How would you like to know the current and historical positions of knowledgeable experts, with proven track records in almost every market - for free? Very few traders take advantage of this resource provided weekly by the Commodity Futures Trading Commission (CFTC): the commitment of traders (COT) report.

The CFTC is responsible for the oversight of all US futures markets. By law, all large futures traders must report their long and short positions, which the CFTC then summarizes by type of trader in the weekly COT report. These reports go back to the 1970s, providing a complete position history for all types of traders. All futures markets are included: equity indices, energy, metals, meats, grains, softs, Treasury bonds, and even currencies.

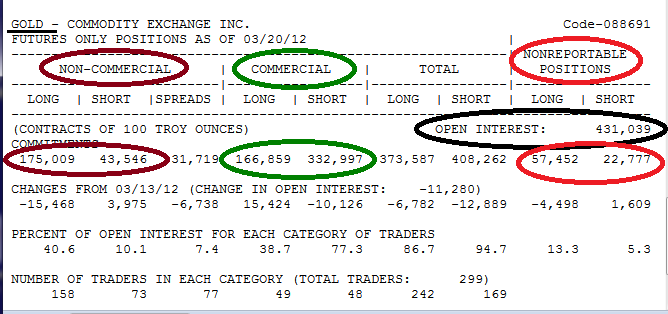

Recently, the CFTC increased the number of trader classifications in the COT report, but we will use the original groupings, which are still available in the legacy report format. These categories are commercial, non-commercial (large speculator), and non-reportable (small speculator).

The commercials actually use or produce the product in their business, hence the name commercial. They are experts in the field and they know more about the product than any other type of trader. They are the smart money and our goal is to trade with the commercials.

Non-commercials, which we will call large speculators are large professional traders who are required to report their positions to the CFTC. While these are large, professional, and successful traders, when their positions reach extreme levels, we will often be taking the opposite position - more on that later. Finally, the non-reportable category on the COT report represents small speculators, or the sheep being led to slaughter. We will always use the small speculator net position as a contrarian indicator.

COT Report

The COT report for Gold futures as of March 20, 2012 is depicted in Figure 1 below. The COT reports are typically released on Fridays, only three days after the Tuesday position dates. We are interested in the net positions for large commercials, large speculators, and small speculators. To find the net positions, simply subtract the short position from the long position in each of the the circled areas below. The positions represent the number of futures contracts. As you can see below, the large speculators and small speculators are net long in gold futures, while the commercials are net short.

The open interest (circled in black) represents the total number of futures contracts outstanding. The number of futures contracts is not constant. When the buyer and seller both originate new positions, the open interest increases. When the buyer and seller both close existing positions, the open interest decreases.

The COT report also shows the changes in each category from the previous week. The next row reports each position as a percentage of the open interest. Finally, the number of traders in each category is provided in the last row of the report.

I already stated that the commercials are the smart money. They are obviously net short, so should we sell gold? Unfortunately, it is not quite that simple. A snap-shot of the COT report is not very meaningful by itself. To gain true insight, we need to examine each group's current net position relative to history. However, before we proceed, we need to have a better understanding of how and why each group trades.

Commercials versus Speculators

As a rule, most speculators (large and small) are trend traders. They trade with the prevailing trend. Large speculators are more sophisticated and typically enter positions earlier in trends than small speculators. Later in the trend, small speculators finally wake up and jump in as well. By definition, when speculators initiate a trade, they are increasing their risk. When they close a position, they reduce their risk. Their profits and losses are not determined until they exit their trade or close their position.

Unlike speculators, commercials are value traders. In addition, when commercials establish a new position, they are reducing their risk and locking in their profits. How can this be? An example will help illustrate this point.

Assume that the commercial trader is a gold mining company. Their marginal cost to mine, ship, and deliver gold is $650 per ounce, which they know within a reasonable margin of error. In addition, based on the scope of their operation and past history, they know approximately how much gold they expect to produce each year. Their profits and the success of their entire business depends on the price of gold. As a result, over many years they have devoted enormous resources and become experts in the gold market.

