I introduced the topic of recession forecasting in late October and have since developed several recession forecasting tools that I created by applying probit, logit, and neural network models to a diffusion index of economic and market-related variables. If you are new to Trader Edge and would like some additional background on these models, I encourage you to read the previous recession model articles in chronological order.

- Forecasting Recessions is Easier than Modeling Asset Prices

- New Probit Models: U.S. Recession Risk is Currently Low

- Recession Models and the Fiscal Cliff

- Recession Model Improvements

The probability that we are currently in a recession increased from 0.2% last month to 3.4% based on the November data. The probability that the S&P 500 is between its peak and trough associated with an NBER recession increased from 6.4% last month to 23.6% according to the UNIT model and from 5.1% last month to 27.4% according to the neural network model.

Diffusion Index

The diffusion index represents the percentage of independent variables indicating a recession. There are a total of 16 explanatory variables, each with a unique look-back period and recession threshold. The graph of the diffusion index is presented in Figure 1 below. Currently three out of 16 variables indicate a recession, resulting in a diffusion index value of 18.8%. This ties the highest diffusion index reading since July 2009. Unfortunately, the diffusion index alone does not directly forecast the probability of a recession.

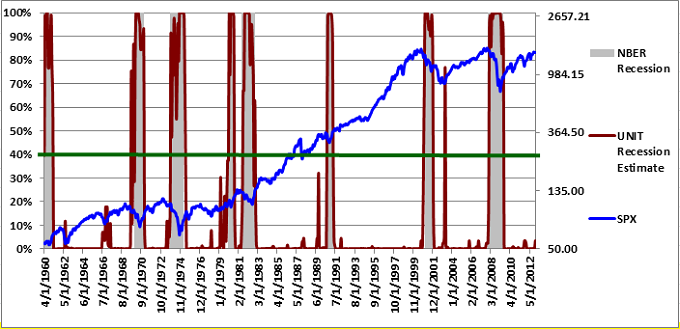

UNIT Recession Model

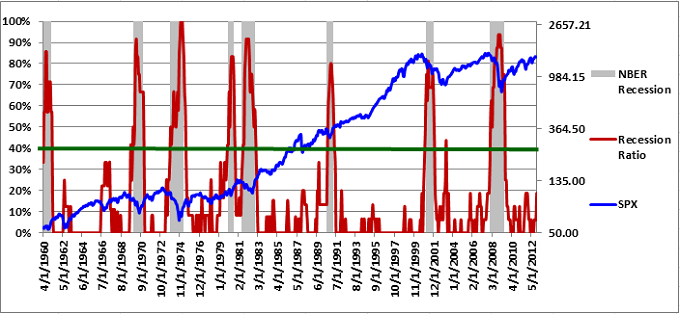

The UNIT recession model represents the average of two different recession models: a probit and a logit model. The probit and logit models use the diffusion index and recent changes in the diffusion index to estimate the probability of currently being in a recession.

The UNIT recession model estimates are depicted in Figure 2 below (red line - left vertical axis). The gray shaded regions represent NBER recessions and the blue line represents the log value of the S&P 500 index (right vertical axis). When the recession probability estimates exceed the 40% (horizontal green line), the U.S. is almost certainly in a recession. Lower recession warning thresholds (e.g. 30%) could also be used, but would result in more false positives.

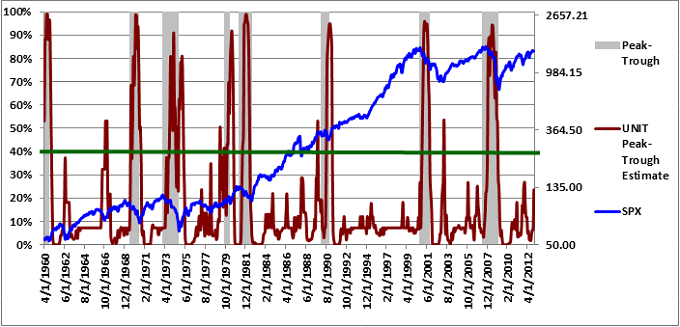

UNIT Peak-Trough Model

As was the case above, the UNIT peak-trough model represents the average of two different recession models: a probit and a logit model. However, the forecast is different. The probit and logit models use the diffusion index and recent changes in the diffusion index to estimate the probability of the S&P 500 being between the peak and trough associated with an NBER recession.

The S&P 500 will peak before recessions begin and bottom out before recessions end. As a result, it is more difficult for the model to fit this data and the model forecasts have larger errors than the recession model. Nevertheless, the peak-trough model usually provides advance warning of impending recessions. As mentioned above, according to the UNIT peak-trough model, the probability that the S&P 500 is between a peak and trough associated with an NBER recession increased from 6.4% last month to 23.6%, based on the November data. The new UNIT peak-trough model forecasts are illustrated in Figure 3 below.

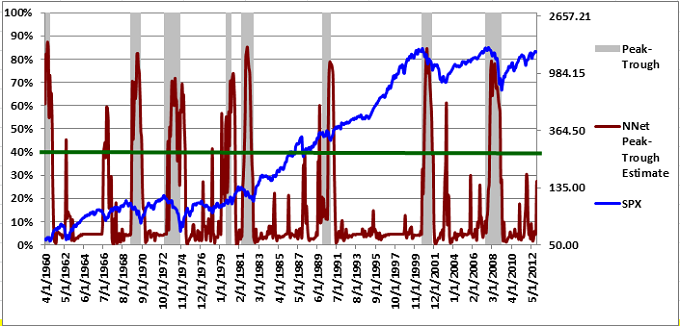

Neural Network Peak-Trough Model

The neural network peak-trough model represents the average of five different neural network models, each using a unique architecture and different independent variables (all based on the diffusion index). According to the neural network peak-trough model, the probability that the S&P 500 is between a peak and trough associated with an NBER recession increased from 5.1% last month to 27.4%. The neural network peak-trough model forecasts are illustrated in Figure 4 below.

Conclusion

There is no question that the risk of a U.S. recession increased significantly in November, but the model forecasts are still below the 30%-40% warning thresholds. In addition, the data was affected by hurricane Sandy, which means the slowdown could be temporary. Fears of the fiscal cliff could also have influenced the data.

It is interesting to note that ECRI is still standing by their recession call from the fall of 2011. Lakshman Achuthan, the COO of ECRI provided additional evidence to support the recession call in an interview on Bloomberg TV on November 29, 2012. The video of the interview is available on the ECRI website.

The UNIT and neural network model forecasts over the next few months should be very telling.

The following disclaimer regarding the limitations of the models is still applicable:

“Forecasting models in general cannot deal with external shocks that are not directly captured by the data. This includes terrorist attacks, conflict in the Middle East, political disruptions, exits from the Euro, country defaults, etc.”

“Given the precarious state of the global economy, if a U.S. recession were to occur, it could come on quickly and it could be severe. Failure to resolve the fiscal cliff would only accelerate that process, making it even more challenging for the models.”

Feedback

Your comments, feedback, and questions are always welcome and appreciated. Please use the comment section at the bottom of this page or send me an email.

Do you have any questions about the material? What topics would you like to see in the future?

Referrals

If you found the information on www.TraderEdge.Net helpful, please pass along the link to your friends and colleagues or share the link with your social or professional networks.

The "Share / Save" button below contains links to all major social and professional networks. If you do not see your network listed, use the down-arrow to access the entire list of networking sites.

Thank you for your support.

Brian Johnson

Copyright 2012 - Trading Insights, LLC - All Rights Reserved.

Pingback: A New Recession Slack Indicator | Trader Edge