reliable than the mean, because it is not affected by extreme values. On a positive note, the trend in the recession slack indices is favorable.

Figure 3: Recession Slack Index 12-01-2019

To gain further insight into the slack index, I provide the three-month moving average of the percentage of variables with increasing slack in Figure 4, but I personally monitor the monthly percentages as well.

Slack is a standardized value, so it is directly comparable across all variables. More slack indicates a larger cushion relative to a recessionary environment. As a result, we would like to see as many variables as possible with increasing slack. Given the diverse nature of the explanatory variables, it is unusual to see more than 60% of the variables with increasing slack or fewer than 40% of the variables with increasing slack. These extreme values are significant and predictive of the near-term direction of economic growth and often the equity market.

The 3-month moving average of the percentage of variables with increasing slack increased from 51.3% to 56.4% in November. New evidence of economic weakness (or strength) often shows up first in this timely metric.

Figure 4: MA(3) % Slack Increasing 12-01-2019

The ability to track small variations and trend changes over time illustrates the advantage of monitoring the continuous recession slack index. The new slack variable will provide additional insight into the near-term direction of the economy and should be used in conjunction with the median recession slack index.

While it is useful to track the actual recession slack index values and percentage of variables with increasing slack, the diffusion percentages and slack index values are also used to generate the more intuitive probit and logit probability forecasts.

Aggregate Recession Probability Estimate

The Trader Edge aggregate recession model is the average of four models: the probit and logit models based on the diffusion index and the probit and logit models based on the recession slack index. The aggregate recession model estimates from 1/1/2006 to 12/01/2019 are depicted in Figure 5 below (red line - left vertical axis). The gray shaded regions represent NBER recessions and the blue line reflects the value of the S&P 500 index (right vertical axis). I suggest using a warning threshold of between 20-30% for the aggregate recession model (green horizontal line).

The aggregate recession model probability estimate remained decreased from 0.1% to 0.0% in November. According to the model, the probability that the U.S. is currently in a recession is extremely remote.

Figure 5: Aggregate Recession Model 12-01-2019

Aggregate Peak-Trough Probability Estimate

The peak-trough model forecasts are different from the recession model and are much more responsive. The peak-trough models estimate the probability of the S&P 500 being between the peak and trough associated with an NBER recession. The S&P 500 typically peaks before recessions begin and bottoms out before recessions end. As a result, it is far more difficult for the peak-trough model to fit this data and the model forecasts have larger errors than the recession model.

The Trader Edge aggregate peak-trough model equals the weighted-average of nine different models: the probit and logit models based on the diffusion index, the probit and logit models based on the recession slack index, and five neural network models.

The aggregate peak-trough model estimates from 1/1/2006 to 12/01/2019 are depicted in Figure 6 below, which uses the same format as Figure 6, except that the shaded regions represent the periods between the peaks and troughs associated with NBER recessions.

The aggregate peak-trough model probability estimate for 12/01/2019 was 4.3%, which decreased slightly from last month's revised value of 5.2%.

Figure 6: Aggregate Peak-Trough Model 12-01-2019

Conclusion

January and February 2016 marked a potential tipping point in U.S. recession risk, but those conditions proved to be temporary. Conditions improved significantly since early 2016, but deteriorated due to the Government shutdown before rebounding in the last few months. The recession risk appeared to increase in January of 2019, but this was largely due to the effects of the Government shutdown.

U.S. recession risk improved slightly in November. The diffusion index decreased from one (3.8%) to zero (0.0%) and the new 0.5-sigma diffusion index declined from 30.8% to 23.1%. The mean and median recession slack indices both increased slightly. Both slack indices remain marginally above the early warning threshold. The moving average of explanatory variables with increasing slack increased from 51.3% to 56.4% in November. The aggregate recession probability dropped from 0.1% to 0.0%. The peak-trough recession probability decreased from 5.2% to 4.3%.

Even with the relatively low recession model probabilities, the limited protection offered by the levels of the recession slack indices continues to be a concern, especially with the weak global economy and ongoing trade war.

Based on the most recent data, the equity allocation percentage regression model indicates that the expected annual price return of the S&P 500 index for the next 10 years is still negative (-0.1%), with an expected drawdown in that period of 35% (from 12/1/2019 levels). Expected price returns are still extremely low in a historical context, especially given the near-term market, economic, and geopolitical risks.

The "Buffett Indicator" regression model currently indicates that the expected annual price return of the S&P 500 index for the next 10 years is materially negative (-5.3%), with an expected drawdown in that 10-year period of 56% (from 12/1/2019 levels).

Overvalued markets can always become more overvalued - especially in the near-term. That said, history offers compelling evidence that bullish equity positions today will face significant headwinds over the coming years.

Unlike human prognosticators, the Trader Edge recession model is completely objective and has no ego. It is not burdened by the emotional need to defend past erroneous forecasts and will always consistently apply the insights gained from new data.

Brian Johnson

Copyright 2019 Trading Insights, LLC. All rights reserved.

Option Strategy Risk Management: An In-Depth Article Introducing an Interactive Analytical Framework for Hedging Option Strategy Risk

Option Income Strategy Trade Filters: An In-Depth Article Demonstrating the Use of Trade Filters to Enhance Returns and Reduce Risk

Exploiting Earnings Volatility: An Innovative New Approach to Evaluating, Optimizing, and Trading Option Strategies to Profit from Earnings Announcements.

Option Strategy Risk / Return Ratios: A Revolutionary New Approach to Optimizing, Adjusting, and Trading Any Option Income Strategy

About Brian Johnson

I have been an investment professional for over 30 years. I worked as a fixed income portfolio manager, personally managing over $13 billion in assets for institutional clients. I was also the President of a financial consulting and software development firm, developing artificial intelligence based forecasting and risk management systems for institutional investment managers. I am now a full-time proprietary trader in options, futures, stocks, and ETFs using both algorithmic and discretionary trading strategies. In addition to my professional investment experience, I designed and taught courses in financial derivatives for both MBA and undergraduate business programs on a part-time basis for a number of years. I have also written four books on options and derivative strategies.