They already own the gold in the ground. Sure, they need to dig it up, but they effectively have a huge long position in gold and have substantial market risk. The way to reduce that risk is by selling gold futures contracts. The price of gold is currently $1650 per ounce. If they sell or short one futures contract at $1650 per ounce, they would lock in a profit of $1000 per ounce ($1650 - $650). Each contract represents 100 ounces of gold, so they would lock in a marginal profit of $100,000 per contract sold ($1000 x 100).

After the trade, they would report a position of one short contract to the CFTC, but you can see that they actually reduced their risk (or hedged) by initiating the short position. What happens if the gold price continues to rise to $1750, $1850, $1950, and $2050? More speculators would initiate or add to their long positions as they follow the trend, increasing their risk.

What about our gold mining company? As the price of gold rises, they would sell more of their annual production at higher prices, locking in profits of $1100, $1200, $1300,and $1400 per ounce, all while reducing their exposure to the market.

The speculator who bought at $1650 would have an unrealized gain of $400 per ounce. Looking exclusively at the futures transaction, it would appear that the commercial trader lost $400 per ounce on the same trade. However, that would be incorrect. As demonstrated above, the gold miner actually would have locked in a profit of $1000 per ounce when initiating the sale at $1650 per ounce.

When would the trend end? When we run out of speculators. There is a limit to the amount of risk speculators can take and every new long position increases their risk. When the last small speculator finally entered the market at the end of the trend, there would be nobody left to buy. All of the speculators would be fully invested in gold at their maximum risk levels. What about our gold mining company? They are able to produce gold at $650 per ounce; they would certainly not want to buy more at $2050 per ounce.

Now it gets interesting. The commercials would be more than willing to continue selling at $2050 per ounce. The amount they can sell is only limited by the amount of gold they have in the ground. With nobody left to buy and the commercials still selling, prices would have to decline.

The small speculators who entered late would be quickly stopped out for losses. They would sell, forcing prices to drop further. Large and small speculators would both have huge long positions that they would now need to unload in an environment of rapidly declining prices, but there would be few buyers. It would be a stampede for the exits and the small speculators who entered late would get crushed in the new downtrend.

Strategy Implications

Now that we understand the process, how do we use this information? We are still speculators, but we want to trade with the commercials. However, commercials already have market exposure through their business; we do not. Commercials are executing hedging transactions and reducing risk; we are establishing new positions and increasing risk. As a result, we can only trade with the commercials (and against the speculators) when their positions reach extreme levels.

How do we determine the extremes? We look at the current net positions of the speculators and commercials relative to their "normal" historical positions. Large deviations from their historical normal or average positions and/or large changes in their net positions over time suggest possible extreme positions. However, identifying extreme position levels is only the first hurdle.

As demonstrated above, commercials will always begin selling before the downtrend begins and begin buying before the uptrend begins. If the trend continues, they would not lose money; they would have already locked in their gains. As speculators, if we enter enter early against the trend, we could be wiped out before the trend reverses. As a result, BOTH of the following two criteria must be met before we enter trades based on the COT data:

- The COT positions for speculators and commercials must have recently reached extreme levels, AND

- There must be evidence of a reversal in the price trend

Figure 2 below is a weekly gold chart (continuous Gold futures contract) from November 2009 to March 2012. The top panel is a weekly candlestick price chart for gold. The second panel shows the raw COT net-position data for commercials (green), small speculators (bright red), large speculators (orange) and total speculators (dark red). The zero line is marked in yellow.

Finally, the blue line in the bottom panel is my custom COT oscillator for gold. It combines position data for small speculators, large speculators, and commercials into a single oscillator that can be used for all futures contracts. The indicator evaluates the current position levels relative to historical levels as well as incorporating recent changes in position levels. The results are then standardized, which means that the indicator values can be used to rank all futures contracts from most bullish to most bearish.

When the indicator is positive, that means that commercials are net long and speculators are net short (relative to their norms). When the indicator is negative, commercials are net short and speculators are net long (again, relative to their normal values). The horizontal yellow line is the zero line.

When the blue line crosses above the green horizontal line, the conditions are extreme and our bias is bullish. Below the red line, the conditions are extreme and our bias is bearish. Again, we never initiate a position until the extreme conditions are confirmed by a corresponding change in the price trend. For illustration purposes, I have included a short-term moving average of the closing price in the top panel. One possible confirmation technique is to wait for the price to close above (bullish) or below (bearish) the moving average. Note: you do not need to wait for the COT indicator or raw COT position data to reverse direction, only the price.

Gold has been trending higher for years. This is well known throughout the industry. If you had wanted to establish a new long position in gold or add to your existing position, the COT data would have been very useful for identifying low risk entry points. Notice that at points A, C, and E above, the custom COT indicator reached the green extreme line AND then the price closed above the moving average within the next week or two, confirming the entry signal. In every case, the bullish trend continued for many weeks.

As I have explained in other posts, I do not normally suggest trading futures against the trend. However, the custom COT indicator could be used to signal entry points for selling out-of-the-money (OTM) credit spreads (discussed in an upcoming post) against the trend. In the case of gold, this would mean executing out-of-the-money bear call spreads after bearish signals. Using OTM credit spreads means that you make money even if the trend does not reverse and prices just consolidate.

The red vertical lines above mark the week that the custom COT indicator reached a negative extreme, indicating a bearish bias. However, these lines are not trade signals. Remember, the signal is not generated until the trade is confirmed by a price reversal - in this case, a close below the moving average. Using the appropriate entry trigger and reasonable trade management, most of these trades would have been profitable as well, even against the trend. Even at point D, the market consolidated for several months after the entry signal (which occurred several weeks after the indicator reached the extreme level). An OTM credit spread would probably have made money during the consolidation.

As always, use stops to limit your losses. In addition, you might consider using a trailing stop to lock in your profits as the price moves in your direction. Finally, be aware that the COT data will not identify every price reversal.

As you can see in Figure 2 above, it is much easier to use a standardized COT oscillator than the raw COT data. It is difficult to determine by looking at the raw data exactly which values are extreme and how extreme they are relative to past data. However, the real value in using a standardized oscillator is the ability to scan all futures markets for the most extreme position data.

Extreme COT Data - Current Futures Markets

I use a weekly COT indicator scan to identify the most extreme bullish and bearish positions in an intermediate time frame. As of last Friday, the most extreme contract with a bullish bias was the Japanese Yen (see figure 3 below). The chart format is the same as in figure 2 with price, raw COT data, and the custom COT oscillator in the three panes from top to bottom.

You can see that the custom COT oscillator reached an extreme level several weeks ago (Point A) and has increased to a current level of 1.2 (versus the extreme threshold of 0.4). The levels are so extreme that they are even obvious by looking at the raw COT data. However, note that there has not been a buy signal in the Yen. The extreme COT position has not yet been confirmed by price.

While prices did rise last week, they are still below the moving average. You may use any type of price trend confirmation that you choose, but always wait for the price confirmation before entering these kinds of trades. Remember, the commercials are always early.

As of last Friday, the most extreme contract with a bearish bias was Soybeans (see the weekly Soybean chart in Figure 4 below). Three weeks ago (Point A below), the custom COT oscillator reached the bearish extreme level. Since then, the COT oscillator has continued to decline, becoming even more extreme.

Conversely, prices have continued to rise, although they did decrease slightly last week. Again, there has been no official bearish signal and there may not be one for weeks or possibly even months. The bearish signal is not confirmed until the price trend reverses.

When evaluating new prospective trades, it is frequently useful to see how prices behaved around previous extreme COT levels. The previous bullish and bearish extreme COT levels for Soybeans are depicted in Figure 4 above by the red and green vertical lines. Again, it took a few weeks for the price trend to reverse, but both signals generated profitable trades. Unfortunately, I missed the above bearish trade, but I did participate in the recent bullish move in Soybeans.

Running a scan on the weekly COT oscillator will help identify the most extreme future markets, leading to higher probability prospective trades with significant upside potential over an intermediate term investment horizon.

Last Friday, I also conduced a similar scan using a monthly chart and monthly COT oscillator. By definition, the monthly screen will identify longer-term extreme conditions than the weekly COT screen. There were no notable bearish candidates, but there was one bullish candidate. When evaluating the monthly COT oscillator values, it is important to remember that it is more difficult to reach monthly extremes than weekly extremes.

The futures contract with the most extreme monthly COT oscillator value with a bullish bias was the Swiss Franc (see Figure 5 below). The custom COT oscillator reached the extreme threshold several months ago (Point A below) and has continued to rise as speculators have continued to sell and commercials have continued to buy.

Surprisingly, the price of the Swiss Franc (continuous contract) turned higher the next month, confirming the buy signal. The last two bullish extremes are depicted by green vertical lines. Both occurred within one month of a significant interim low in the Swiss Franc.

COT Data on the Equity Indices

Can this approach be used to trade the equity markets? Absolutely, but there is a little problem. There are multiple futures contracts on the major equity indices. For example, the main futures contract on the S&P 500 index has a multiplier of 250. The e-mini contact on the S&P 500 has a multiplier of 50. Both contracts have very large open interest and neither can be ignored. The COT data is calculated separately for both contracts. Since we are interested in the total position for commercials and speculators, we need to combine the COT data for both contracts, but we need to use their respective multipliers when calculating the aggregate COT positions.

To make matters worse, commercials could use any or all of the equity indices for hedging purposes. In other words, they could have positions in the Russell 2000, NASDAQ 100, S&P 500, and/or the DJIA futures contracts. To understand their true equity exposure, we would need to combine the COT data for all of the equity indices on a weighted basis. This is certainly possible, but you can see why I did not use the equity indices in my examples.

Conclusion

The COT data offers insights far beyond technical indicators based on price and volume. It is almost like trading with inside information - legally. There are several key points to remember:

- Commercials are typically early

- Trade with the commercials, but only at the extremes

- The extremes are relative to the "normal" position levels for each group of traders

- Always wait for the extreme level to be confirmed by a price reversal before entering the trade

- Always use stops to control your losses

If you would like to learn more about interpreting the COT data, you might be interested in the book: "Trading Stocks & Commodities with the Insiders - Secrets of the COT Report" by Larry Williams. The book explains the COT data in great detail and includes numerous chart examples for many different futures contracts. Larry Williams is one of the most experienced traders and respected market technicians in the industry. He also discusses a number of his own proprietary indicators in the book.

As always, the examples presented here are for educational purposes only and are not investment recommendations. Please read the Disclaimer & Termssection of this site in its entirety

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future?

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social network.

The "Share / Save" button below contains links to all major social networks. If you do not see your social network listed, use the down-arrow to access the entire list of social networking sites.

Thank you for your support.

Brian Johnson

Copyright 2012 - Trading Insights, LLC - All Rights Reserved.

.

Pingback: Look at the Big Picture | Trader Edge

Pingback: Everybody Loves Fridays | Trader Edge

Pingback: Use Sector Confirmation to Improve Your Trading Results | Trader Edge

Pingback: Follow the Corporate Insiders | Trader Edge

Pingback: Williams's POIV Indicator Identifies Reversal Prospects | Trader Edge

Pingback: Use Relative Strength to Identify Market Trends | Trader Edge

Pingback: How to Draw Trendlines & Avoid Severe Losses | Trader Edge

Hi,

How did you put COT report to Amibroker?

Best wishes,

Tomasz

Tomasz,

I download the complete historical COT data files from CSI, my data vendor. I run a macro in Excel to pre-process the COT data and export the processed data to new CSV files. I then import the new CSV files into Amibroker. Finally, I use a proprietary COT indicator to manipulate the COT data for use in my strategies.

Regards,

Brian Johnson

Thank’s Brian ;]

Tomasz

Pingback: A Dual Purpose Trend Indicator | Trader Edge